October 14, 2021

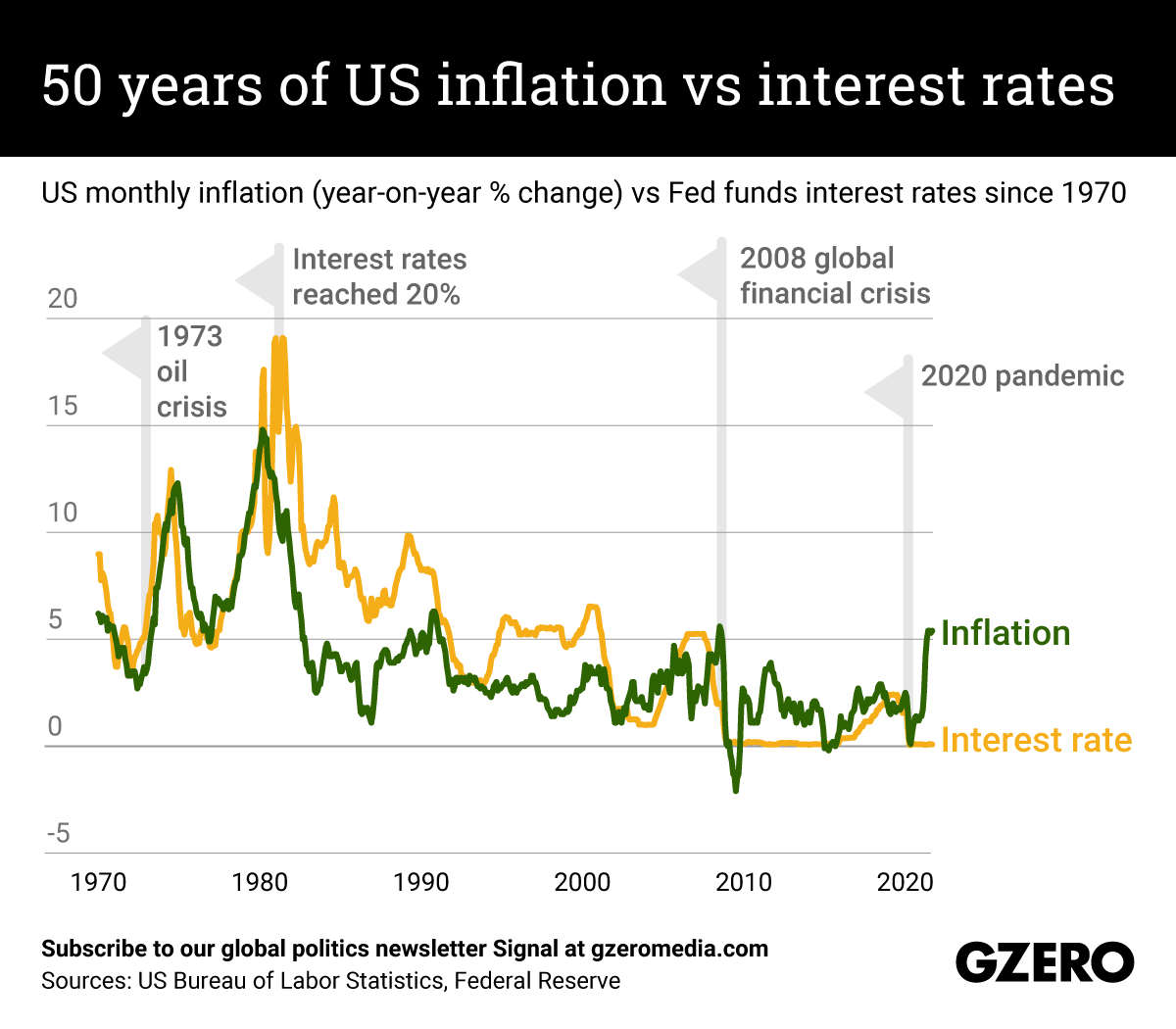

Inflation in the US remains at its highest monthly level since the 2008 financial crisis. Right now most economists agree that rising prices are being driven by pandemic-related supply chain disruptions, which the government can do little about. This has given some oxygen to supporters of the Biden administration's big-spending agenda, who now insist that inflation will ease up once supply chain disruptions resolve. Deficit hawks, for their part, still say that the Federal Reserve is overheating the US economy by keeping interest rates low because it hopes inflation will be short-lived. We compare US inflation and interest rates over the past half century, a period in which America has suffered double-digit inflation figures more than once.

From Your Site Articles

- Think buying American will help ease inflation? Larry Summers says it won’t - GZERO Media ›

- Inflation nation: What’s driving US prices higher? - GZERO Media ›

- Larry Summers: Rising inflation makes society feel "out of control” - GZERO Media ›

- Biden could get Saudis to push Russia out of OPEC+ - GZERO Media ›

- Are we in a recession? - GZERO Media ›

- How bad is inflation in the US and around the world? - GZERO Media ›

- Podcast: Making sense of global inflation, looming recession, & economists who disagree - GZERO Media ›

- S3 Episode 3: Will there be a recession? - GZERO Media ›

- Biden sticks with Powell as Fed Chair amid rising inflation - GZERO Media ›

- What we need to know to fix US inflation - GZERO Media ›

- When high inflation meets high job rates - GZERO Media ›

- Inflation panicking is 1970s hangover, says economic historian Adam Tooze - GZERO Media ›

More For You

- YouTube

In this Quick Take, Ian Bremmer examines the second week of the US-Israel war with Iran and warns that the conflict risks spiraling into a longer and more destabilizing situation.

Most Popular

- YouTube

What might Iran look like a year from now? Ian Bremmer and Brooking’s Thomas Wright discuss possible outcomes.

Smoke rises after an Israeli strike on Beirut's southern suburbs, following an escalation between Hezbollah and Israel amid the US-Israeli conflict with Iran, on March 6, 2026.

REUTERS/Khalil Ashawi

The Lebanese militant group’s strikes against Israel on Monday appear to have given the Israelis the pretext to launch a massive counter-attack, with the ultimate aim being to disarm the Iran-backed group once and for all.

Iran conflict fueled food crisis, Rapper set to win in Nepal, US gives Russia sanction relief

Mar 06, 2026

Cargo ships are unloading newly arrived chemical fertilizers at the port terminal in Lianyungang, East China's Jiangsu province, on February 27, 2024.

(Photo by Costfoto/NurPhoto)

Disruptions to a key Gulf waterway in the Iran conflict aren't just threatening the world’s oil and gas supplies; they could also cause a food security crisis.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.