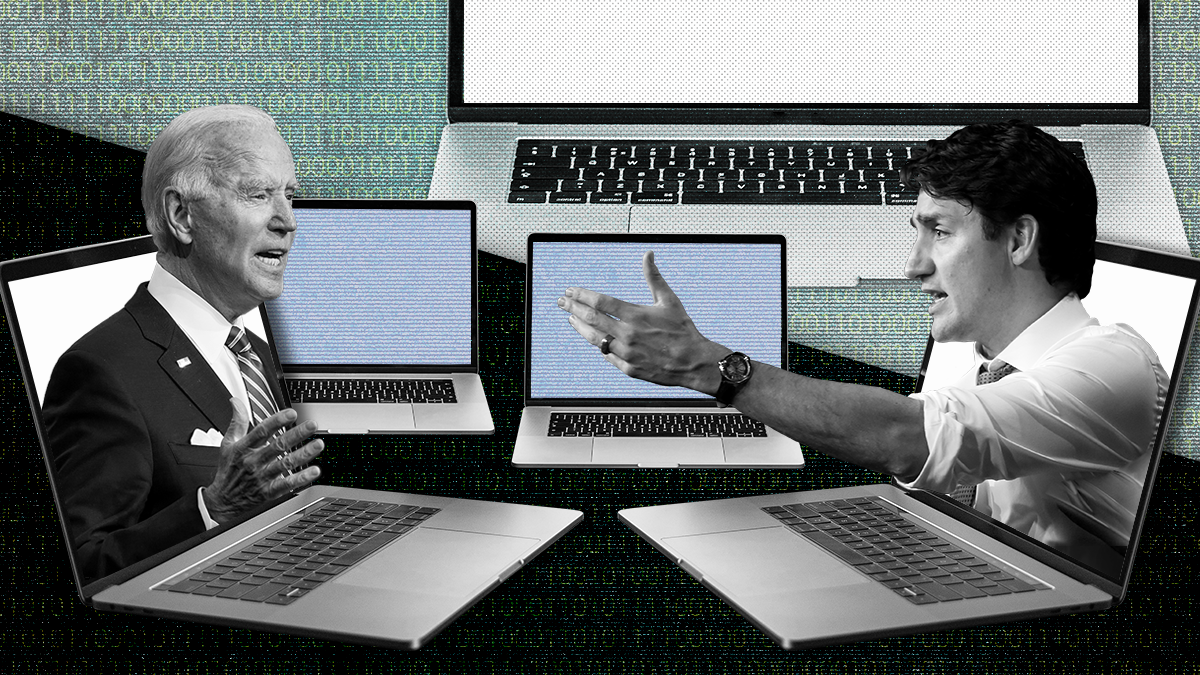

Justin Trudeau and Joe Biden appear to be headed for a showdown over tax policy that could bleed into the US presidential election – and Bruce Heyman, one of Canada’s best friends in the United States, is worried.

Heyman, a former Goldman Sachs banker who Barack Obama sent to Ottawa as ambassador to Canada in 2014, is normally upbeat about the relationship between Washington and Ottawa. During the long and difficult USMCA negotiations, when Donald Trump threatened to tear up NAFTA, Heyman was a loud and persistent voice calling for calm, pointing to the benefits of the enormous cross-border trade.

But he has been worried since last Friday when he watched Finance Minister Chrystia Freeland firmly defend Canada’s plan for a new digital service tax at a forum in Aspen, and absorbed a stern warning from current Ambassador David Cohen. The plan is to impose a 3% tax on big tech revenue in Canada.

“I would recommend everybody take Ambassador Cohen’s comments last week very seriously,” Heyman says. “The US would have to respond in some way.”

In a Canadian interview published Friday, Cohen said that if Canada proceeds with its tax plan, the United States will have “no choice but to take retaliatory measures in the trade context, potentially in the digital trade context.”

On the same day, in Aspen, Freeland stood firm, delivering lines that sounded very much like those she delivered during the high-stakes USMCA negotiations.

“We believe in being nice,” she said. “We believe in being polite. When we have disputes we think they should be negotiated in a civil way. But we also believe at the end of the day you have to stand up for the national interest.”

How we got here

The roots of the dispute go back to the Canadian election of 2019, when the Liberals promised to “make sure that multinational tech giants pay corporate tax on the revenue they generate in Canada,” in the form of a 3% digital services tax, similar to measures in the UK, France, and Italy. Freeland included the measure in a budget document in 2020 but postponed the plan for two years while OECD members worked toward an international agreement. The 143 countries in the tax deal are trying to reallocate taxing rights on about $200 billion in profits from multinationals to the countries where they do business.

But the OECD talks ended two weeks ago with the parties agreeing to another delay, at which point Freeland said Canada would bring in its own tax on Jan. 1, 2024. “Canada is being asked, again, having agreed to a two-year standstill, to agree to further standstills with no fixed date … so for us, that’s clearly a disadvantageous position,” she said in Aspen.

Canada is isolated. Of the countries in the tax talks, only four other countries — Belarus, Pakistan, Russia, and Sri Lanka — rejected a one-year extension. “When you look at the countries that do not agree with that position, they are not countries that you would normally think Canada wants to be a part of,” Cohen said. “They are a combination of autocracies and Third World countries.”

This is the second run the Canadians have taken at Silicon Valley this year. In June, Trudeau’s government passed a law that would require social media platforms to make payments to Canadian news outlets. Both Meta and Google have balked and moved to drop Canadian news from their platforms rather than pay, embarrassing the government.

Tyler Meredith, a former advisor to Trudeau, helped write the tax policy in question. He says the Canadians are determined to implement a digital services tax, in part because multinationals are able to shelter their profits in low-tax jurisdictions, meaning they extract money from Canada without contributing meaningfully to the economy.

How Washington will respond

Meredith says that while the United States can impose tariffs, they may not win a trade-dispute resolution process on the issue because the tax measure is within Canadian jurisdiction, and any tax would apply to both Canadian and foreign companies. He says the government won’t want to just drop its plan.

“Having put effectively four years into this effort and already made assumptions in our fiscal framework … and having worked in partnership with the US and other OECD partners, it’s very hard for Canada to move off that position without confidence we’re getting something in return.”

But Heyman warns that Cohen isn’t bluffing. “The US embassy and the US government are going to work hard to stand up for US industry. I don’t know what actions will or could be taken. But, trust me, I would just take the ambassador's comments seriously.”

Jonathan Lang, Eurasia Group’s director for trade and supply chains, agrees that the US will feel obliged to respond if Canada proceeds. “I do think the US would have to respond with a tariff regime of some kind if DST were to move forward in Canada, sidestepping the OECD negotiations,” Lang says. “That would be a warning to others.”

Lang, who was director for international economic affairs in Trump’s White House, points out that the former U.S. president threatened France with a wine tariff when French President Emmanuel Macron brought in a similar tax in France. The Americans, under Biden or Trump, don’t want to see countries imposing taxes on U.S. tech companies. “I strongly suspect that the US would have to draw a line in the sand of some kind here,” he adds.

This high-stakes showdown is taking place in the run-up to the 2024 presidential election, in which Trump can be expected to argue that Biden is too soft on foreign competitors.

That is what makes Heyman nervous about the whole thing: “The US in 2024 may have a Trump card, and that changes the dynamic of the poker game entirely.”