May 24, 2021

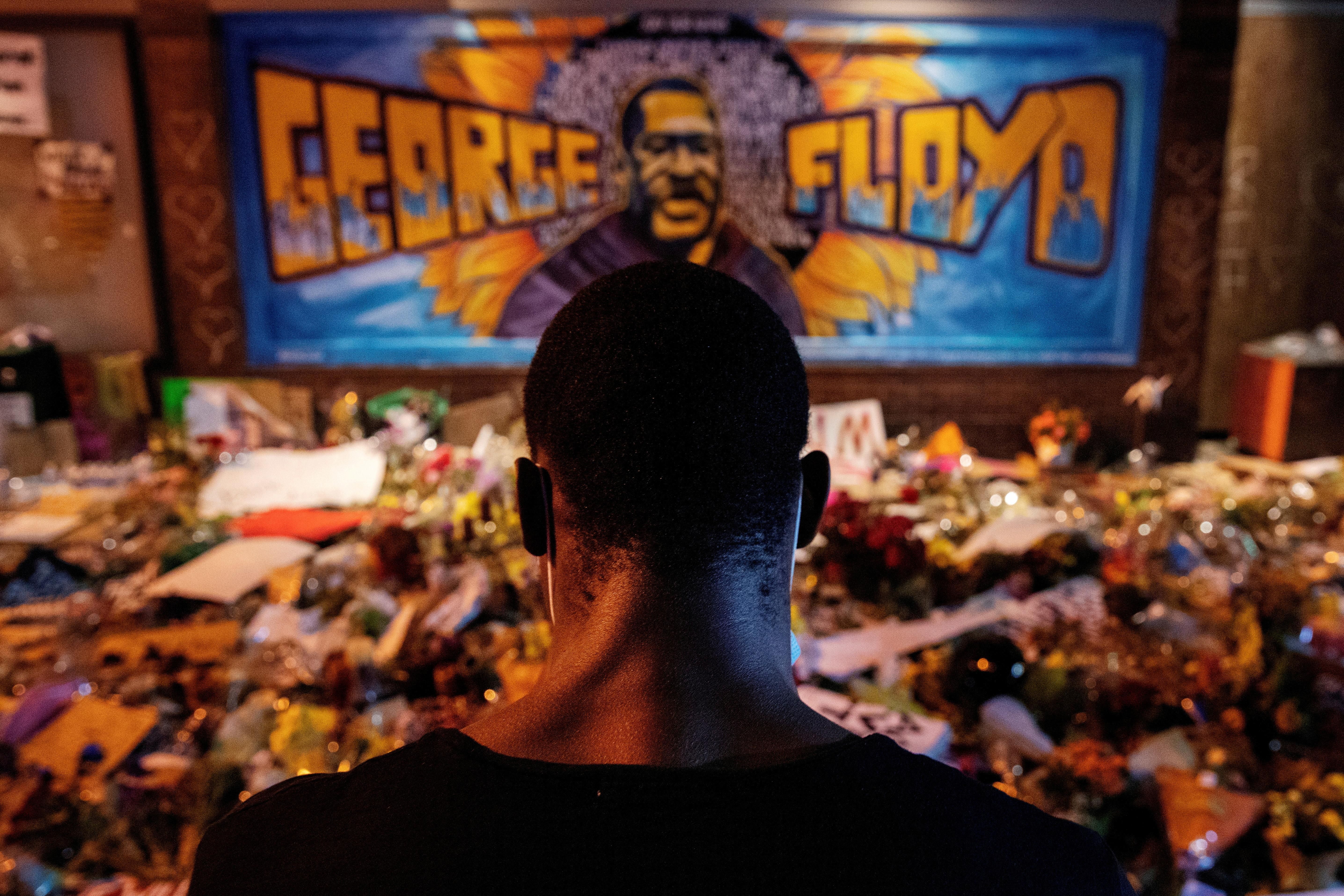

Marking a year since George Floyd's murder: May 25 marks one year since the killing of George Floyd in Minneapolis, which galvanized the biggest anti-racism movement in America in generations – and inspired a global reckoning with racial inequality and policing in dozens of countries around the world. Since then, former police officer Derek Chauvin has been charged with Floyd's murder, a historic development after decades of near-total impunity for police who use excessive force against Black Americans. But many say that Chauvin's' conviction is not enough and are calling for the passage of broad police reform legislation in the US Congress. While the House of Representatives passed the George Floyd Police Reform Act, the bill in its current form doesn't appear to have sufficient support to pass in the Senate. One of the biggest sticking points in the bill is over "qualified immunity," which protects government officials and law enforcement from being held personally liable for constitutional violations. Republicans oppose this structural reform, but even if they come to an agreement in the Senate, progressive House Democrats say they will not accept a watered-down version that does not eliminate this provision in at least some instances. Meanwhile, President Biden will host the Floyd family at the White House on Tuesday.

G7 to finalize global corporate tax: The G7 – a group of large economies including the US, Canada, the UK, France, Germany, Italy, and Japan – is close to finalizing global taxation rules for the world's largest companies. For years, big European nations, frustrated with American behemoths like Starbucks, Amazon, and Google that flood their markets with products yet pay almost nothing back to their governments, have been pushing for a similar global corporate tax rate, something the US has long resisted. But as countering domestic tax avoidance has emerged as a Biden administration priority, Washington is now on board with the idea. The US has called for a 15 percent minimum global tax, lower than the 21 percent backed by several European states. While the G7 agreement would not be globally enforceable, it would be a powerful first step in paving the way to formalization of a global minimum tax rate currently being negotiated in Paris at the OECD, an organization made up of 37 advanced economies. However, while the G7 could finalize a deal for taxing big corporations in the next few weeks, it could still take many months before the broader G20, which is running the talks in Paris, seals a deal, given resistance from countries with low corporate tax rates like Ireland, which has greatly benefited from operating as a tax haven for multinationals to protect their profits.

Is a coup happening in Samoa? The Pacific Island nation of Samoa held elections in early April, and things have been a mess since. The results gave a razor thin, one-seat majority to the Faith in the One True God (FAST) party, which would have ended nearly four decades of rule by the governing Human Rights Protection Party (HRPP). But just before FAST leader Fiame Naomi Mata'afa was set to be sworn in on Monday — as Samoa's first female prime minister, no less — the HRPP government cancelled the required parliamentary session, in a move that the Supreme Court swiftly called "unlawful." Undaunted, FAST held its own swearing-in ceremony for Mata'afa, in a tent. But since that was not done in accordance with the constitution, it's not clear who really runs the country now or what consequences the current PM Tuilaepa Sailele Malielegaoi may face for flouting the country's highest court. This is the first major constitutional crisis of its kind since Samoa gained independence from New Zealand in 1962.

From Your Site Articles

More For You

Microsoft unveiled a new set of commitments guiding its community‑first approach to AI infrastructure development. The strategy focuses on energy affordability, water efficiency, job creation, local investment, and AI‑driven skilling. As demand for digital infrastructure accelerates, the company is pushing a new model for responsible datacenter growth — one built on sustainability, economic mobility, and long‑term partnership with the communities that host it. The move signals how AI infrastructure is reshaping local economies and what people expect from the tech shaping their future. Read the full blog here.

Most Popular

- YouTube

On GZERO World, Finnish President Alexander Stubb says that Ukraine and its NATO allies are aligned on a path to a ceasefire but warns that Vladimir Putin will drag out the war, not because he thinks he’ll win… but because he knows he’ll lose.

- YouTube

At the 2026 World Economic Forum in Davos, GZERO’s Tony Maciulis spoke with Ariel Ekblaw, Founder of the Aurelia Institute, about how scaling up infrastructure in space could unlock transformative breakthroughs on Earth.

- YouTube

Who decides the boundaries for artificial intelligence, and how do governments ensure public trust? Speaking at the 2026 World Economic Forum in Davos, Arancha González Laya, Dean of the Paris School of International Affairs and former Foreign Minister of Spain, emphasized the importance of clear regulations to maintain trust in technology.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.