August 16, 2022

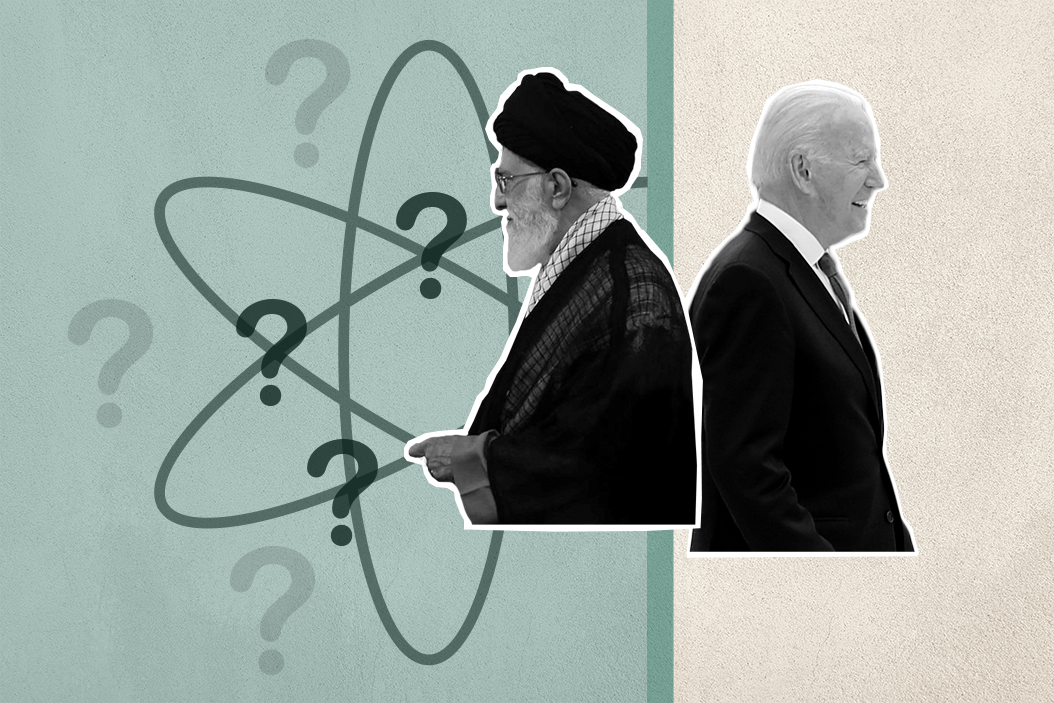

It’s been hard to keep track of the latest developments surrounding the turbulent Iran nuclear talks in recent months.

Mostly, the talks – which resumed in April 2021 – have appeared to be on the verge of collapse, though there have been recent indications of a breakthrough. This week, Iran’s nuclear negotiator said that a deal with the Europeans and Americans is “closer” than ever, but we’ve watched this movie before. Is it different this time?

What’s the Iran nuclear deal again? Brokered by the Obama administration in 2015, the deal aims to give Iran some economic sanction relief – freeing up billions of dollars in oil and gas revenue – in exchange for Tehran agreeing to place temporary curbs on its nuclear enrichment program, which Washington says is being developed for nefarious reasons.

The agreement remained intact until 2018 when former President Trump ditched the deal that he called “laughable.” Iran said that it was doing its part to honor the deal’s terms, but Israeli spies revealed additional uranium enrichment at several undeclared sites in Iran, giving rise to a still ongoing probe by the UN’s International Atomic Energy Agency.

So, what are the deal’s remaining sticking points? The hurdles are high ones. The Iranians want the IAEA to close the years-long UN probe as a precondition to getting the deal back on track. But that isn’t Washington's concession to make because the IAEA is an independent body.

The Iranians also want guarantees that the US will make good on its promise of economic relief, and wants guarantees that Iran will be provided with financial compensation for any flip-flops in US policy. Moreover, in the absence of full guarantees, Iran wants to leave its centrifuge levels intact so that it can return to its current activities if the US walks away again.

Washington, for its part, wants Tehran to stop making demands that go beyond the original deal, and to sign the existing offer on the dotted line.

What’s at stake for both sides?

For Iran, the deal would be a game-changer. Lifting sanctions on its oil exports could allow the energy behemoth to reap an additional $80 million per day, according to some estimates. Access to international markets and foreign financial reserves would allow Tehran to prop up its ailing currency and better tackle chronic inflation.

What’s more, a revival of the nuclear deal could allow Tehran, long deemed an international pariah, to slowly reintegrate itself into the international community.

For the US, it’s more of a mixed bag. A return to the 2015 deal would freeze Iran’s already-advanced nuclear program and prevent Tehran from changing the global nuclear balance of power – for now.

Crucially, it would prevent Iran from launching a nuclear attack on Israel, a US ally, in the near term, and dramatically reduce the likelihood of Washington and Tehran fighting it out. In short: it buys the US more time.

But time is of the essence, says Henry Rome, Eurasia Group’s deputy director of research and Iran analyst. “The longer Iran exceeds the deal’s limits, the greater nuclear knowledge and experience it can gain — which not only presents immediate risks but also whittles away the nonproliferation benefits of a future agreement.”

For President Biden, meanwhile, the politics are complex. Reviving the nuclear deal would allow him to follow through on a key foreign policy promise. It would also enable his administration to divert attention away from Iran to areas of greater priority – like China and Russia’s war in Ukraine. Also, American voters love a “winner,” and Biden would certainly spin this as a show of American strength and resolve.

However, if Biden is perceived as caving to Iranian demands – a narrative Republicans will run wild with – that might not bode well for Democrats ahead of midterm elections this November.

Finally, there’s the oil of it all. Since Russia’s war in Ukraine sent energy prices surging, the US has been looking for additional supplies wherever it can find them. Global oil prices have already eased this week as the prospect of a draft nuclear agreement began to loom large.

“A deal would trigger the return of sizable volumes of Iranian crude to the market, which would be a bearish factor for prices,” Rome says, referring to the estimated one million barrels a day of Iranian petroleum exports that could be on the market within a few months of a nuclear deal. Still, Rome does not believe that “that concerns over oil prices will drive the Biden administration to make further concessions.”

So, what happens now? “I don’t think it’s ‘now or never,’ only because it’s been ‘now or never’ for a long time – and yet negotiations continue,” Rome says, adding that “as long as Iran continues to remain engaged, there is a low likelihood that the West would put its foot down and end the talks.”

From Your Site Articles

More For You

Prime Minister Narendra Modi, with President of the European Council António Luís Santos da Costa, and President of the European Commission Ursula von der Leyen, at Hyderabad House, in New Delhi, India, on Jan. 27, 2026.

DPR PMO/ANI Photo

On Tuesday, the world’s largest single market and the world’s most populous country cinched a deal that will slash or reduce tariffs on the vast majority of the products they trade.

Most Popular

Sponsored posts

Five forces that shaped 2025

What's Good Wednesdays

What’s Good Wednesdays™, January 28, 2026

Mexican President Claudia Sheinbaum Pardo stands alongside Canadian Prime Minister Mark Carney and US President Donald Trump during the 2026 World Cup draw at the John F. Kennedy Center for the Performing Arts in Washington, D.C., on December 5, 2025.

Deccio Serrano/NurPhoto

Canadian Prime Minister Mark Carney has repeatedly tussled with US President Donald Trump, whereas Mexican President Claudia Sheinbaum has tried to placate him. The discrepancy raises questions about the best way to approach the US leader.

Fighters of the Qassam Brigades, the armed wing of the Palestinian Islamist Hamas movement, attend a rally marking the 35th anniversary of the group's foundation in Gaza City on December 14, 2022.

Photo by Majdi Fathi/NurPhoto

10,000: The number of Hamas officers that the militant group reportedly wants to incorporate into the US-backed Palestinian administration for Gaza, in the form of a police force.

Walmart is investing $350 billion in US manufacturing. Over two-thirds of the products Walmart buys are made, grown, or assembled in America, like healthy dried fruit from The Ugly Co. The sustainable fruit is sourced directly from fourth-generation farmers in Farmersville, California, and delivered to your neighborhood Walmart shelves. Discover how Walmart's investment is supporting communities and fueling jobs across the nation.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.