VIDEOSGZERO World with Ian BremmerQuick TakePUPPET REGIMEIan ExplainsGZERO ReportsAsk IanGlobal Stage

Site Navigation

Search

Human content,

AI powered search.

Latest Stories

Sign up for GZERO Daily.

Get our latest updates and insights delivered to your inbox.

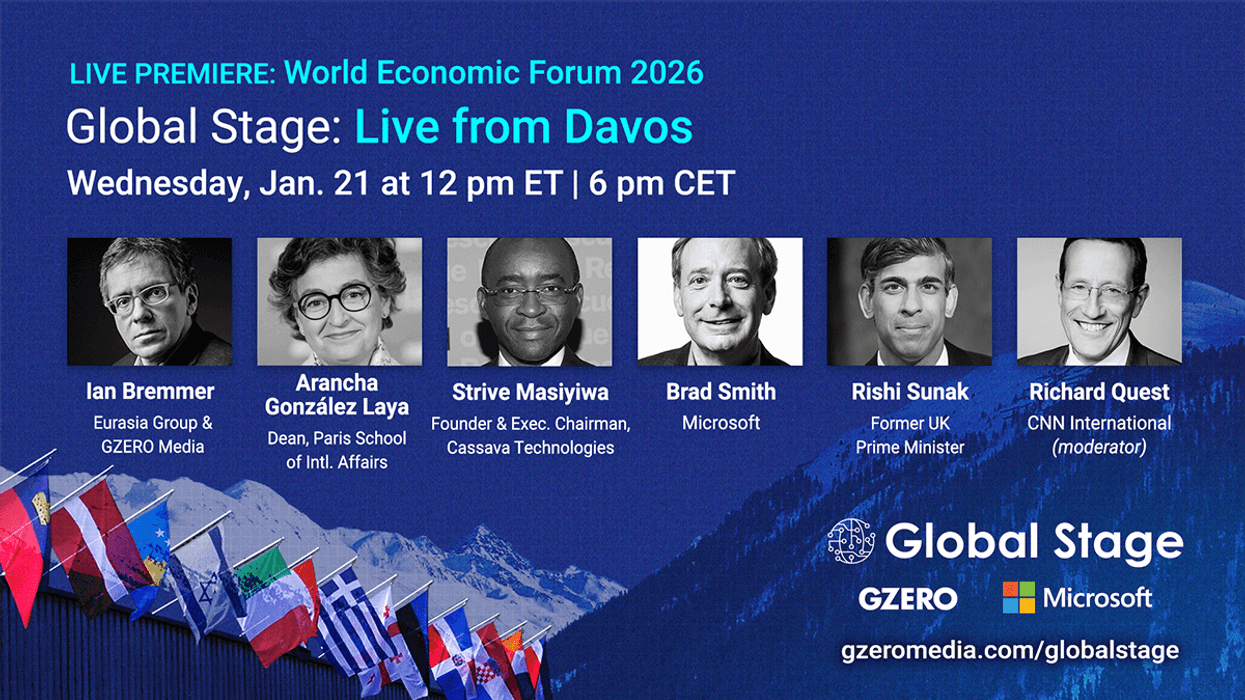

Global Stage: Live from Davos

WATCH

Science & Tech

The geopolitics of science and technology: GZERO's news coverage and analysis of how scientific and tech developments impact the world's economy and society.

Presented by

Betty Liu, Executive Vice Chairman for NYSE Group, explains: What do you make of this recent market volatility?

So, I mentioned before that markets hate uncertainty and we are in unprecedented times right now. Just to give you a little bit of some perspective on just how volatile the markets have been, so, on March 9th, we had, the first time ever, the modern market wide circuit breaker triggered. Now, that has been triggered four times from March 9th to March 18th. On March 16th, the Dow closed down almost 3000 points. That was the steepest drop, 13 percent, since Black Monday in 1987. And also, just one more stat for you, the S&P has closed up or down 4 percent for eight consecutive trading sessions.

What would it take to reduce the market volatility?

So, unsurprisingly, an end to the global pandemic would certainly limit, if not eliminate, the market volatility. The stimulus package also could dampen volatility, but there's still a lot of uncertainty around that. And it's really still uncertain how this global pandemic is going to affect the global economy. So, there's still a lot of questions out there. And with those questions and uncertainty, we're likely going to see continued volatility in the markets.

Keep reading...Show less

More from Science & Tech

What to know about China’s military purges

January 28, 2026

Five forces that shaped 2025

January 28, 2026

What’s Good Wednesdays™, January 28, 2026

January 28, 2026

Two US borders, two different approaches to Trump

January 28, 2026

Walmart’s commitment to US-made products

January 28, 2026

GZERO Europe

Jan 27, 2026

ask ian

Jan 27, 2026

China’s economy is growing, but it’s stuck in a deflationary trap

January 27, 2026

Building community-first AI infrastructure

January 27, 2026

The world economy is resilient, despite tariffs

January 27, 2026

Quick Take

Jan 26, 2026

America’s WHO exit leaves a leadership vacuum

January 26, 2026

Economic Trends Shaping 2026: Trade, AI, Small Business

January 26, 2026

Stubb: Russia is losing in Ukraine

January 26, 2026

Why space tech investment matters

January 25, 2026

Why trust is essential for AI adoption

January 24, 2026

AI in shaping power, politics, and people

January 24, 2026

Europe's wake-up call, with Alexander Stubb and Kristalina Georgieva

January 24, 2026

GZERO World with Ian Bremmer

Jan 23, 2026

The leadership challenge of governing AI

January 23, 2026

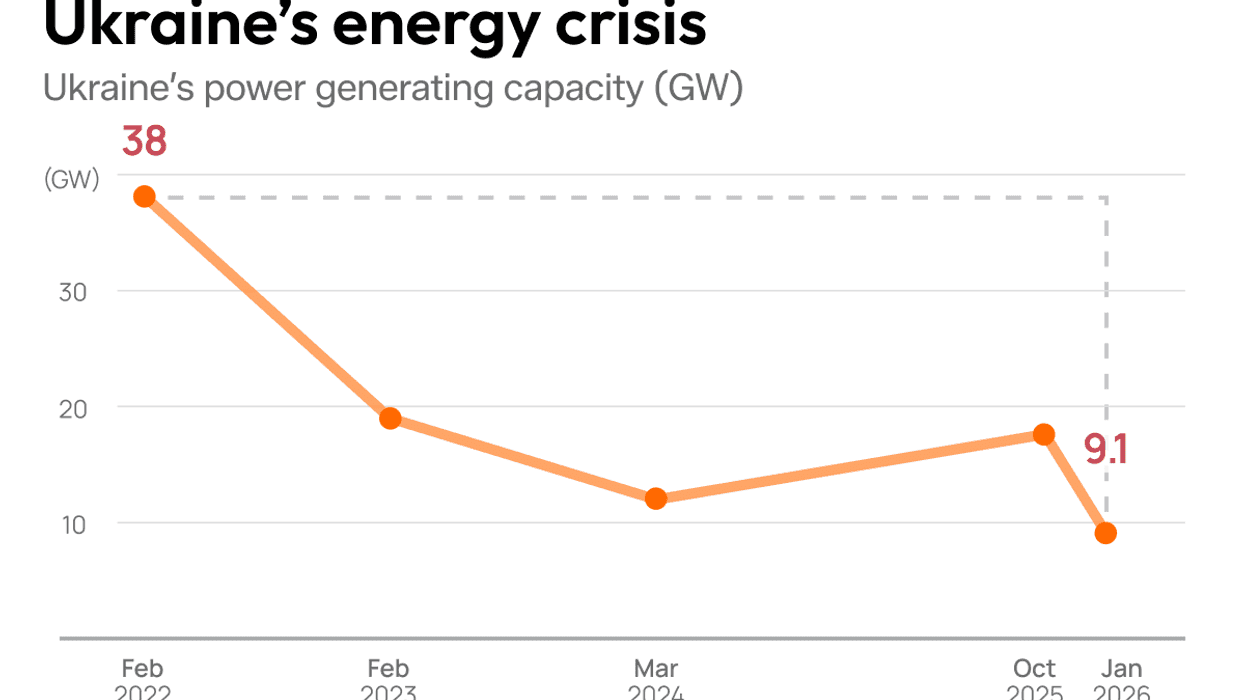

Graphic Truth: Ukraine's energy crisis

January 23, 2026

Moldova’s leader considers whether independence is still worth it

January 23, 2026

Rishi Sunak on AI, sovereignty, and hard power

January 23, 2026

You vs. the News: A Weekly News Quiz - January 23, 2026

January 23, 2026

Which countries are leading the way in AI adoption?

January 22, 2026

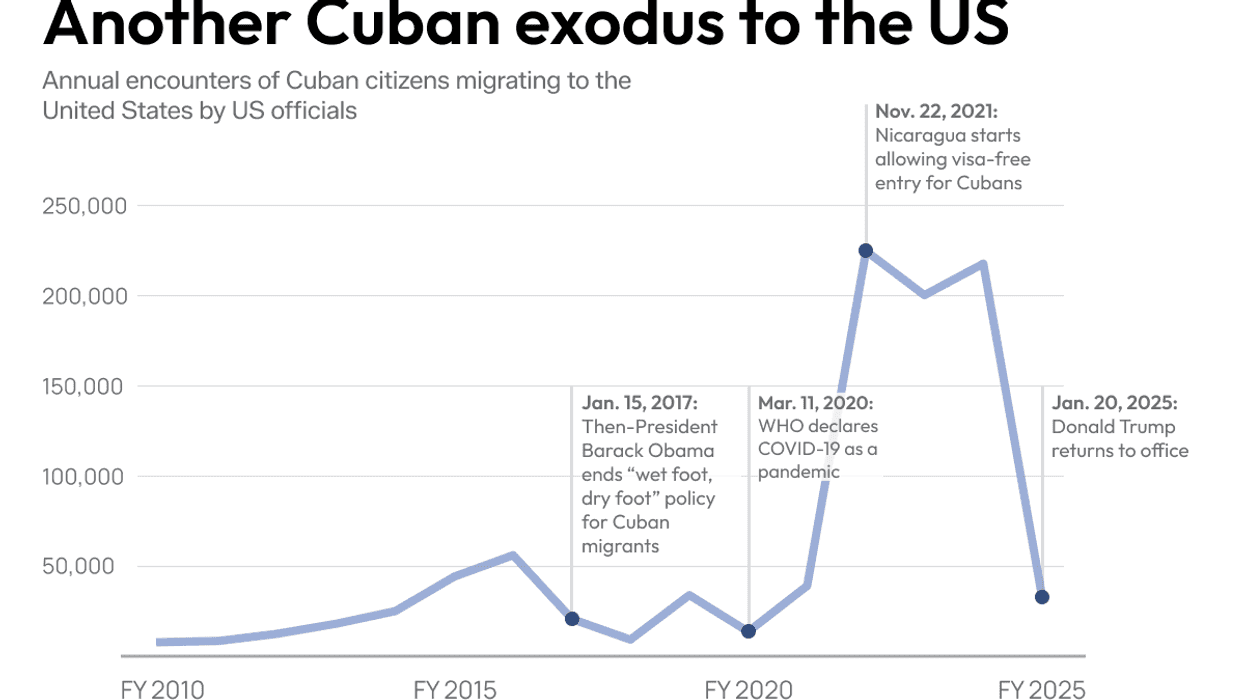

Graphic Truth: the latest Cuban exodus to US shores

January 22, 2026

What does Trump want from a faltering Cuba?

January 22, 2026

Africa’s AI Future: China or the West?

January 22, 2026

Digital sovereignty in the age of AI

January 22, 2026

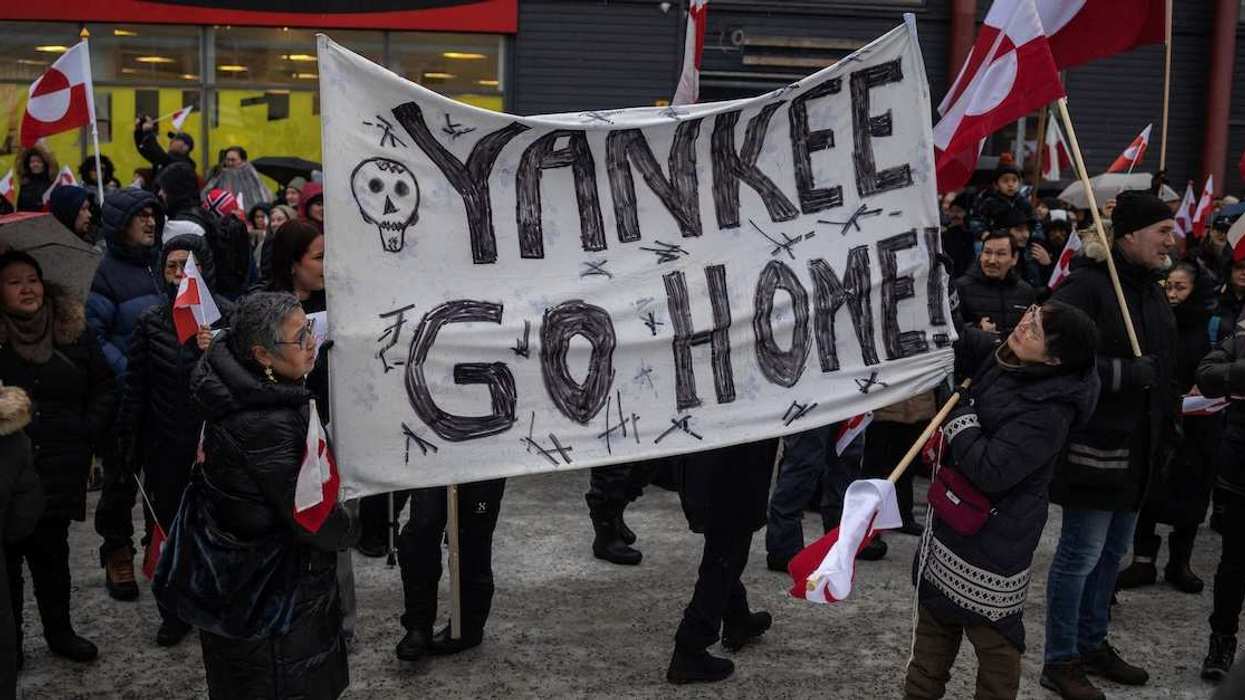

The Greenland crisis will test whether Europe can stand up to Trump

January 21, 2026

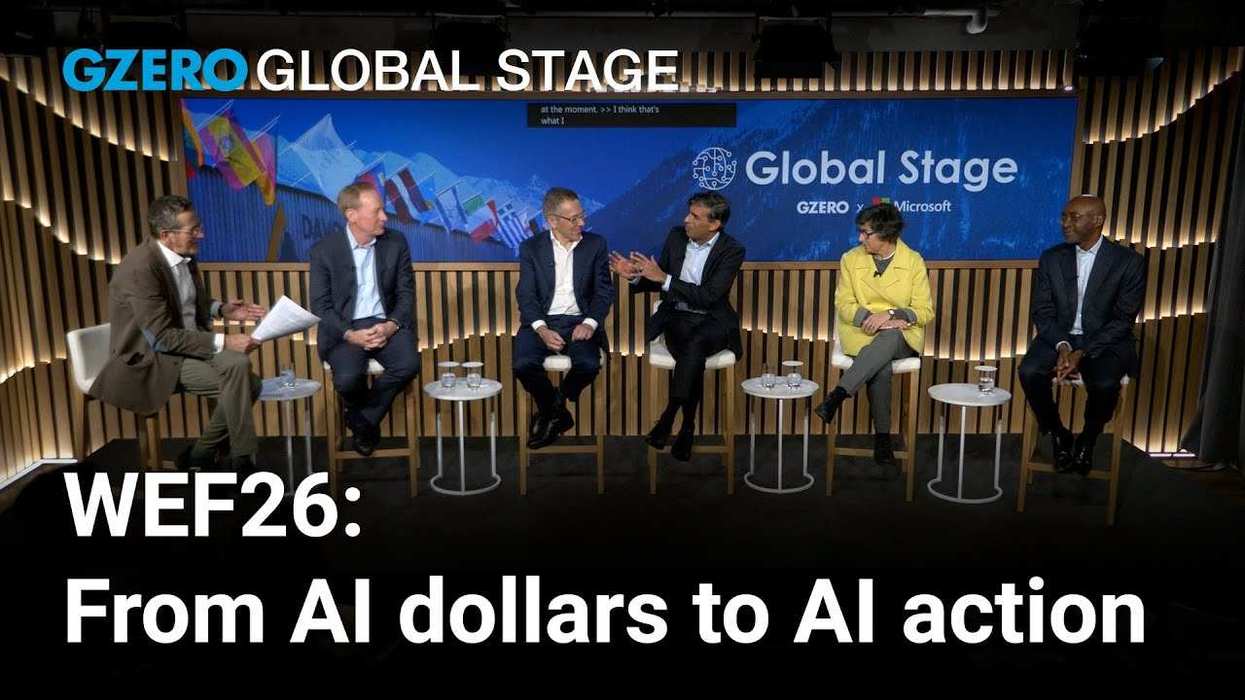

AI and the new world order: Global Stage live from Davos

January 21, 2026

Puppet Regime

Jan 21, 2026

Has the US-led world order ended?

January 21, 2026

Will Trump ever be satisfied?

January 21, 2026

What’s Good Wednesdays™, January 21, 2026

January 21, 2026

BofA awards $1 billion in stock to non-executive employees

January 21, 2026

Watch our Global Stage live premiere from Davos

January 21, 2026

Walmart’s commitment to US-made products

January 20, 2026

Building community-first AI infrastructure

January 20, 2026

Putin's "Special Military Operation" Bop

January 20, 2026

Hard Numbers: The first year of Trump 2.0

January 20, 2026

A new chapter for Davos: Dialogue, AI, and Global Resilience

January 19, 2026

Trump’s demands put Europe in FAFO territory

January 19, 2026

Trump's foreign policy is reshaping the world order

January 19, 2026

Why Trump is pushing to take Greenland

January 18, 2026

One year into Trump 2.0: How the world has changed

January 18, 2026

Trump's second term–one year in, with Stephen Walt

January 17, 2026

Ian Explains

Jan 16, 2026

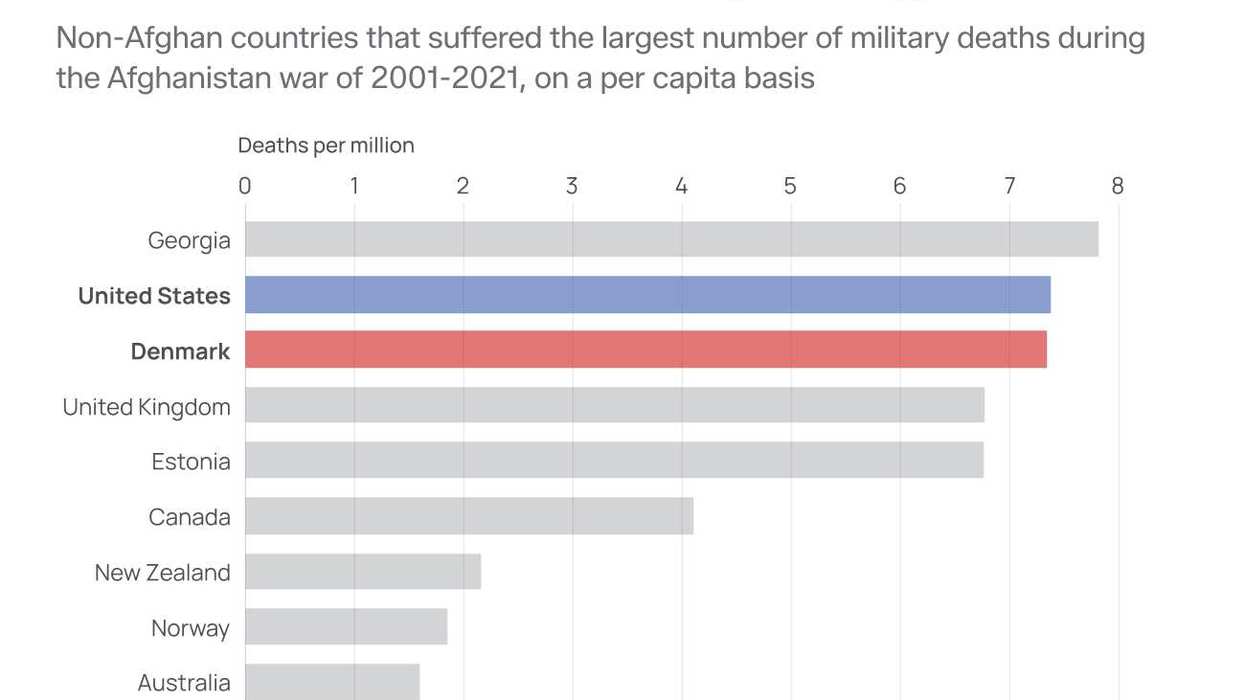

Graphic Truth: Denmark’s losses in Afghanistan

January 16, 2026

The strange silence of Vladimir Putin

January 16, 2026

You vs. the News: A Weekly News Quiz - January 16, 2026

January 16, 2026

A tale of two protests

January 15, 2026

Why Trump’s Greenland threats alarm Europe

January 14, 2026

Will Iran’s protests bring down the regime?

January 14, 2026

Crypto goes steady

January 14, 2026

What’s Good Wednesdays™, January 14, 2026

January 14, 2026

Uganda’s “new breed” of leadership gets old

January 14, 2026

Trump targets Fed chair

January 13, 2026

Walmart’s commitment to US-made products

January 13, 2026

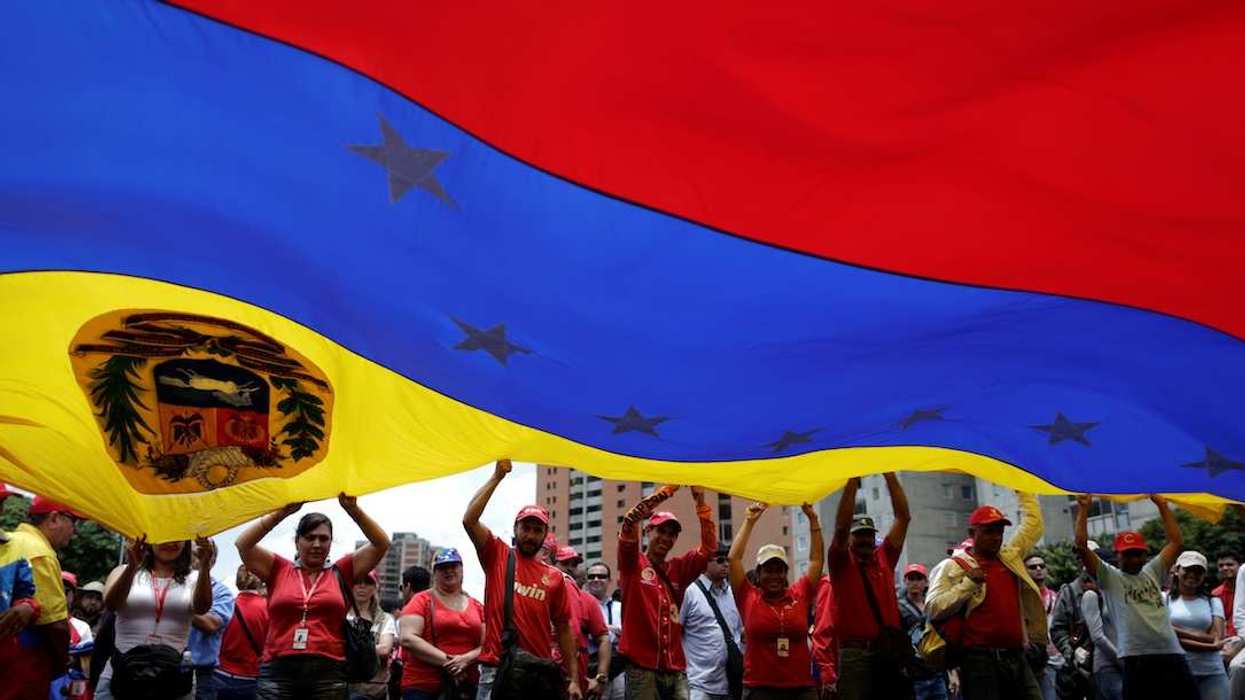

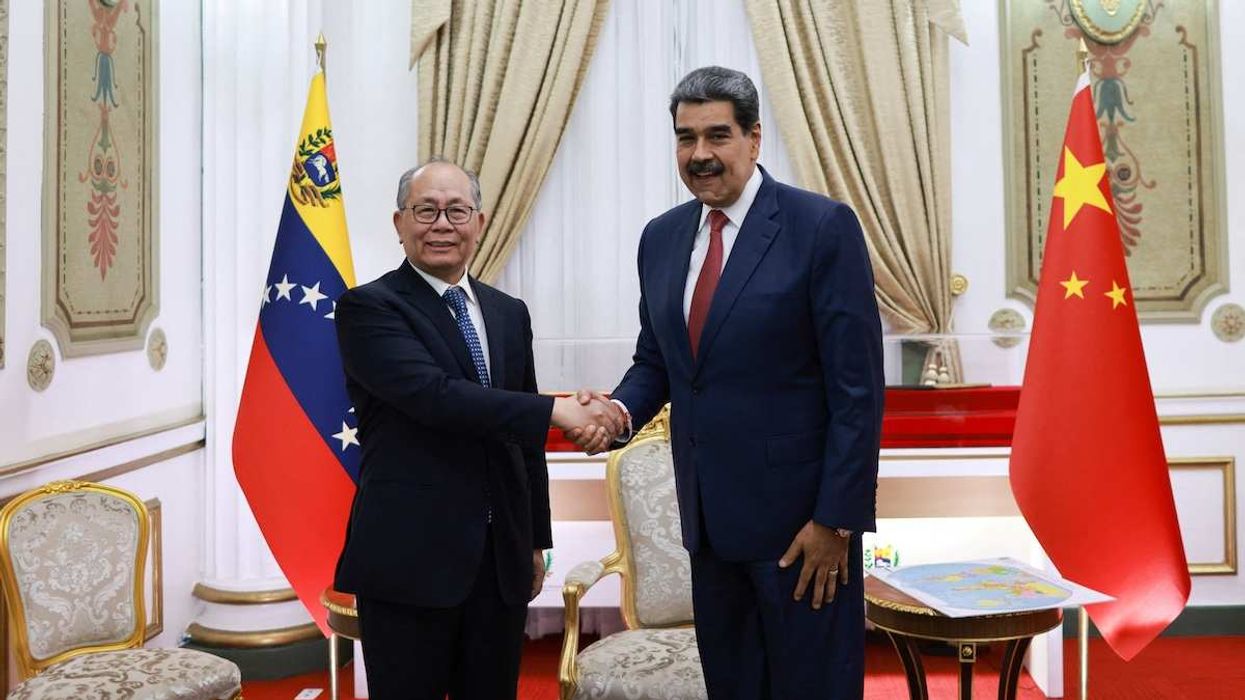

Venezuela owes China money. Will Beijing see it?

January 13, 2026

Frank Fukuyama on Venezuela: "This is a nation-building exercise"

January 13, 2026

US response to Iran protests

January 12, 2026

Dispatch from Kyiv, nearly four years into war

January 12, 2026

Economic Trends Shaping 2026: Trade, AI, Small Business

January 12, 2026

Maduro is gone. What happens now?

January 12, 2026

GZERO Series

GZERO Daily: our free newsletter about global politics

Keep up with what’s going on around the world - and why it matters.