April 07, 2021

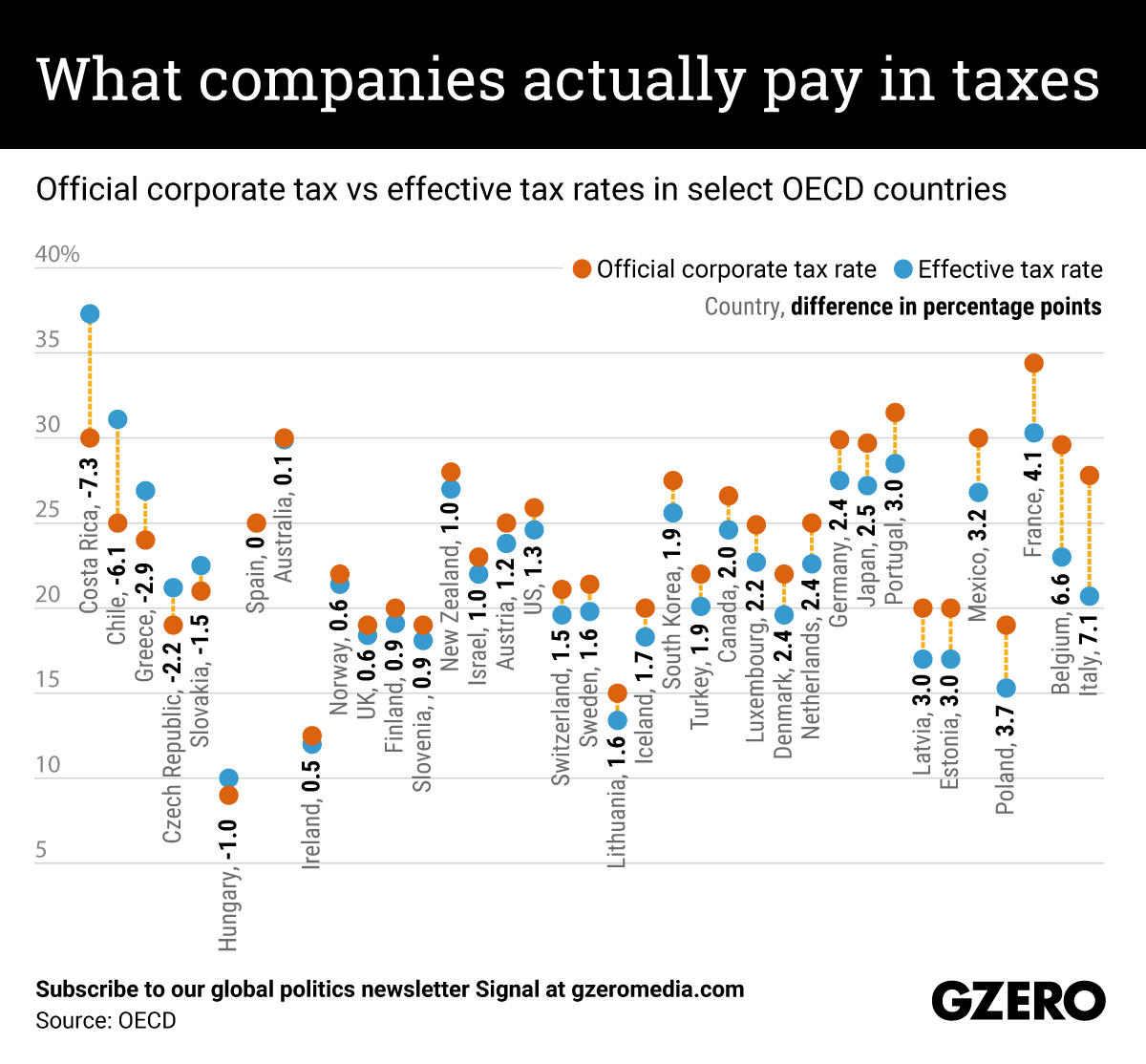

On top of the global debate about enacting a minimum global tax for multinational corporations, there's another growing movement in a host of countries for all firms to pay their fair share in taxes, whether they do business abroad or not. Many US corporations are notorious for getting away with paying little to no federal taxes by taking advantage of multiple loopholes in the tax code — which is true for a lot of them. However, as a whole the average percentage of income US corporations do pay taxes on — their effective tax rate — is in reality not much lower than the legal national rate due to additional taxes levied by some US states and cities — the same as in many other developed economies. We compare the official and the effective corporate tax rates in some nations around the world.

More For You

Bad Bunny during the Super Bowl LX halftime show press conference at Moscone Center.

Kirby Lee-Imagn Images

100 million: The number of people expected to watch the Super Bowl halftime performance with Bad Bunny, the Puerto Rican superstar and newly minted Album of the Year winner at the Grammys.

Most Popular

Think you know what's going on around the world? Here's your chance to prove it.

- YouTube

An imminent US airstrike on iran is not only possible, it's probable.

Americans are moving less — and renting more. Cooling migration and rising vacancy rates, especially across the Sunbelt, have flattened rent growth and given renters new leverage. For many lower-income households, that relief is beginning to show up in discretionary spending. Explore what's changing in US housing by subscribing to Bank of America Institute.

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.