When the United States seized Venezuelan strongman Nicolás Maduro earlier this month, and started working on a plan to take long-term control of the country’s oil reserves, Caracas’s largest crude customer was bound to take notice.

After all, China is owed Venezuelan oil, and quite a lot of it, too.

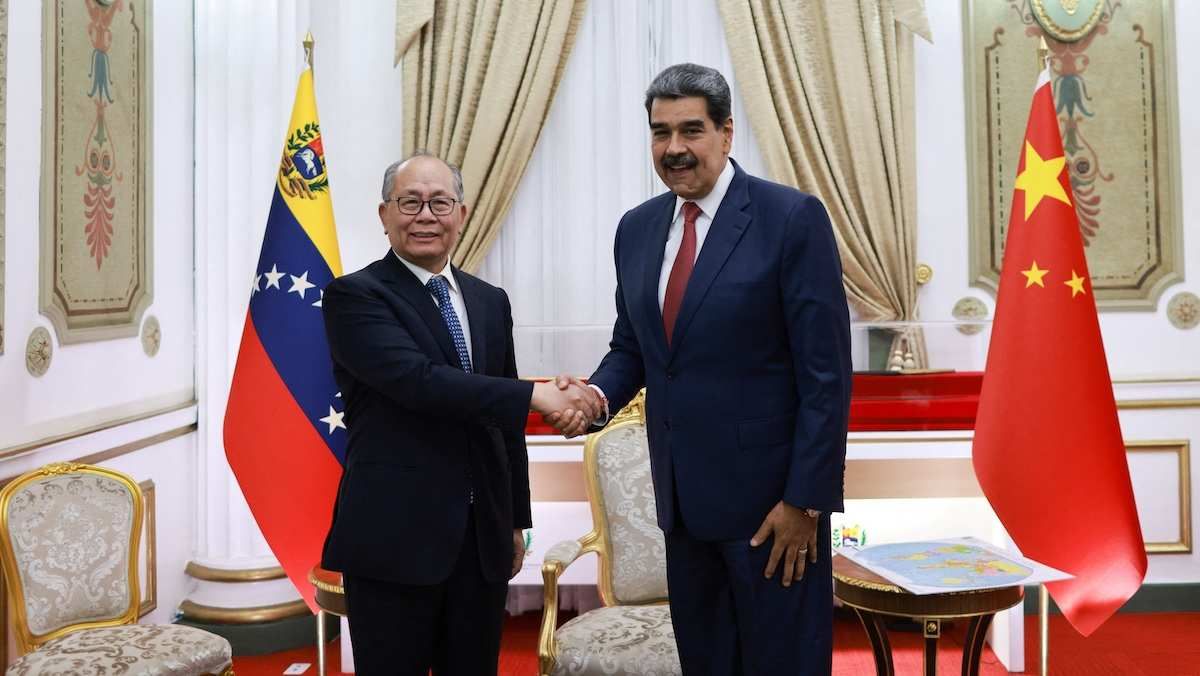

Since the turn of the current century, China has loaned Venezuela over $100 billion, money the Latin American country has used for infrastructure projects like railways and power plants. Instead of repaying the loans in cash, Caracas has used oil. At least $10 billion of the debt remains outstanding.

Beijing is now wondering when, if ever, it will see that money. The US is effectively implementing a blockade on Venezuelan oil, seizing tankers carrying crude abroad and halting production at Chinese-run fields in the country – such fields account for an estimated 10% of Venezuela’s production, and Chinese national oil companies are entitled to roughly 4.4 billion barrels of Venezuelan oil reserves. What’s more, US President Donald Trump has said that Caracas will hand 30-50 million barrels of oil to the United States.

“I suspect the US blockade could disrupt the lion’s share of Venezuela’s oil exports to China,” Columbia University SIPA scholar Erica Downs told GZERO. Roughly one-third of Venezuela’s oil exports to China go toward debt repayment.

What are China’s options? One thing China could do is reimpose controls on rare-earth exports, a tactic it used to great effect last year during a trade war with the US, and compel the US to strike a deal with Chinese creditors. However, Beijing may be reluctant to take such a move, in part because the total amount of debt is a drop in the ocean for the world’s second-largest economy. What’s more, Caracas “hasn’t been servicing these loans for years,” according to Eurasia Group’s Venezuela expert Risa Grais-Targow, so delayed repayment is nothing new for Beijing.

The legal avenues for China are more complicated. After the US seizure of Maduro, China insisted its economic ties with Venezuela are “protected by international law and relevant laws.” However, the country’s interim president, Delcy Rodríguez, could challenge some of Beijing’s agreements with Caracas and seek to cancel the debt altogether.

“There is even talk out there of Venezuela repudiating its debts with China because they might be determined to be ‘odious’ in how they were incurred and for what reasons,” said Eurasia Group’s China expert David Meale. A new government can claim that debt is “odious” if a previous regime incurred it, and it wasn’t beneficial to the country.

China’s oil suppliers under threat. Since Trumpreturned to office, the US has targeted several sources of Chinese oil imports. There were threats against Iranian oil during the 12-day war with Israel last June, and now secondary sanctions against Iranian trade partners. Washington also imposed sanctions on the top two Russian oil producers. And now Venezuelan oil – roughly 80% of which went to China last year – is under a de facto blockade.

In isolation, the limits on Venezuela’s oil industry won’t be a major concern for the Chinese Communist Party. The country only accounts for 3-4% of Chinese crude imports, and much of it goes to small firms known as “teapot refineries” rather than to China’s state oil giants.

Yet on principle alone, China won’t be best pleased.

“At some point they would like to get that money back,” said Downs.

Will China get its money back? The US didn’t capture Maduro because it wants to halt debt repayments to China, but rather to re-establish its influence in Latin America under what Trump himself has called the “Donroe Doctrine.” Still, with the US wielding enormous leverage over Venezuela, China doesn’t hold the high card.

“China is not in a strong position here,” said Meale. He added that China will be able to purchase Venezuelan oil, but won’t be able to claim it as a debt repayment.

Beijing, Meale explains, “will obviously push otherwise. But they will struggle to be effective, at least for now.”