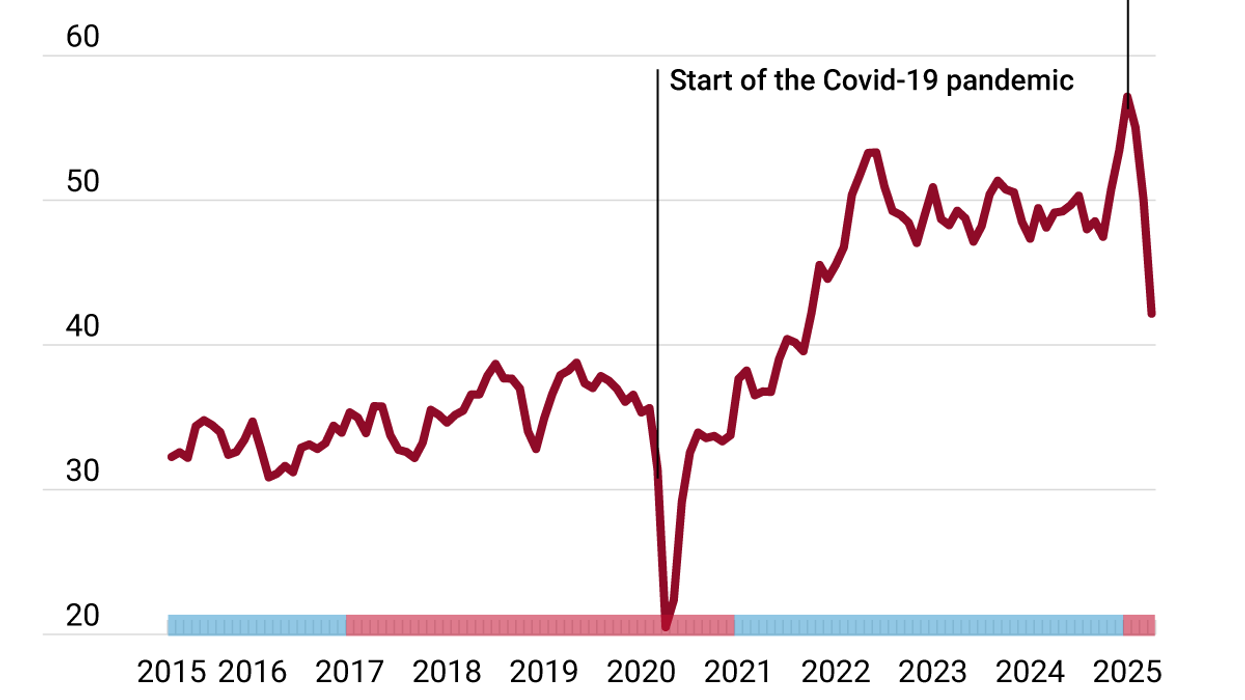

Canada's annual inflation rate dropped more than expected to only 2.8% in June, the lowest figure since April 2021. That's good news, right? Well, it depends.

On the one hand, Canadian inflation is now within the 2-3% range that economists consider healthy, and it remains the lowest rate of all G-7 countries. This means the Bank of Canada might soon move to cut interest rates despite hiking them last month to 5%, the highest level in 22 years. Even if it doesn't, the Canadian economy looks on track for a "soft landing" — economist-speak for avoiding the recession that rate hikes can trigger.

On the other, core inflation — excluding volatile food and energy prices — remains "sticky" (economist-speak for prices that just keep rising whatever the central bank does). This is also happening south of the border in the US, where inflation has receded but things like rent or dining out are getting a lot more expensive.

While Canada's central bank and the US Federal Reserve are often in sync, earlier this year the Bank of Canada famously went off-script by being the first to hit pause on rate hikes. So don't be surprised if Canada goes a step further by slashing rates soon once core inflation is brought under control.

The US, meanwhile, saw 3% year-over-year inflation in June, and economists now predict that Americans may avoid a recession. The US Federal Reserve – likely eyeing Canada’s results – held rates in June but looks likely to raise rates this month from 5% to 5.25%. We’ll be watching to see whether that’s the last Fed hike … and the prospects for a soft landing in the US.