After years of uninhibited expansion into nearly all corners of modern life, consumer internet companies could this year face meaningful action to curb their activities from governments around the world. From Delhi to Dublin, Beijing to Brussels, and Washington to Warsaw, there is real momentum behind unprecedented legislation and stepped-up regulatory enforcement against big tech. In response, these companies will launch forceful advocacy campaigns to try to deflect the most aggressive measures, while modifying their business models and practices in response to the changing environment. We spoke to Eurasia Group expert Alexis Serfaty to get a sense of how the backlash against big tech is likely to play out in three major markets: the EU, China, and the US.

So, what’s in store for these firms in the EU?

A two-pronged strategy is taking shape in Europe. On the one hand, authorities are preparing to ramp up public investment in local technology companies and industries. The Digital Decade 2030 package has committed to spending 150 billion euros ($167 billion) to help reduce the bloc’s dependence on foreign technology by aiming, for example, to double its share of global semiconductor production from 10 percent to 20 percent. The EU’s Recovery and Resilience Fund is also expected to finance multi-billion-euro investments in areas such as artificial intelligence, 5G, semiconductors, cloud computing, and quantum technologies.

On the other hand, authorities are preparing legislation that will place new restrictions on the activities of US companies such as Google, Facebook, and Amazon that dominate much of the consumer internet sector. The aim is partly to strengthen user protections and partly to create new space for home-grown alternatives to develop. The Digital Services Act and the Digital Markets Act will create new obligations for addressing illegal and other harmful content and to stop practices such as targeting ads at users based on sensitive features such as ethnicity or sexual orientation. Consumers would in some instances also have the ability to opt-out of targeted advertising. The legislation will also grant regulators expanded powers to launch investigations and seek remedies for undesired business practices, including breaking up companies in extreme cases.

How about China?

As European regulators move to crack down primarily on US-owned consumer internet companies, their counterparts in China are seeking to rein in the country’s own internet giants. Authorities last year grew concerned that e-commerce firms such as Alibaba, Tencent, and Baidu had grown too big and powerful after years of laissez-faire regulation and sought to force them into alignment with the government’s own economic priorities. In May 2021, Xi Jinping made a speech on digital economy development calling on tech companies to support the Chinese Communist Party’s plans to invest in areas such as semiconductors, critical infrastructure, and high-end manufacturing.

In a sharp shift, authorities have begun punishing internet firms for anti-competitive practices with unprecedented fines and imposing new restrictions on firms seeking to hold IPOs overseas. They have also launched a series of new laws and regulations, many of which were modeled on tough European data protection and competition rules. These combined actions have signaled that the Gilded Age of online economy growth in China has come to an end. Internet behemoths will have to adjust to a new normal in which they face a regulatory environment comparable to that of traditional industries.

And the US?

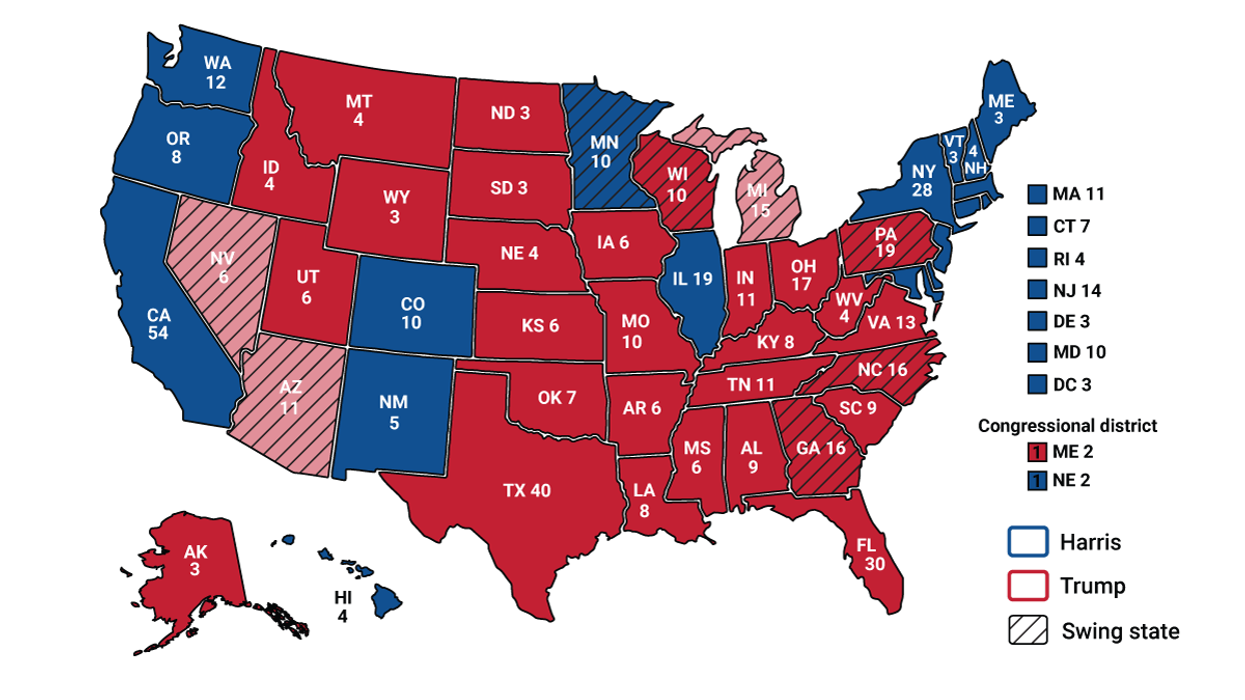

The techlash is coming even in the US, where there is bipartisan momentum behind several bills in Congress that threaten large technology companies with significant new regulation. This includes overarching federal privacy legislation, more robust content moderation requirements, and a prohibition on e-commerce companies promoting their own products and services over those of smaller competitors using their platforms. The SAFE Act would expand digital privacy rights and place new obligations on companies regarding data portability and consent. The Platform Competition and Opportunity Act would require merging companies to prove that their transactions are good for competition, instead of requiring regulators to prove the opposite as is currently the case.

It is possible that November’s midterm elections will delay much of this legislation in Congress, but federal regulators are poised to step into the breach. The Federal Trade Commission may soon be led by a long-time privacy advocate and embark on an ambitious agenda to regulate privacy and data security using existing legal authorities. Both the Department of Justice and the FTC have filed lawsuits against major tech firms for their alleged anti-competitive practices. The FTC’s antitrust lawsuit against Facebook, for example, alleges that the tech giant’s acquisitions of Instagram and WhatsApp are intended to protect what amounts to an illegal monopoly. These legal cases, however, will take years to play out and will not likely have a direct impact on tech companies in 2022.