On Thursday afternoon, just before golden hour, President Donald Trump threw a white hardhat over his flaxen coif and strode into the Federal Reserve building on Constitution Avenue.

The stated purpose of his visit to the world’s most influential central bank was almost comically mundane: he was there to inspect a building renovation project for cost overruns. Trump is, as he likes to remind people, a “builder,” so he knows an overpriced crown molding when he sees one. He says the $2.5-billion project, funded by Congress, is already more than $500 million over budget. The Fed disputes this number.

Sure enough, after a walking tour of the sites with Fed Chairman Jerome Powell, the two men sparred about the costs of the buildings that are currently being rebuilt by the Fed – and at least one that is not being built because, as Powell gamely pointed out, it was already built five years ago.

But the hardhat haggling was pantomime for a more serious dispute.

For weeks now, Trump has been insulting and pressuring the “numbskull” Powell to lower interest rates, in hopes that doing so will give the US economy, “the hottest in the world,” a boost. The midterms are, after all, approaching.

But Powell isn’t budging. He argues that with Trump’s tariff threats still nudging up prices, lower rates could set inflation soaring all over again. The Fed’s legally-mandated job is to keep inflation low and growth humming – without presidential meddling.

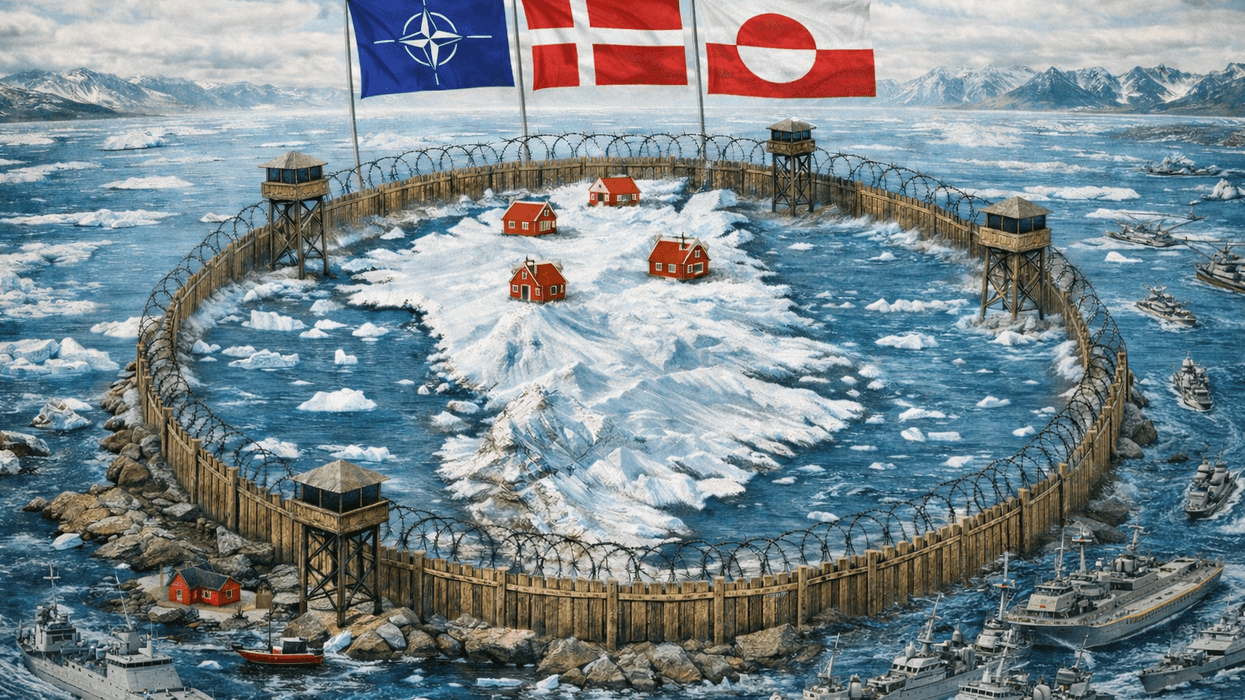

More alarmingly, Trump has recently pondered removing Powell – whom he nominated as Fed chair eight years ago – before his term ends next spring. Doing so would be an unprecedented assault on the Fed’s independence. Under the law, a president can sack a Fed chair only for serious violations of the law or ethics.

Disagreements over interest rate policy are not that. But an allegedly botched building renovation that has cost taxpayers hundreds of millions of dollars in cost overruns? Maybe it’s malfeasance enough. And while Trump said yesterday that firing Powell because of cost overruns would be a “a big move” that is “not necessary” right now, the visit sends a clear message: this is an issue that can be brought up again if Powell doesn’t, as Trump insists, “do the right thing.”

So what is “Fed independence”? And why is it a problem if it suffers?

To learn more I rang up one of the smartest global economy analysts out there – Rob Kahn, Managing Director of Global Macro at Eurasia Group. Our exchange has been edited for clarity and concision. Here goes.

Rob, why is central bank independence so important, and to whom?

When a central bank is subservient to the government, it will often make decisions to keep interest rates too low. And as a result you get too much money printed up and then more inflation.

There is a vast body of evidence that says that economies that have independent central banks do better. They tend to have lower inflation and higher growth. When everyone – financial markets, firms, households – can make longer-term investment and spending decisions based on stable accurate expectations about what the future will hold, they make better decisions and they have better outcomes.

Economies just perform better when individuals have reasonably stable expectations about what inflation's going to be this year, next year, five years from now.

If Trump forces Powell to cut rates, or replaces him with someone who does that, what might happen?

The first thing to remind people of is that the Fed doesn’t actually control all the interest rates in the economy. They control the so-called “federal funds rate,” which is the rate at which banks lend to each other. By doing that, they can influence all the other interest rates in the economy, but they don’t control them directly.

If the Fed were perceived to be cutting rates under pressure from Donald Trump, you might see that even though the Fed funds rate went down, other lenders would say, “Wow, in the longer term we’re going to have higher inflation, so we’re going to actually need higher interest rates ahead of that.” So even though the Fed rate goes down, the market rates for a lot of people could actually go up.

Why is Trump’s hardhat visit so alarming for people worried about Fed independence?

Well, if they can fire the Fed chair for overspending on a building project, then you know that any time a president has a disagreement with the Fed chair in the future, he can just come up with something and say, “oh, this is the real cause,” and fire him for that.

And that will effectively undermine the Fed’s independence. So Trump in a hard hat is really not about a renovation. This is really about whether the Fed can be independent in setting monetary policy. Don’t be fooled.