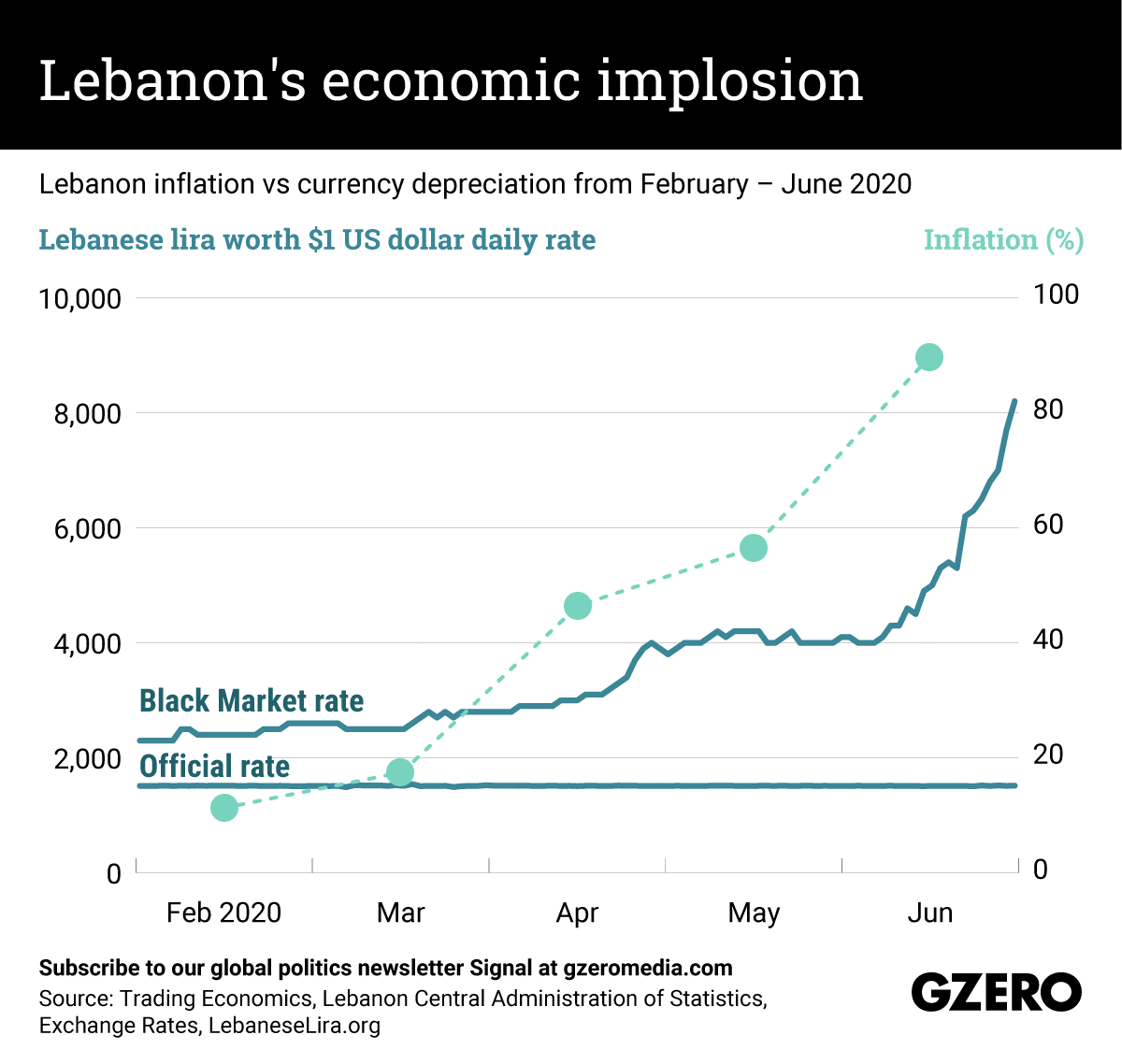

Even before last week's explosion — which killed over 200 people, turned downtown Beirut into rubble, and forced the government to resign — Lebanon was already in economic dire straits. The value of the local currency has plunged following decades of corruption, mismanagement and political chaos, dragging about half of the population into poverty. Since the beginning of 2020, the depreciation of the Lebanese pound (on the black market, while the official rate remains somewhat pegged to the US dollar) and soaring inflation have increased the price of basic goods beyond what most citizens can afford, and wiped out pensions and salaries. If the situation does not improve soon, Lebanon could see unprecedented levels of hunger — and international assistance may not be enough to feed everyone. We compare how the Lebanese pound has traded with the US dollar amid rapidly rising inflation over the first half of the year.

More For You

Ian Bremmer sits down with former US Ambassador to NATO Ivo Daalder to unpack a historic shift in the transatlantic alliance: Europe is preparing to defend itself without its American safety net.

Most Popular

Think you know what's going on around the world? Here's your chance to prove it.

Argentina, Armenia, Belarus, Egypt, Indonesia, Jordan, Pakistan, Paraguay, Vietnam – to name only a few.

A poster featuring Andrew Mountbatten-Windsor, formerly known as Prince Andrew, is installed on a sign leading to the parking area of the Sandringham Estate in Wolferton, as pressure builds on him to give evidence after the U.S. Justice Department released more records tied to the late financier and convicted sex offender Jeffrey Epstein, in Norfolk, Britain, February 5, 2026.

British police arrested former Prince Andrew Mountbatten-Windsor today over allegations that in 2010, when he was a UK trade envoy, he shared confidential government documents with convicted sex offender Jeffrey Epstein.