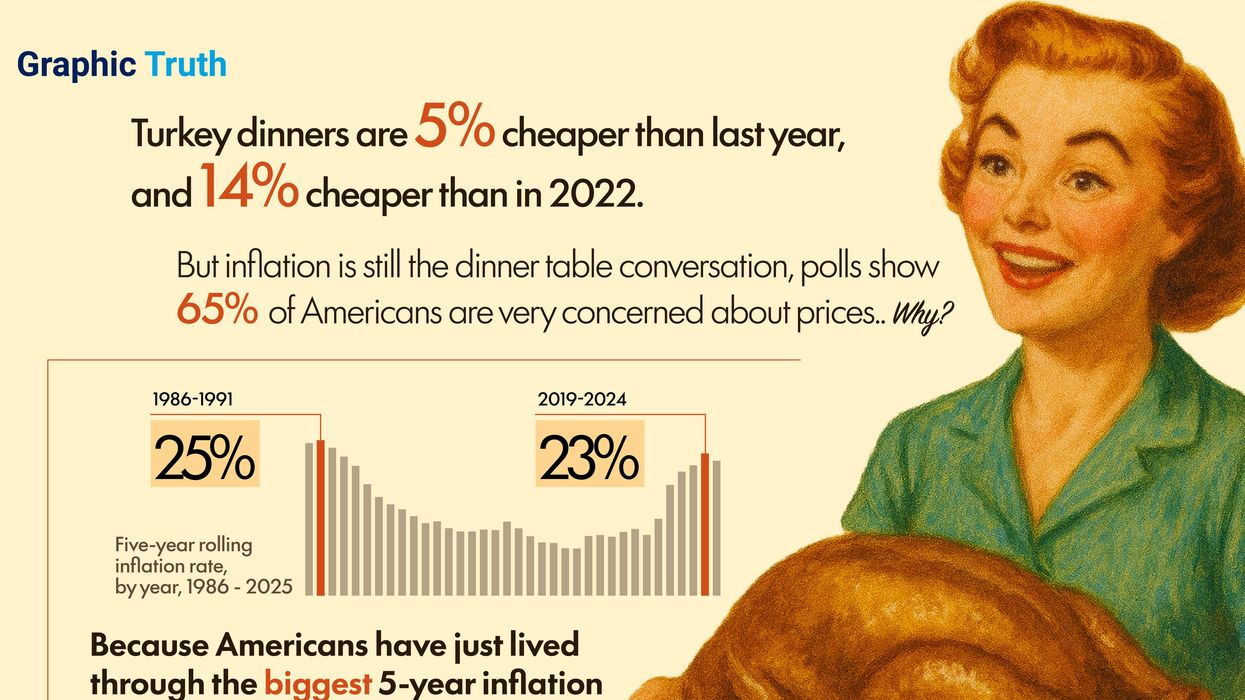

Graphic Truth

Graphic Truth: Turkey is cheaper, but inflation still gobbles

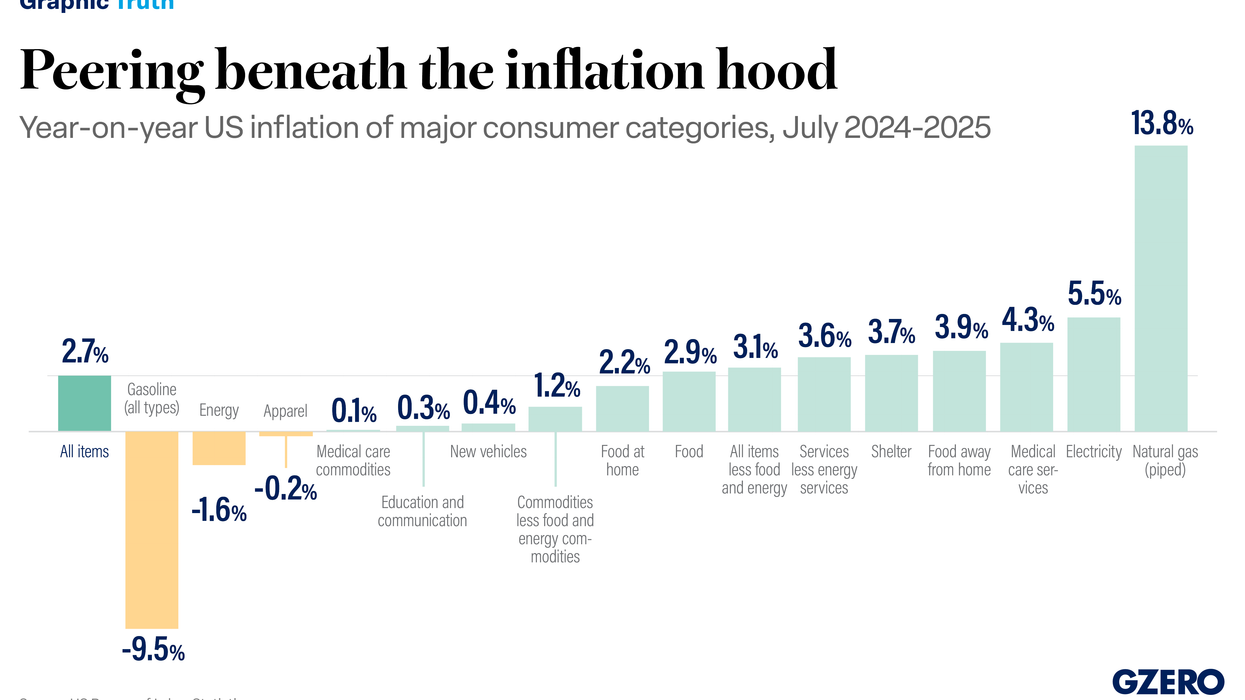

One thing to be grateful for this US Thanksgiving is that a turkey dinner for 10 people has gotten cheaper for the third year in a row. But nearly 65% of Americans are still upset about rising prices, according to a recent Pew Research Poll. How to reconcile those two things?

Nov 26, 2025