October 28, 2025

President Trump has directly sanctioned Russia for the first time since retaking office, over President Putin's refusal to come to the negotiating table on Ukraine. It's a move aimed at weakening Putin’s war economy, says Eurasia Group's Gregory Brew, but one that could have ripple effects from Beijing to the US gas pump.

Trump is getting tough on Russian oil, but to have a real impact on Putin, he'll likely have to go further, which could undermine his big trade deals and push up gas prices. Here at home, US President Donald Trump is running out of patience with Vladimir Putin who refuses to return to the negotiating table for a ceasefire in Ukraine.

Last week, Trump took the surprising step of putting sanctions on two of Russia's largest oil companies, the first time the US has directly sanctioned Russia since he became president. Now, in theory, these sanctions should prevent Russia from selling oil to its two biggest customers, India and China, who together take more than two-thirds of Russia's crude oil exports an important source of income for Putin's war in Ukraine. But as ever, the devil is in the details.

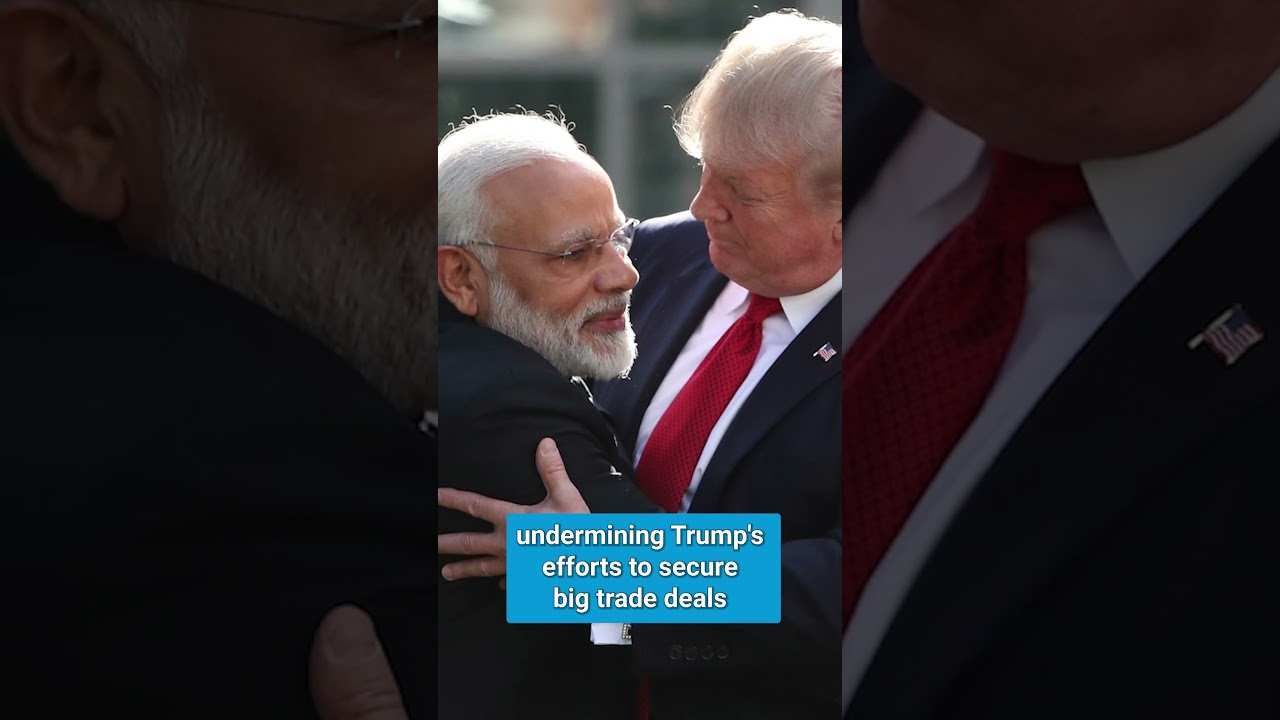

Russia has been facing sanctions and other Western measures to disrupt its crude exports for years now, and it will probably find a way around these new sanctions if the US doesn't keep up the pressure. That means more sanctions will be necessary, not just on Russia, but on its customers. Secondary sanctions on Indian and Chinese refiners who have been buying Russian crude would help cut off the flow, but there could be blowback. Sanctions could anger the Indian and Chinese governments, undermining Trump's efforts to secure big trade deals with Beijing and New Delhi.

And even if some or all of Russia's customers decide to stop taking its oil, Trump could feel the pain back at home. The disruptive impact on Russia's crude oil exports could push up oil prices, which would, in effect, raise the price of gasoline in the United States. That means that after this big initial blow, Trump is likely to take it slow. He'll look to India to voluntarily back away from Russian oil to the EU to put on some new sanctions of its own, and finally to Putin to return to the negotiating table or risk tougher sanctions ahead. As ever, Trump will look to accomplish his goals without causing a big shock to oil prices. It's a delicate balancing act that Trump will have to manage as he tries to avoid nasty economic shocks that could undermine his position back at home.

More For You

Ian Bremmer sits down with Finland’s President Alexander Stubb and the IMF’s Kristalina Georgieva on the sidelines of the World Economic Forum to discuss President Trump’s Greenland threats, the state of the global economy, and the future of the transatlantic relationship.

Most Popular

- YouTube

Who decides how much control a country should have over its technology? Speaking at the 2026 World Economic Forum in Davos, former UK Prime Minister Rishi Sunak discussed the balance between national sovereignty and global interdependence.

Think you know what's going on around the world? Here's your chance to prove it.

- YouTube

How widely is AI actually being used, and where is adoption falling behind? Speaking at the 2026 World Economic Forum in Davos, Brad Smith, Vice Chair and President of Microsoft, outlined how AI adoption can be measured through what he calls a “diffusion index.”

© 2025 GZERO Media. All Rights Reserved | A Eurasia Group media company.