In this special edition of Signal, we'll look at why there will be no US-China Cold War (yet), track declining population growth in both countries, and fight business culture wars over Xinjiang. This edition is part of the "Living Beyond Borders" series, presented by GZERO and Citi Private Bank.

Thank you for reading — while you're at it, please tell your friends to subscribe here.

— The Signalistas

The US and China are too busy to fight

Willis Sparks

Willis SparksAt the dawn of the US civil rights movement, Atlanta mayors William Hartsfield and his successor Ivan Allen promoted Georgia’s capital as “the city too busy to hate.” Whatever the reality of race relations at the time, both men wanted Atlanta to avoid the confrontations plaguing other southern US cities, and to open their city as the commercial hub of the “new South.”

In recent decades, US and Chinese leaders have relied on a similar approach to relations between the two countries. The risk of conflict was obvious, given differences in their interests and political ideologies, but there was much money to be made and stability to be gained as long as they protected their mutually profitable business opportunities.

But over the past five years, US and Chinese words and deeds have taken on a harder edge. As US post-Cold War dominance of the international system has eroded, and as Xi Jinping has more explicitly offered China’s leadership as an alternative to the West’s global rule-setting, Washington and Beijing have seemed headed toward a digital-age Cold War. Former US President Donald Trump pushed for a more open confrontation between the two powers, and current President Joe Biden has done little to change course.

There is good news, however, for those who believe that a US-China Cold War would be catastrophic for both countries and the world. In reality, both countries are far too busy to transform rivalry into hate. But it isn’t just business opportunities that now preoccupy them. It’s also major domestic challenges and distractions, particularly for China, that demand something close to their full attention.

Troubles at home

One year into the job, Biden knows the success of his presidency will depend on helping to end the pandemic, revive the US economy, and deliver on more of his legislative promises. With midterm elections in November, his need to focus on these priorities is increasingly obvious. Fights with China won’t help, because they undermine investor confidence in the country’s immediate and longer-term future and distract from the issues his voters care more about.

Xi faces an even longer list of domestic problems. In a year in which he wants a smooth path toward a third term as China’s leader, and the indefinite extension of his power, he’s coping with both urgent and longer-term challenges for China.

First, China is days away from hosting the Beijing Winter Olympic Games in the middle of a public health emergency — and Xi is well aware that the credibility of his government’s COVID response is very much on the line. From the beginning of the pandemic, China has enforced a zero-COVID policy, imposing large-scale lockdowns in response to small numbers of infected people.

Now, with the Games about to begin, the much more transmissible omicron variant has appeared inside multiple Chinese cities, and more than 20 million people have been locked down in response. An added complication: it will be months before China can roll out an mRNA vaccine that’s more effective than currently available Chinese vaccines.

This problem arrives at a moment when China’s economy was already cooling off — and this slowdown creates a more urgent worry in China than a temporarily stalled economy in the US or Europe. China is still a middle-income country. To reach Western levels of prosperity, it needs growth above 6 percent for another generation, according to Eurasia Group estimates.

But in a world where factories’ production depends less heavily on cheap labor and more on robots, that’s a serious concern for China’s future. The country’s changing demographics — fewer workers and more retirees as birth rates remain low — compounds that problem.

Then there’s China’s debt problem. For decades, the state has boosted growth by encouraging Chinese lenders, some of them state-owned, to finance real estate and other speculative projects with little worry over the financial wisdom of each investment. When big companies have struggled to repay, the state has subsidized repayment to avoid a systemic financial crisis.

But when borrowers believe that government will prevent default, they take on even more risk, including by borrowing more from foreign lenders, creating a debt bubble. In recent years, China has tried to allow some companies to default and fail. But reform comes with risks that demand careful attention.

Bottom line: Biden and Xi have good political reasons to talk tough, and to challenge one another at the margins. But both leaders have bigger worries to manage, and the two countries still need strong economic ties to address their own problems.The Graphic Truth

Gabrielle Debinski

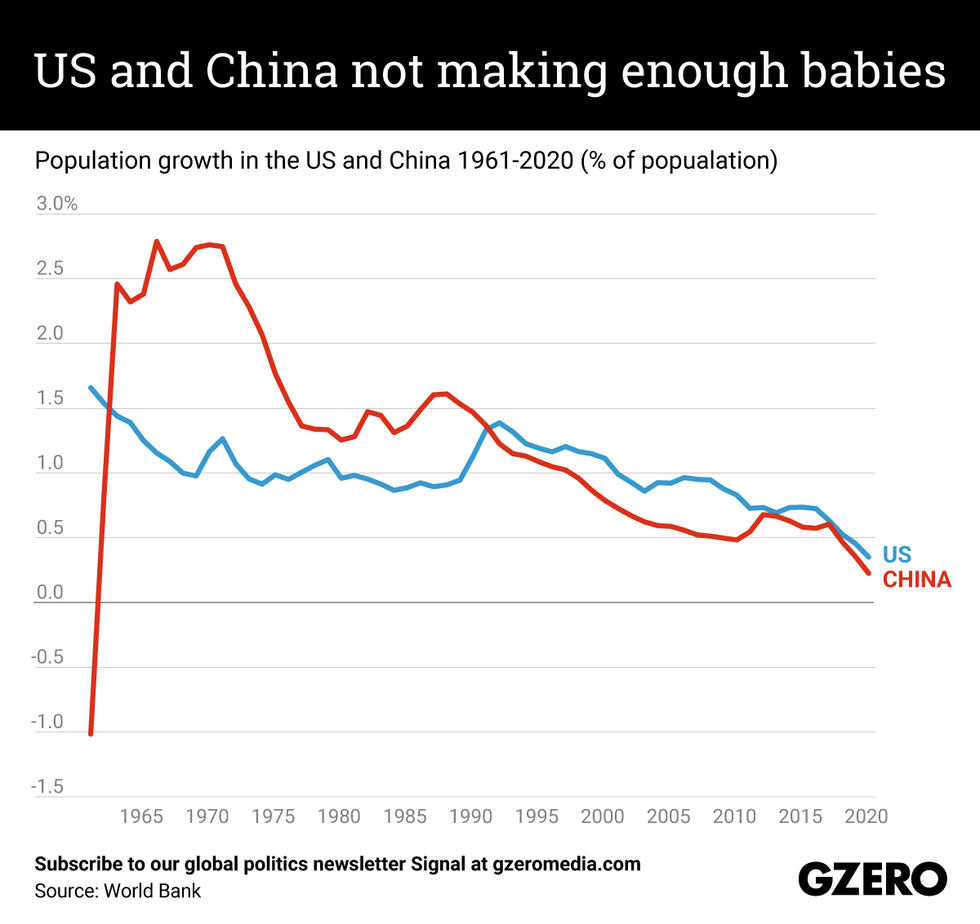

Gabrielle DebinskiFor decades, the Chinese Communist Party was worried about overpopulation. In 1978 it told Chinese families they could only have one kid to contain the ballooning population size. But after years of restricting the number of births, China's population is now shrinking — fast. This demographic trend is a massive problem for China, currently vying to overtake the US as the world's largest economy. Meanwhile, the US population has also started to decline over the past decade. We compare their population growth rates from 1961-2020.

The expansion will endure: Seeking sustained returns

Citi Private Bank

Citi Private BankThe economic recovery and bull market are maturing, with moderate growth expected ahead. We believe portfolios should evolve to provide exposure to more defensive sectors, quality firms and dividend growth strategies. In Outlook 2022 we highlight asset classes and regions that may lead the way in 2022 and beyond.

You can click here to read the full report, learn more about key themes in the report, and view related videos.

What We’re Watching: COVID Olympics, US-China business dilemma, China and the US midterms

Gabrielle Debinski

Gabrielle DebinskiCOVID at the Games. The Beijing Winter Olympics, which begin on Friday, will be the most serious test to date of China's zero-COVID policy. President Xi Jinping wants to make a big international splash with the Games, as his predecessor did with the Beijing Summer Olympics in 2008. That'll be tough with stadiums only half-full with domestic spectators pre-screened by the Communist Party, and no foreign fans allowed to attend at all. To avoid an outbreak at the Olympic Village, China initially imposed strict testing and quarantine policies for everyone attending the Games. But it’s possible that the CCP is having at least some doubts about this policy's ability to contain the omicron variant: Only days out from the inauguration ceremony, authorities have relaxed testing and isolation guidelines, signaling a slight pivot in China's pandemic management strategy. Does this mean the Olympics will be the beginning of the end of zero COVID? China's economy — and the world's — would surely benefit from a transition to living with the virus. Beijing says it is developing its own mRNA vaccines to achieve this, but that could still be many months away.

Xinjiang business culture wars. The Beijing Winter Olympics will also pose a big test for multinational corporations that will try to attract business in China despite the CCP’s ongoing human rights violations. US firms will worry about American consumer boycotts if they source products from Xinjiang, where some Chinese manufacturers rely on Uyghur forced labor. (Elon Musk recently came under fire for opening a Tesla showroom in the region.) But if US corporations take a firm stand on Xinjiang and other politically-sensitive issues in China, they risk a similar backlash from Chinese consumers. Last year, a vocal online movement in China called for the boycott of Nike after the multinational corporation criticized abuses in Xinjiang. Indeed, the CCP is more game to stoke nationalist fervor at the expense of business opportunities than the US government, which is reluctant to support consumer-led boycotts that hurt US businesses. Now, American corporations will face a very tough choice between drawing the potential ire of the US public or nationalist Chinese consumers.

China enters US midterms campaign. Republicans and Democrats in the US Congress don’t agree on much these days, but they do find much common ground on China — specifically, the need to counter Beijing’s growing economic and diplomatic clout. This “tough-on-China'' competition will surely intensify in the lead-up to the November midterm elections. Last summer, the Senate passed a bill to augment the US’ tech capabilities and “global competitiveness” – for instance by producing more US-made semiconductors instead of relying on Chinese chips. Tellingly, the legislation explicitly refers to China as the "greatest geopolitical and geoeconomic threat" to US foreign policy. The House of Representatives, meanwhile, passed two separate research and development bills, with some Democrats saying the Senate bill was too focused on countering China. In the months ahead, expect Republicans to jump at the opportunity to cast the Democratic party — and President Biden — as weak on China. Senator Marco Rubio from Florida, who is up for re-election, has previously sent out campaign emails with the subject line "Dems <3 China.” This could prove to be a decisive electoral strategy considering that most Americans have a negative view of China, and support a more assertive stance towards its government.

Podcast: The US and China

This two-part instalment of Living Beyond Borders, a special podcast series from GZERO and Citi Private Bank, focuses on the relationship between the US and China. Moderated by Caitlin Dean, head of the Geostrategy Practice at Eurasia Group, the two episodes feature David Bailin; Chief Investment Officer and head of Investments for Citi Global Wealth; Steven Lo, co-head Citi Global Wealth for Asia-Pacific; and Ian Bremmer, President at Eurasia Group and GZERO Media. Watch part I (Tariffs, tutors, and tension) here and part II (Common prosperity, coal, and competitiveness) here.

Quiz: Nixon goes to China

Carlos Santamaria

Carlos SantamariaFebruary 21 is the 50th anniversary of Richard Nixon's historic visit to China, which began the normalization of US relations with the world's most populous Communist state — instantly shifting the Cold War balance of power. This bold move by a US president who had made his political reputation as an anti-Communist crusader shocked many at the time, but it helped set the stage for deeper ties between what are now the world's two most powerful nations and largest economies.

How well do you know the details of Nixon's week-long trip? Take our quiz to find out.

1. How did Nixon refer to National Security Adviser Henry Kissinger during his meeting with Mao?

A. A foreign policy genius

B. A ladies' man

C. A doctor of brains

2. The leader of which Asian country brokered Kissinger's secret 1971 visit to China that paved the way for Nixon's trip?

A. Yahya Khan, Pakistan

B. Indira Gandhi, India

C. Suharto, Indonesia

3. What did Nixon say while touring the Great Wall?

A. How long is it?

B. This is a great wall.

C. Who built it?

Hard Numbers: GDP wars, WTO rules in Beijing’s favor, Africans support Chinese engagement, China winning 5G battle

Gabrielle Debinski

Gabrielle Debinski5.9: China’s GDP could grow on average 5.9 percent per year until 2025, according to the Center for Economics and Business Research, which predicts that China will overtake the US as the world’s largest economy by the end of the decade. The Chinese economy was worth $18 trillion in 2021, compared to America’s $23 trillion.

645 million: Amid an ongoing trade war between the world’s top two economies, the World Trade Organization ruled last week that Beijing can slap $645 million worth of tariffs on US goods. A decade ago, the US placed tariffs on some Chinese products, including steel pipes and solar panels, saying that Beijing was giving unfair subsidies to state-owned companies.

59: The US has been trying to discredit China’s growing influence in Africa, but it’s not working: 59 percent of Africans view China’s economic and political clout favorably. Almost exactly the same number — 58 percent — feel the same about the US.

90: More than 90 countries have signed up to use 5G networks made by the Chinese telecom giant Huawei. Meanwhile, only eight nations have so far agreed to join the US ban on Huawei. Why? Many analysts say it’s because China offers way superior 5G infrastructure.

Answers

1. C — According to the now-declassified transcript of their conversation, when Mao asked Nixon about Kissinger's PhD, the US president responded that his national security adviser was a "doctor of brains." Mao was however also very interested in Kissinger's playboy reputation, which Nixon acknowledged and joked about.

2. A — Soon after taking office in early 1969, the Nixon administration put out feelers to China through Pakistan, whose dictator personally delivered a message for China’s PM Zhou Enlai to relay to Mao. Mao agreed to start a dialogue — under the condition that the US withdraw all its forces from Taiwan. When Zhou finally met Kissinger in Beijing, the Chinese kept their promise to the US of total secrecy.

3. B — On the fourth day of his visit, Nixon took a road trip outside Beijing to check out China's most famous monument. After admiring the centuries-old structure, he famously quipped to the American media: "I think that you would have to conclude that this is a great wall." (The original quote is much longer.)

This edition of Signal was written by Gabrielle Debinski, Carlos Santamaria, and Willis Sparks. Art by Jess Frampton, graphic by Ari Winkleman.