The US ambassador has once again warned Canada that it should expect consequences if it proceeds with a plan to impose a digital service tax on the tech giants. David Cohen, in response to an audience question at a Canadian Club luncheon in Ottawa, signaled that it could get nasty.

“That will be an area of contention unless it is resolved," he said. “There’s a place where we’re either going to have to have agreement, or we’re going to have a big fight.”

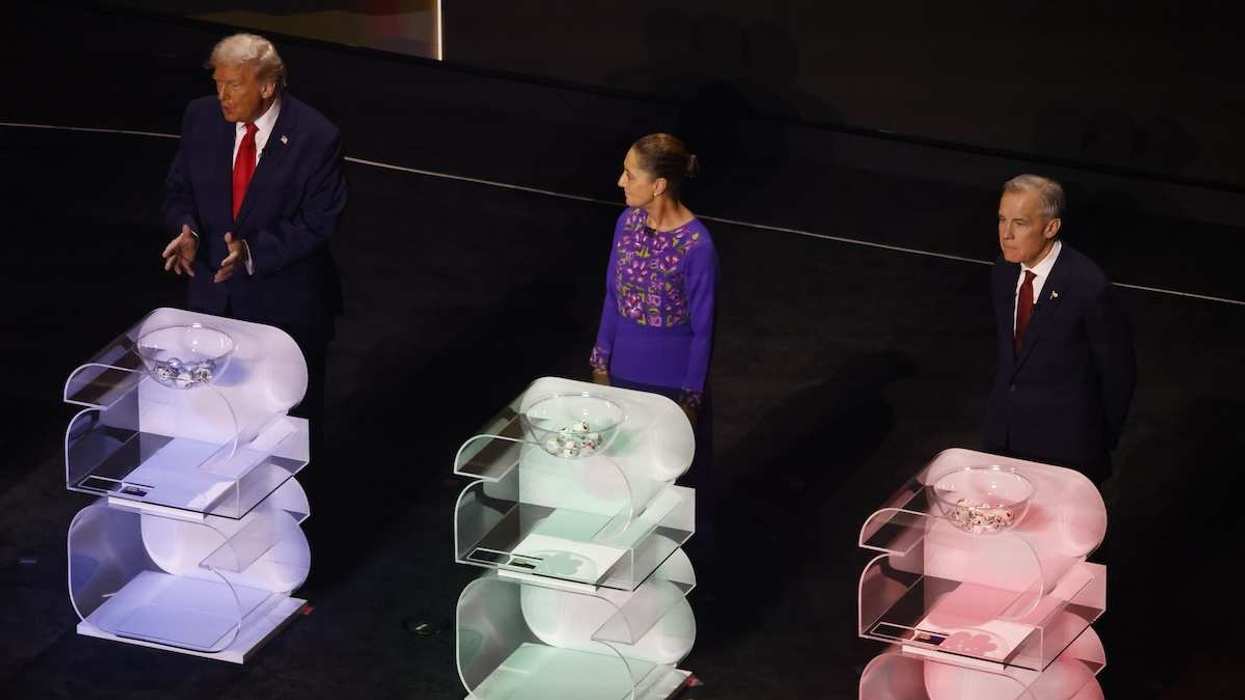

Finance Minister Chrystia Freeland surprised observers, and her friends in the United States, when Canada refused to agree with other countries to delay adopting such a tax at a meeting of the OECD this summer, complaining that it had waited long enough.

The tax would impose a 3% levy on big tech firms — many of them American — that earn revenue from Canadian customers without paying tax in the country. It is scheduled to kick in on Jan. 1.

On Wednesday, Freeland said that after a recent trip to Washington, she was “cautiously optimistic” that she would reach a deal with the Americans and avoid a showdown.

Neither side would benefit from a high-profile dispute over the matter, so a face-saving compromise would be welcomed by both countries’ business communities, which have warned Freeland against forging ahead in the face of opposition from Washington and Silicon Valley. If a showdown has been averted, Freeland may reveal as much in her department’s Fall Economic Statement, due for release later this month.