Analysis

Do additional sanctions on Iran make a difference now?

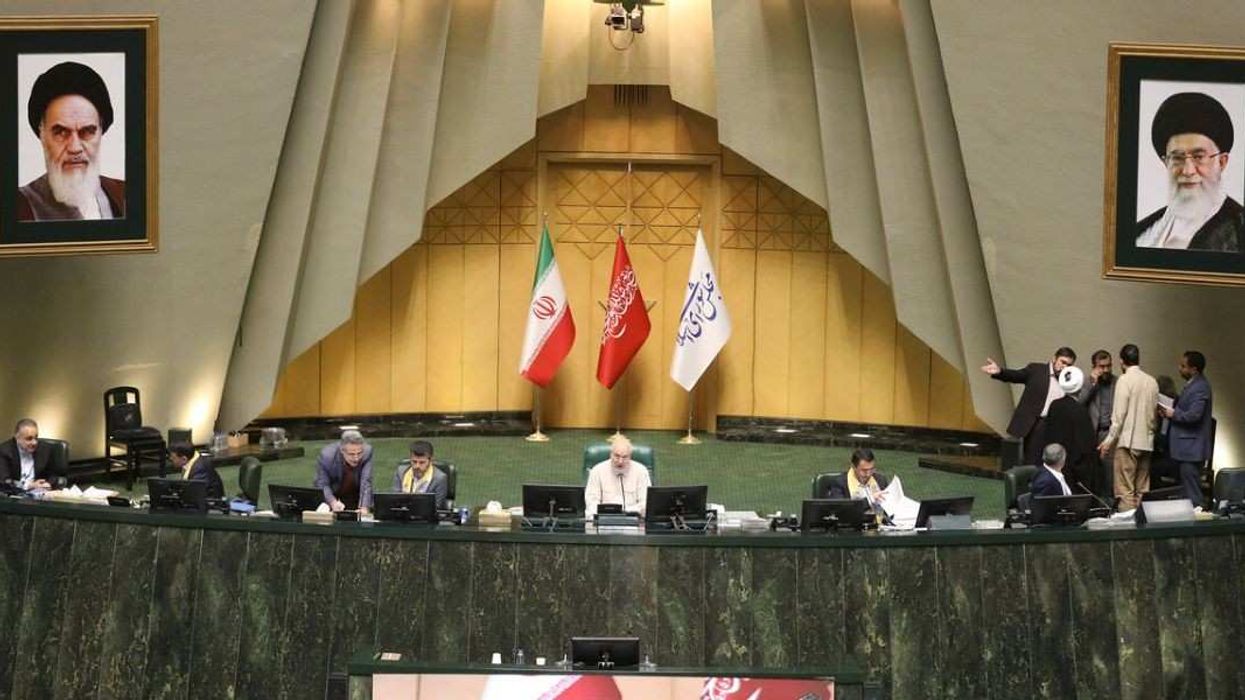

The European Union confirmed on Monday that it has reinstated sanctions on Iran over its nuclear program, following the United Nations’ decision over the weekend to reimpose its own penalties.

Sep 30, 2025