April 04, 2024

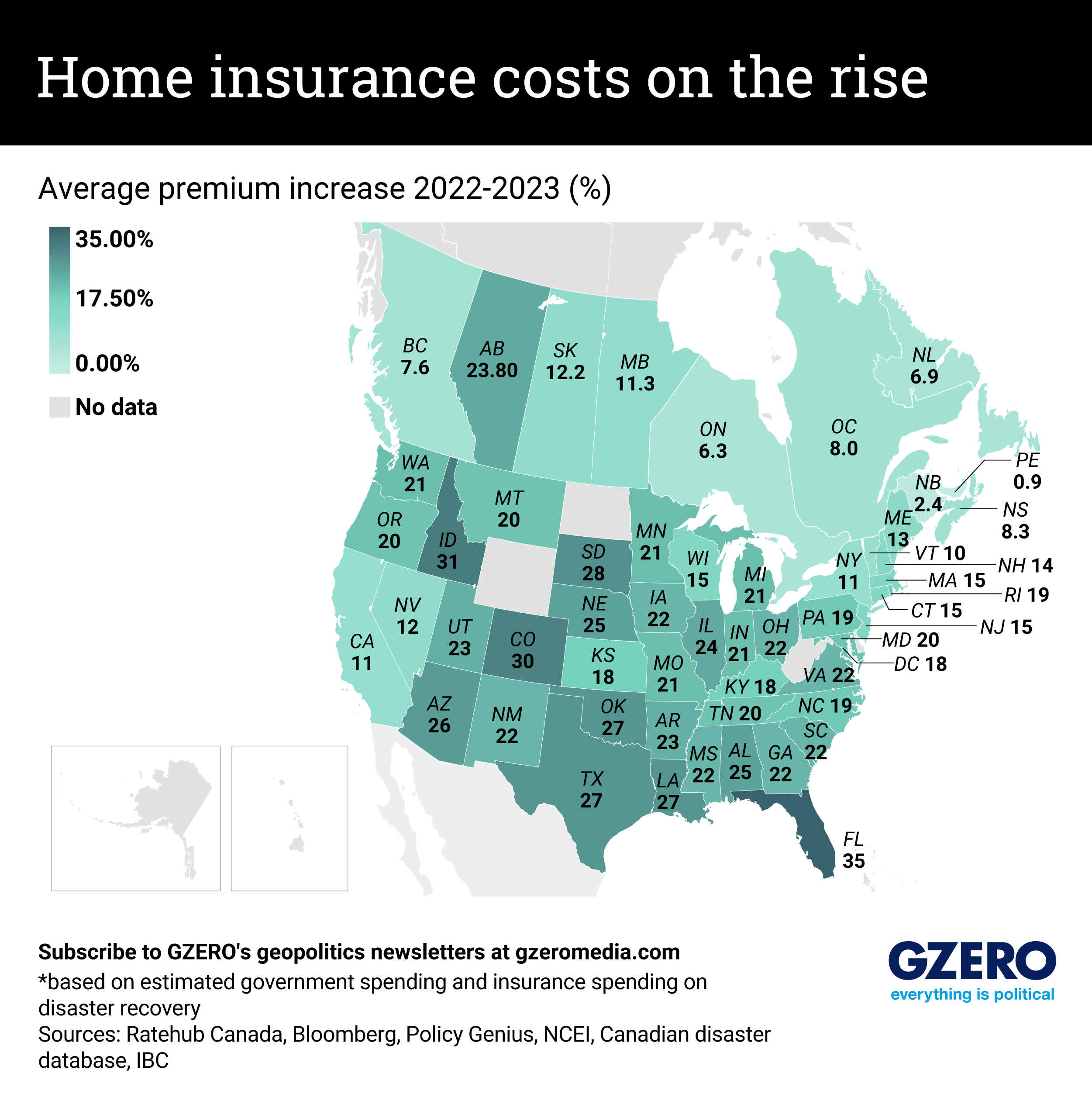

From devastating hurricanes and ceaseless wildfires to catastrophic floods, natural disasters are increasing in frequency and cost in Canada and the US. As climate change makes disasters more frequent and destructive, insurers are having to raise rates and reduce coverage.

In the US, the home insurance industry has had three straight years of underwriting losses. Insurance rates rose an average of 21% in 2023 as a response, with some insurers in disaster-prone places like California and Florida ceasing to write new policies altogether. As a result, homeowners are forced to pay higher premiums for the fewer insurance options that remain.

In Canada, last summer’s record wildfires compounded with historic floods, costing more than $3.1 billion in insured damage and spiking rates in Alberta, Saskatchewan, Manitoba, and British Columbia.

For this week’s Graphic Truth, we looked at how much insurance rates have risen around the US and Canada.

More For You

Ian Bremmer sits down with former US Ambassador to NATO Ivo Daalder to unpack a historic shift in the transatlantic alliance: Europe is preparing to defend itself without its American safety net.

Most Popular

Think you know what's going on around the world? Here's your chance to prove it.

U.S President Donald Trump, U.S. Vice President JD Vance, and U.S. Secretary of State Marco Rubio pose for a family photo with other representatives participating in the inaugural Board of Peace meeting, at the U.S. Institute of Peace in Washington, D.C., U.S., February 19, 2026.

REUTERS/Kevin Lamarque

Argentina, Armenia, Belarus, Egypt, Indonesia, Jordan, Pakistan, Paraguay, Vietnam – to name only a few.

A poster featuring Andrew Mountbatten-Windsor, formerly known as Prince Andrew, is installed on a sign leading to the parking area of the Sandringham Estate in Wolferton, as pressure builds on him to give evidence after the U.S. Justice Department released more records tied to the late financier and convicted sex offender Jeffrey Epstein, in Norfolk, Britain, February 5, 2026.

REUTERS/Isabel Infantes

British police arrested former Prince Andrew Mountbatten-Windsor today over allegations that in 2010, when he was a UK trade envoy, he shared confidential government documents with convicted sex offender Jeffrey Epstein.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.