Warning: The following piece may change your mind. If all you’re looking for is confirmation of your existing view, read no further.

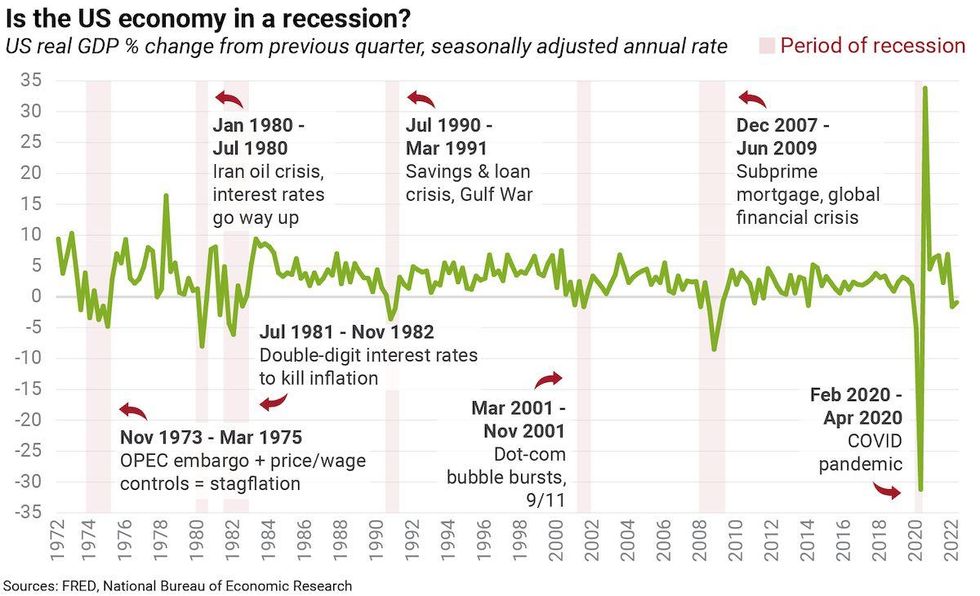

On Thursday morning, the Bureau of Economic Analysis released data showing that U.S. gross domestic product (GDP) fell at a 0.9% annual rate in the second quarter of 2022. This is the second straight quarter the economy is estimated to have shrunk.

Does this mean we’re in a recession? Not necessarily.

Two negative quarters of GDP growth is sometimes used by analysts and the media as a rule of thumb to call recessions because the two things often go together.

But “often” is not always. You can have a recession without GDP falling for two straight quarters, and GDP can fall for two straight quarters outside of a recession. The pandemic recession of 2020, for example, was the deepest downturn in American history... but it only lasted a month!

And contrary to popular belief, a two-quarter contraction is not the definition used by professional economists or by the U.S. government. Not now, not ever.

Want to understand the world a little better? Subscribe to GZERO Daily by Ian Bremmer for free and get new posts delivered to your inbox every week.

Is the US economy in a recession?FRED, National Bureau of Economic Research

Is the US economy in a recession?FRED, National Bureau of Economic Research

So what is a recession and how do we know if we’re in one?

In the United States, recessions are defined by the National Bureau of Economic Research’s Business Cycle Dating Committee, a non-partisan panel of eight academic economists with no political agenda. They define a recession as "a significant decline in economic activity that is spread across the economy and that lasts more than a few months." In other words, an economic downturn has to be deep enough, broad-based enough, and long-lasting enough to be considered a recession.

The NBER has always explicitly said it does not base its recession calls on GDP alone, in large part because GDP data is mismeasured in real time and initial estimates are subject to continuing—and often large—revisions. This year’s first and second quarter estimates will almost certainly get updated multiple times as better data comes in.

In fact, if history is any guide, there’s a significant chance the real GDP growth number in Q1 and/or Q2 was actually positive. That’s why the NBER only makes recession in hindsight, based on revised data rather than initial estimates.

The NBER is also very clear that it looks at a number of indicators other than GDP, including employment, personal income, consumer spending, manufacturing and trade sales, and industrial production—all of which come out monthly.

How do these measures look right now?

Many are rising slower than before and some are flat, but none are in a clear, significant decline. Consumer spending is still growing. Personal income looks solid. Employment levels, vacancies, and wage growth are holding up. Since the beginning of the year, the unemployment rate has fallen from 3.9% to 3.6% and around 2.7 million jobs have been created.

In short, several key parts of the economy remain quite strong, painting a picture that is inconsistent with what we normally call a recession. Importantly, downturns are usually associated with a run-up in layoffs, and we aren’t seeing that yet. The Sahm rule, another widely used recession indicator that looks at unemployment, is far from being triggered. As Fed chair Jerome Powell said on Wednesday, “there’s just too many areas of the economy that are performing too well” for there to be a recession right now.

That’s not to say the economy is in great shape.

Unlike NBER recession calls, the state of the economy is continuous, not binary. Things are better and worse, not just good or bad. For the typical American, the difference between GDP growth of 2.0% and 1.0% matters more than the difference between 0.1% and -0.1%. There is nothing magical about the 0% threshold.

What today’s GDP release does show is the economy is clearly slowing—or at least some sectors are. We may well be barreling toward a recession, as the IMF believes. That wouldn’t be surprising: we have very low unemployment, high inflation, and significant supply constraints that continue to hold down economic activity. The Fed has signaled its willingness to accept a mild recession to bring inflation down and restore price stability. By design, its rate hikes will over time act to slow demand. That along with other factors (e.g., the Russia-Ukraine war) is likely to cause a recession.

But there’s no evidence we’re there yet.

Of course, just because we aren’t in a recession doesn’t mean the economy is working for people. Inflation is at 40-year highs. Gas, food, and rents are expensive. Wages aren’t keeping up. All of this obviously contributes to the perception that the economy is bad.

That explains why consumer sentiment is in the dumps even as the unemployment rate nears a 70-year low. It also explains why the Biden administration is losing the political argument

Politics are driven by perception, which in turn is shaped by the information environment, partisanship, and confirmation bias as much as by actual economic fundamentals. Recession or not, Americans are feeling down about the economy, and no amount of explainers are about to change that.

Still, facts matter. A cost-of-living crisis is not the same as a slowing or shrinking economy. The economy can have very high inflation at the same time as it adds hundreds of thousands of jobs each month. We can bemoan the former while acknowledging the latter. Calling it a recession doesn’t make it so.

TL;DR: The economy is clearly slowing, although several areas are still growing. The NBER may end up calling a recession sometime down the road. But Thursday’s Q2 GDP release can’t tell us whether we’re in one already.

🔔 And if you haven't already, don't forget to subscribe to my free newsletter, GZERO Daily by Ian Bremmer, to get new posts delivered to your inbox.