by ian bremmer

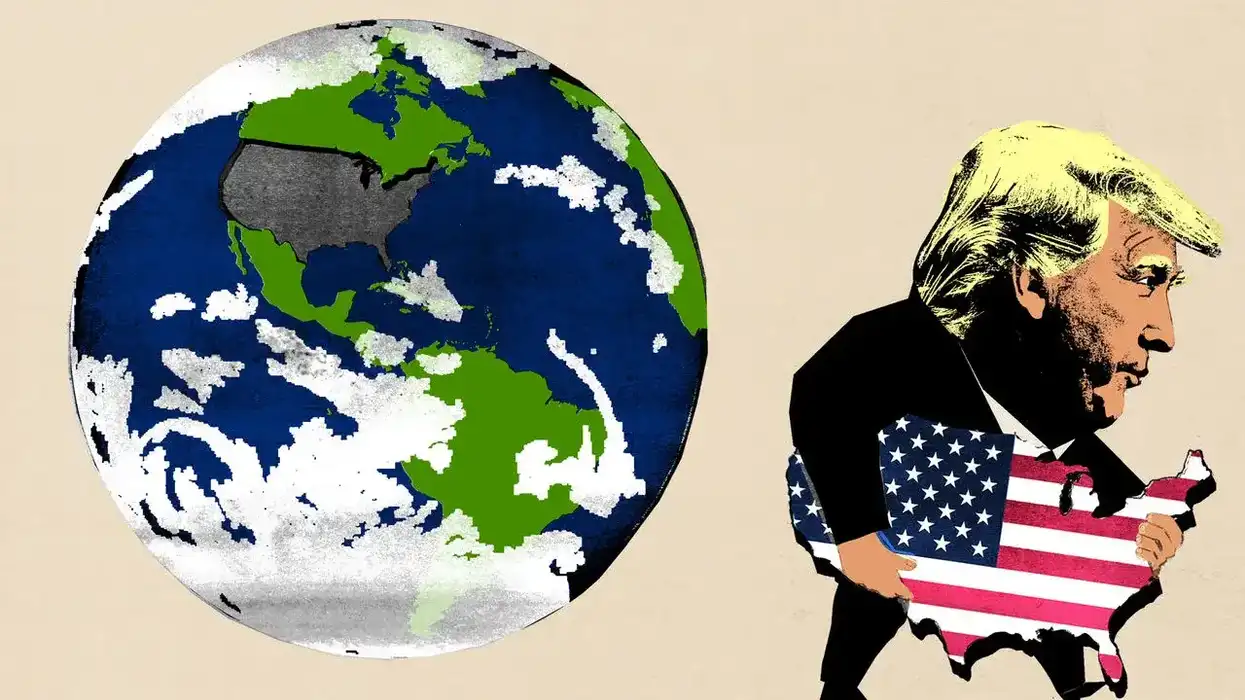

The world’s response to America’s Revolution

Last week, I wrote about the political revolution that President Donald Trump has launched in the United States and how it has made America a fundamentally unreliable player on the world stage.

Oct 29, 2025