Remember when the world was “running out of oil?” Seems like a long time ago. New technologies changed the game by helping companies find oil they couldn’t have found 10 years ago and draw it from places once thought inaccessible. Today, oil sells for about half the price it earned ten years ago. That’s been bad news for countries like Saudi Arabia, Russia, Venezuela and others that sell lots of oil, and good news for importers that want oil at affordable prices. It also helps keep gasoline prices lower.

But… the oil price has risen 60% in the past 11 months, and we might be on the verge of another surge over the coming 12–18 months, perhaps to heights we haven’t hit in a decade. Call it a possible perfect storm:

- Lower prices have discouraged investment in new oil production, and countries and companies now hold less oil in reserve.

- President Trump’s decision to reimpose sanctions on Iran may pull hundreds of thousands of barrels per day of Iranian crude off the market later this year.

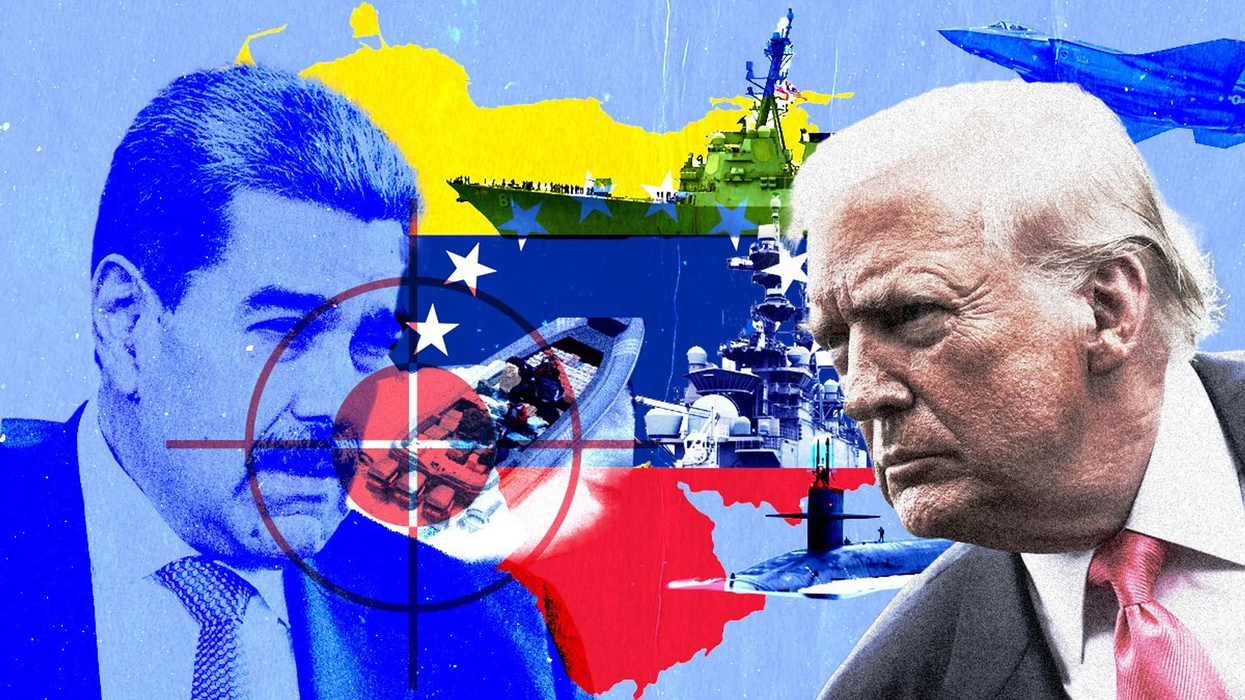

- Crisis-stricken Venezuela, home to the deepest oil reserves in the world, can’t invest in fixes to dilapidated state oil company PDVSA, which now produces 700,000 barrels per day less than it did a year ago. That death spiral will continue.

- US production is still rising, but lack of investment in infrastructure, especially pipelines, will delay the arrival of new US supplies.

- The Saudis could help by pumping more oil, but the Saudi government is prepping to sell shares in state-owned Saudi Aramco and will raise more cash with a higher oil price.

- The Russians could also pump more, but a higher price helps President Putin avoid tough choices on state budget cuts in sensitive areas and makes trouble for oil importers in Europe. (China wouldn’t much like $150 per barrel either, particularly at a time when its economy is already slowing.)

A possible unintended political consequence: What if Trump’s move to sanction Iran forces US gasoline prices higher… just in time for the November midterm elections?