Graphic Truth

Graphic Truth: Netanyahu’s strategic window in Iran

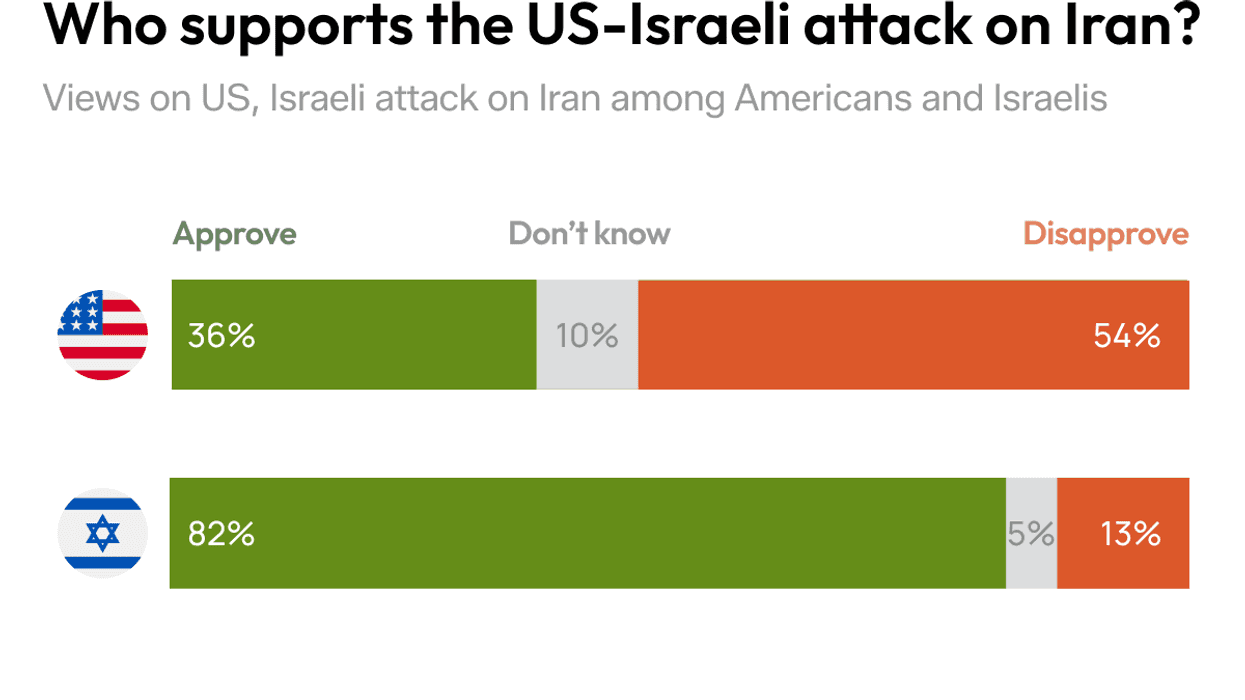

There’s a striking gap in how Americans and Israelis view the US-Israeli war on Iran. Polling done by the Israel Democracy Institute showed the attacks have overwhelming support among Israelis.

Mar 09, 2026