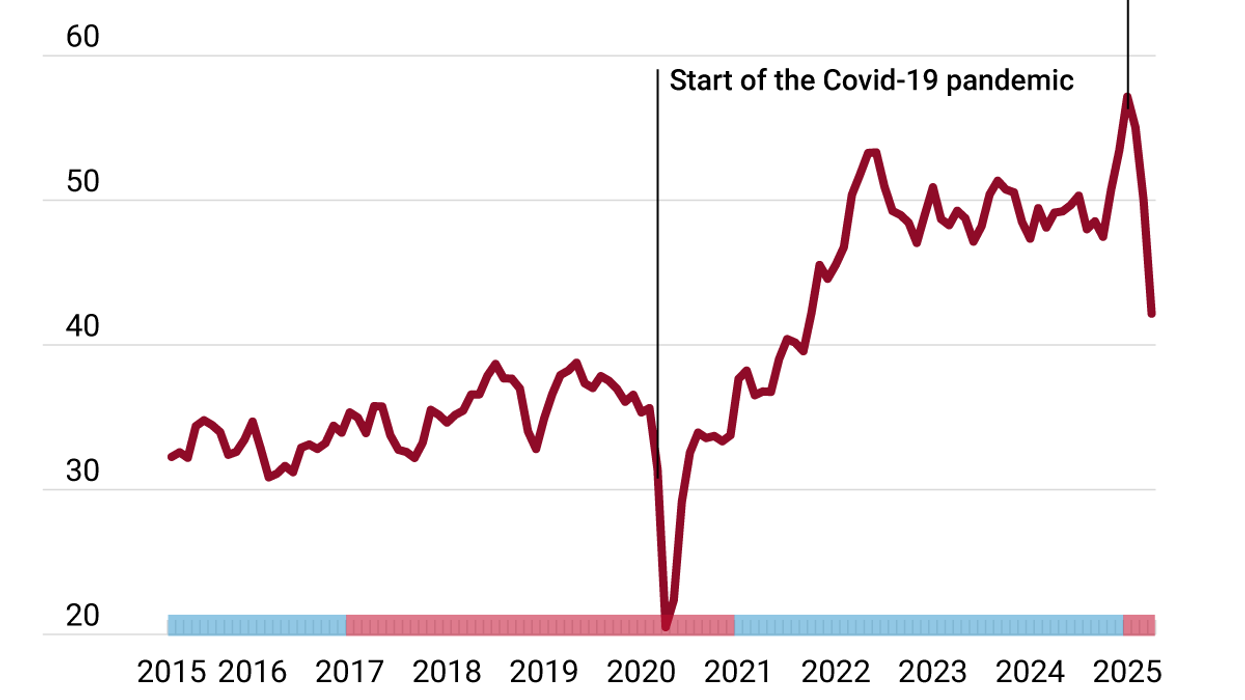

Last April, Canada confirmed that it was going ahead with a digital services tax, retroactive to 2022, on big tech firms with annual revenues above CA$20 million. A tax had been in the works for years as a multilateral effort among OECD countries, but it’s been stalled time and time again by the US. In the face of US opposition, Canada decided to go it alone.

The Biden administration argues the 3% tax unilaterally pursued by Canada unfairly targets US companies. It has requested trade dispute consultations with Canada, calling the measure “discriminatory” and alleging it violates the country’s free trade agreement by treating Canadian firms differently than their American counterparts.

The dispute consultations could take months and, if not resolved within 75 days, could lead to a dispute settlement panel that will arbitrate the matter.

In response to the tax, Google has levied a 2.5% ad surcharge, effectively passing the tax along to Canadians firms that may pass the cost along to consumers.

The Canadian business lobby is warning that the tax could provoke a trade war with the US. But the Liberal government of Justin Trudeau is not backing down, reiterating that it will keep the tax that it promised back in 2020, setting up a showdown with the US and tech giants ahead of the 2025 Canadian general election.