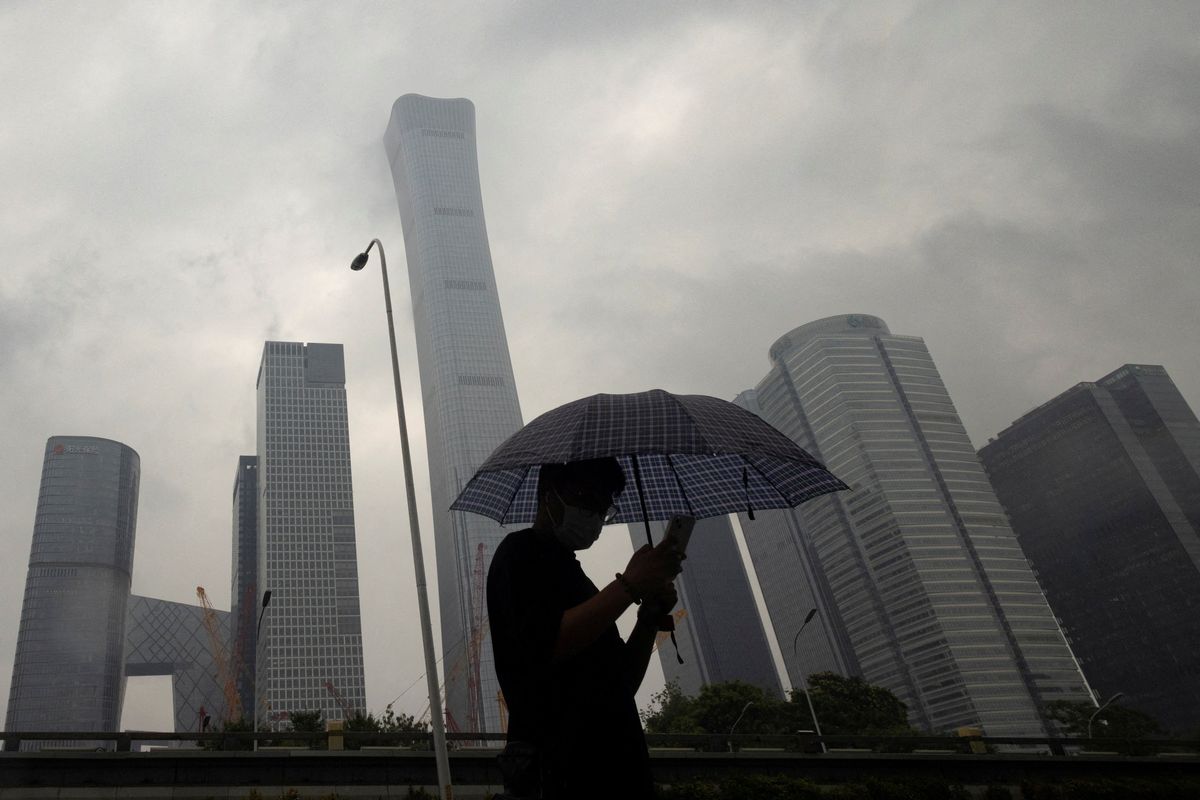

China's economy grew a measly 0.8% in the second quarter compared to the first three months of the year, the government announced Monday. Quarterly GDP expanded by a healthier 6.3% from 2022, but that was when the world's second-largest economy was still being walloped by strict COVID lockdowns that sent global supply chains into a tizzy and made economic activity grind to a halt.

After he finally scrapped his zero-COVID policy late last year, Xi Jinping was confident that the Chinese economy would rebound quickly. But following a short uptick right after restrictions were lifted, China's GDP growth has been lagging.

There are three main reasons for this lackluster economic performance. First, China's mammoth property sector — which by some estimates accounts for a whopping quarter of GDP — remains in a slump. The collapse of real-estate giant Evergrande in late 2021 freaked out both developers and buyers, so now the former can't get loans to finance projects, and the latter are wary of buying new homes that might not get built at all.

What's more, since about 70% of China's household savings are tied up in real estate, a weak property sector means that ordinary families can't accumulate the wealth they need to spend money on buying stuff — what really powers a modern economy.

Second, Xi's unpredictable economic policies have spooked many foreign investors, who no longer see China as a safe place to park their money.

China has also become a very risky business for US companies, increasingly targeted by Beijing's new anti-espionage law amid the broader US-China economic rivalry. Expect things to get even worse when Washington begins enforcing US investment curbs to prevent American corporations from (unwittingly) funding Chinese military programs.

Third, and perhaps more importantly, the government has failed in all its attempts to jumpstart the economy from the demand side and by boosting consumption.

The ruling Communist Party has stuck to its usual playbook of supporting manufacturers and investing in infrastructure. But it has rejected sending direct cash support to consumers for them to spend more on goods and so services. Despite lower interest rates, most Chinese families seem to be cutting back and waiting for the uncertainty to pass, which is starting to cause deflation.

The sputtering economy is starting to become more than a headache for Xi, who might need some creative accounting for China to reach its rather meh 5% GDP growth target for 2023. Still, don't expect the Chinese leader to go big on stimulus — Xi doesn't want to take on more debt and likely thinks he can ride out the economic storm by the end of the year.