When Japanese Prime Minister Sanae Takaichi called snap elections last month, it was a big gamble. Holding a winter election just four months into her tenure with no real policy record to run on? Staking her sky-high approval ratings – then hovering around 70% – on an untested bet that personal popularity would translate into seats? The conventional wisdom said she was overreaching. The conventional wisdom got torched.

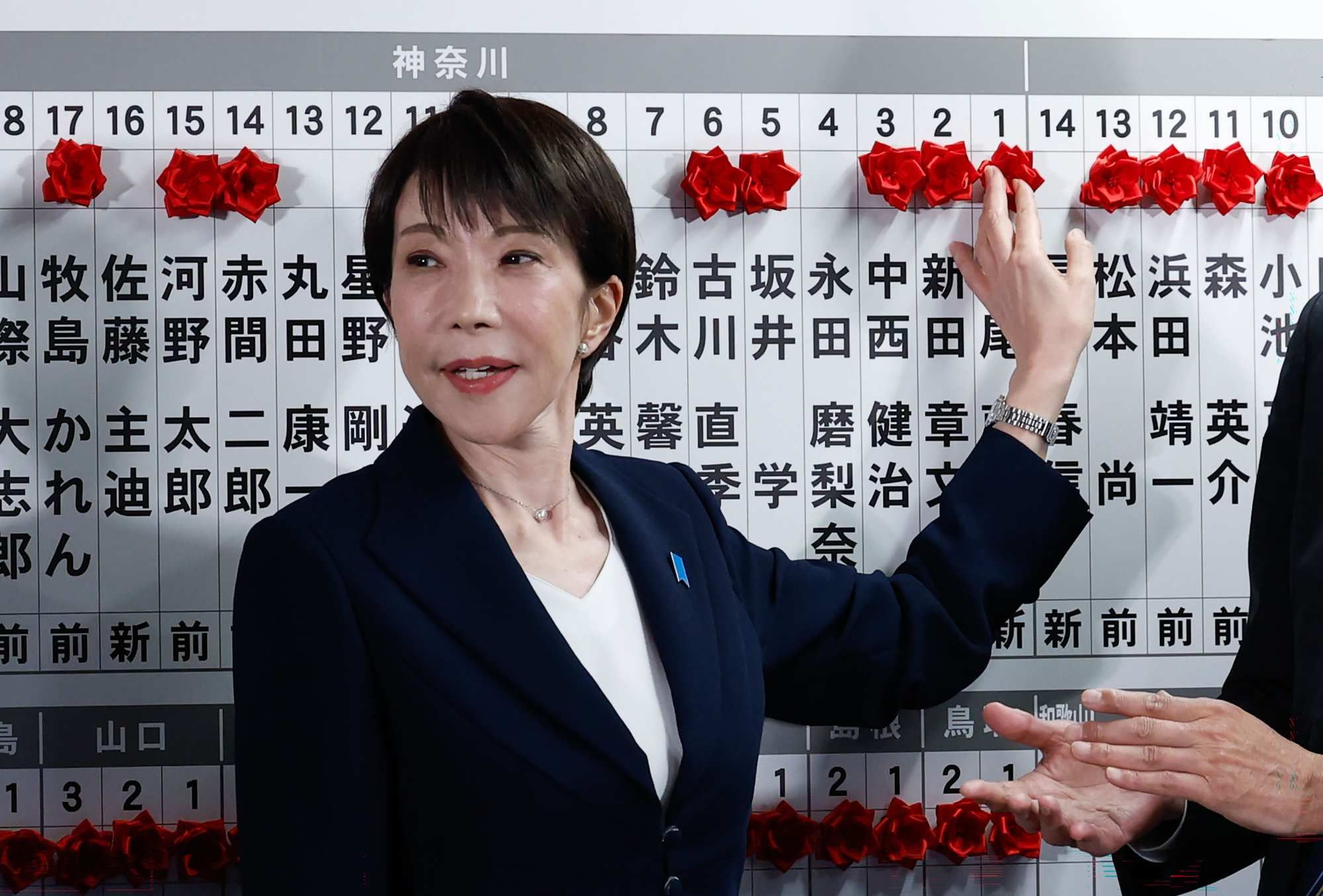

Takaichi walked away from the Feb. 8 vote with a historic landslide, securing a rare two-thirds supermajority in the lower house for her Liberal Democratic Party. The LDP went into the day with 198 seats in the 465-seat chamber and walked out with 316. That's the largest mandate in Japan's postwar history, bigger even than any won by Shinzo Abe, Takaichi's late mentor. The LDP can now override vetoes from the upper house, where it lacks a majority. After cycling through revolving-door prime ministers for years, Japan has elected its most powerful leader since World War II.

The big loser was the newly formed Centrist Reform Alliance, a hastily assembled union of the main opposition Constitutional Democratic Party and the LDP's former coalition partner, Komeito. The merger was supposed to consolidate the center-left and center-right vote by playing the “reasonable middle” against Takaichi's right-wing pitch, but voters found its value proposition confusing and stale. Takaichi, with her blunt style and growth-first message, was better able to charm independents in an environment where most Japanese are hungry for change amid widespread economic discontent. Notably, the LDP's vote share wasn't dramatically higher than in past elections, but because the opposition collapsed, the party swept single-member districts across the country.

Takaichi now has the political capital and legislative power to pursue her ambitious agenda virtually unconstrained – and she won’t hesitate to use it. She has promised “completely new economic and fiscal policies” – code for spending a lot of money Japan doesn’t have. She’s leaning into industrial policy to pick winners in AI and semiconductors. Expect a record-large national budget to pass by late April or early May, stuffed with new government spending on social welfare, defense, and emerging technology. A two-year cut in consumption taxes on food will follow by year's end, aimed at easing the affordability crisis that remains the top political issue in Japan.

Takaichi insists she won’t issue new debt to finance the extra spending and tax cuts, instead claiming her policies will generate enough growth and revenue to pay for themselves. That’s … optimistic. The problem is that Japan's national debt is already the highest in the developed world. The country has historically relied on low interest rates, anchored by low inflation, to keep its massive debt sustainable. But now that the Bank of Japan is normalizing monetary policy to tackle rising inflation, Tokyo’s ability to borrow without breaking a sweat is ending. Without fiscal consolidation, Japanese interest costs and debt levels are on an unsustainable path.

Takaichi has some tools to delay the inevitable reckoning. She can embrace “financial repression” and pressure domestic institutional investors to buy more bonds, artificially suppressing yields – though that’s not a sustainable long-term strategy. Alternatively, the Bank of Japan could resume large-scale bond purchases – but that would risk a weaker yen and inflationary pressure that would undercut Takaichi's affordability agenda. Eventually, though, Japan will need a more credible commitment to solving the debt problem, one that includes politically costly tax increases. Or else markets will force one.

Takaichi’s electoral mandate may prove even more consequential on the foreign policy front, where she now faces little domestic resistance to hardening Japan's posture toward China and strengthening military deterrence. She plans to establish a national intelligence bureau, create a CFIUS-style body to screen inbound Chinese investments, and pass an anti-espionage law. She’s pledged to revise Japan's three national security documents by year’s end, enabling Tokyo to increase defense spending, develop offensive weapons, and boost arms exports. She will also deepen security cooperation with Australia, India, South Korea, and the Philippines to reduce Japan's security dependence on the United States.

Japan doesn't need to amend its pacifist constitution, drafted by American occupation forces after World War II, to achieve these goals; revising the security documents is enough. Takaichi has vowed to pursue constitutional revision – a long-term aspiration of the LDP's right wing – anyway, but amendments require a two-thirds majority in both houses plus voter approval in a referendum, and the Japanese public has been historically skeptical. It’s never been done since 1947; don’t expect her to break the 80-year streak soon.

Not that this will hinder her efforts to turn Japan into a more muscular regional player – or ease tensions with China, already twitchy about the country’s hawkish shift. Beijing has been applying extraordinary pressure on Tokyo since November, when Takaichi expressed vocal support for Taiwan. China threw the kitchen sink at Japan – tourism restrictions, seafood bans, export controls on dual-use items and rare earths – in the hopes of weakening Takaichi politically. That … didn't work. Now Beijing is stuck dealing with a Japanese prime minister who has a stronger mandate than anyone expected. And with neither side looking for an off-ramp, tensions are more likely to escalate further, especially in the run-up to President Donald Trump’s trip to China in April.

Trump endorsed Takaichi right before the election and immediately claimed credit for her landslide. The two have a lot in common: both are right-wing nationalists, hawkish on defense, skeptical of immigration, and claim a special bond with Shinzo Abe. Trump also appreciates Japan’s $550 billion trade and investment agreement, signed last year. Takaichi plans to leverage this goodwill during her March state visit by announcing major investments in US projects to flatter the president and reinforce the centrality of the US-Japan alliance to his strategic goals in Asia. She'll likely secure a commitment from Trump to stop in Tokyo on his way back from his summit with Xi. If she’s lucky, maybe she’ll even get him to carry a message to Xi on her behalf: time to dial this down.

Takaichi has won the right to run Japan exactly how she wants for the foreseeable future. Her approval ratings are extremely high, the opposition is in disarray, and even political heavyweights like former Prime Minister Taro Aso are getting on board or staying quiet. Trump's blessing only strengthens her hand to reshape the country and its place in the world.

But as dominant as she may be politically, that’s only part of the story. The affordability crisis that propelled Takaichi to power hasn’t gone anywhere. If her economic policies fail to tame inflation – or make it worse – voters will turn on her. A prolonged freeze with China could cripple trade with Japan's largest partner. And bond markets will eventually force a fiscal reckoning. A political scandal, the kind that eventually hits every LDP government, could test her at any moment. Takaichi’s base is shallower than the LDP’s seat count suggests.

For now? Japan’s “Iron Lady” is the only game in town, and she’s playing for keeps.