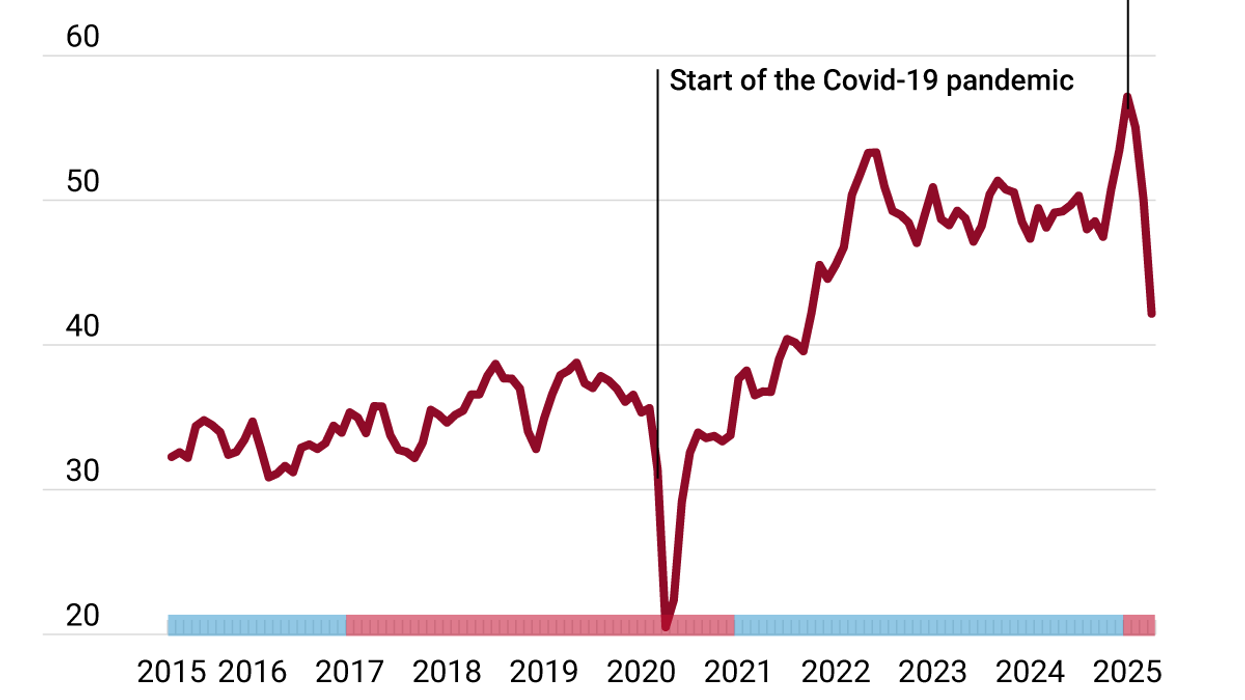

When Finance Minister Chrystia Freeland tabled a bill Tuesday to implement financial measures from the Canadian budget she presented last month, one thing was missing: a mechanism to increase the amount of taxable income on capital gains. The move is expected to raise $19 billion over five years, mostly at the expense of the wealthy.

Freeland will introduce the tax policy in a separate bill, allowing the Liberals to force a stand-alone vote and pinning down opposition MPs. Polling shows that most Canadians like the idea of taking more from those well enough off to need to use the capital gains exemption, which shelters some income from the sale of a business or vacation home from the taxman. Tech entrepreneurs have objected to the move, complaining it could discourage investment, but Conservative Leader Pierre Poilievre, who takes pains to portray himself as on the side of the little guy, has not taken a position.

Freeland’s budget was aimed at young voters who voted for Liberals in previous elections but have now moved their support to Poilievre, who has succeeded in blaming Trudeau for the housing crisis that is making rent unaffordable and putting the prospect of home ownership out of reach. The polls, so far, do not show that the budget has helped win those voters back to the Liberal fold. But Freeland hopes they will take notice of the tax measure that will help pay for housing affordability measures in the budget.