The U.S. dollar reigns supreme among all currencies in global trade and finance.

What does this mean? Only that the dollar is the currency of choice for most economic activities conducted around the world, including those by and between non-U.S. entities. For instance:

- Most commodities and internationally traded goods get priced in dollars

- About half of world trade is invoiced and settled in dollars, far beyond the U.S. economy’s role in global trade

- The dollar is part of nearly all foreign exchange transactions

- Non-U.S. banks lend and take deposits largely in dollars

- Non-U.S. firms predominantly borrow in dollars

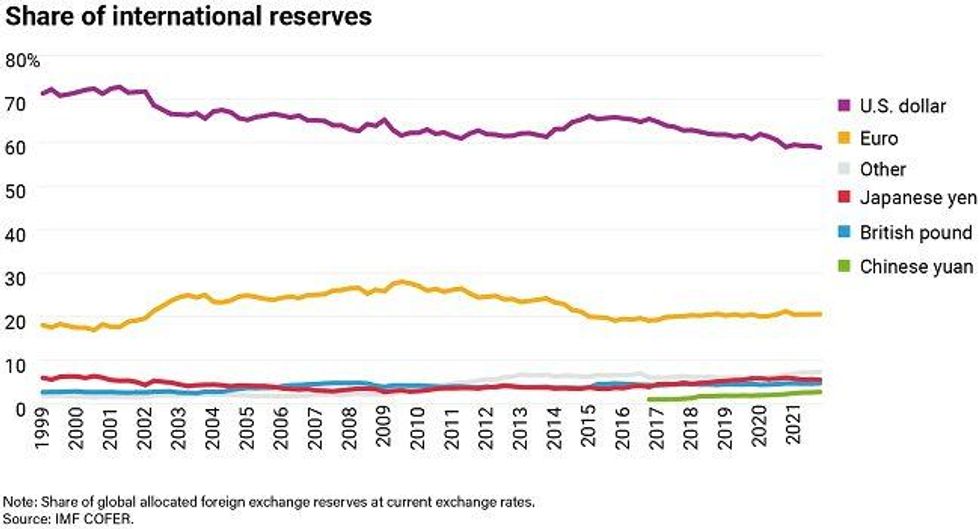

- Central banks hold three-fifths of their foreign exchange reserves in dollar-denominated assets, and many choose to peg their own currencies to the dollar

Want to understand the world a little better? Subscribe to GZERO Daily by Ian Bremmer for free and get new posts delivered to your inbox every week.

Whereas most currencies are only used domestically and in cross-border transactions that directly involve the currency’s issuer, only the dollar is widely used outside its issuing country. Its nearest competitor for global currency status, the euro, accounts for 20% of central bank reserves compared to the dollar’s 60%, followed by the Japanese yen at 4%. The Chinese yuan lags far behind at about 2% of foreign exchange reserves.

Share of international revenuesIMF COFER

Share of international revenuesIMF COFER

The dollar’s special role did not originate by chance, force, or decree. For much of the 19th century through the early 20th century, it was the British pound sterling that was the dominant global currency. But after World War II, the American economy became dominant in global output, trade, and finance. At the time, U.S. GDP accounted for roughly half of world output, so it made economic sense for the dollar to be the principal global means of exchange, unit of accounting, and store of value.

America’s economic supremacy has since waned, its share of global output now a fraction of what it was in 1945. This trend has led many over the decades to warn about the imminent end of dollar primacy.

Doomsayers from Wall Street and Silicon Valley to Moscow and Beijing offer numerous reasons for the dollar’s allegedly inevitable demise: China’s meteoric rise to global superpower; America’s stagnant productivity growth, out-of-control fiscal spending, unprecedented monetary stimulus, growing debt burden, record-high inflation, protectionist trade policies, and imperial overreach; challenges from disruptive technologies like crypto-assets; and, most recently, Washington’s weaponization of the dollar against its geopolitical foes.

(To be clear, it’s not obvious that losing dollar dominance would be a bad thing for the United States. In the 1960s, former French president Valery Giscard d’Estaing claimed that being the issuer of the global reserve currency afforded America with an “exorbitant privilege,” allowing it to borrow cheaply from the rest of the world, run chronic trade and budget deficits, and live beyond its means. That’s true, but it’s only half of the story. The oft-neglected downside (or “exorbitant burden”) is that outsized foreign demand for dollars pushes up the currency’s value, making U.S. exports artificially more expensive, harming domestic manufacturers, increasing American unemployment, suppressing American wages, fueling speculative bubbles, and widening inequality. Dollar dominance is a boon for Wall Street. For Main Street, not so much.)

Rumors of the dollar’s death, however, are greatly exaggerated.

Going by most usage measures, the dollar remains incontrovertibly dominant, if a little less so than at its apex. Its share of the world’s $13 trillion currency reserves is nearly twice that of the euro, yen, pound, and yuan combined—the same as it was a decade ago. Even China, in an environment of intensifying geopolitical competition with the U.S. and having just witnessed Washington’s freezing of Russia’s international reserves, has no choice but to continue accumulating dollar-denominated assets.

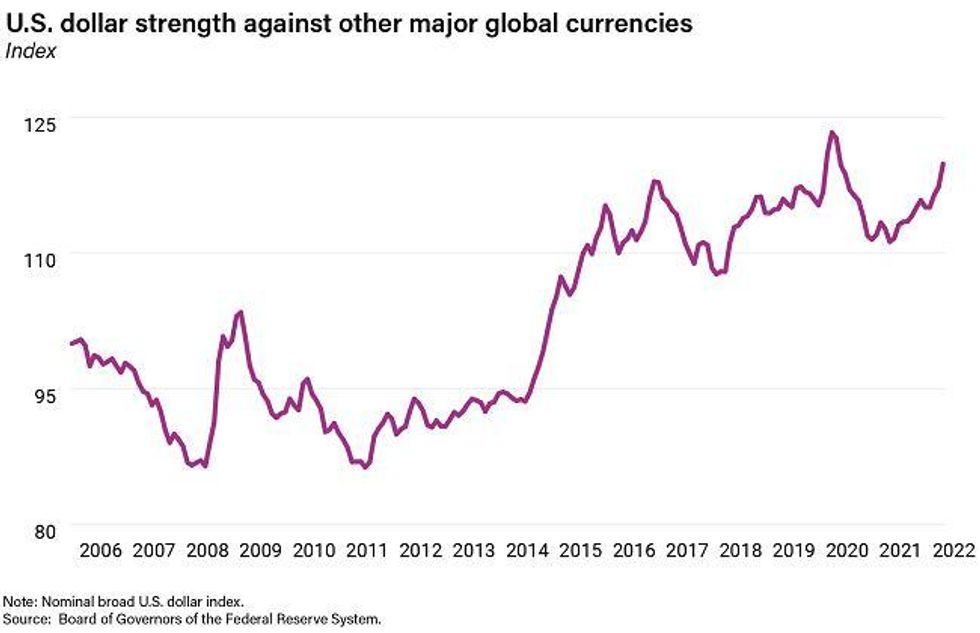

If prognosticators are right that the dollar’s days are numbered, markets—the ultimate judge, jury, and executioner—have yet to find out. As we’ve seen repeatedly and are witnessing now, every time turmoil roils global markets the dollar strengthens, as investors flock to the most plentiful and liquid safe assets in existence. In fact, despite unprecedented sanctions on Russia and 40-year-high inflation prints, the dollar has strengthened more than 10% year-to-date relative to other major currencies and is currently trading at its highest levels in 20 years.

U.S. dollar strength against other major global currenciesBoard of Governors of the Federal Reserve System

U.S. dollar strength against other major global currenciesBoard of Governors of the Federal Reserve System

Why has dollar dominance remained so sticky?

In large part, it’s because incumbency is self-reinforcing due to inertia and network effects. People use dollars because other people use dollars. The more the dollar is used, the more useful it becomes, and the more it is used in response. Dollar dominance begets continued dollar dominance.

But it’s not just turtles all the way down. The dollar has inherently desirable features: it is at once highly stable, liquid, safe, and convertible. And U.S. financial markets are by far the largest, deepest, and most liquid in the world, offering a plethora of attractive dollar-denominated assets foreign investors can trade. No other market comes remotely close.

Investors want to hold dollar assets because America’s economic, political, and institutional fundamentals inspire credibility and confidence. The U.S. has the world’s strongest military, the best research universities, the most dynamic and innovative private sector, a general openness to trade and capital flows, relatively stable governing institutions, an independent central bank, sound macroeconomic policies, strong property rights, and a robust rule of law. People all over the world trust the U.S. government to safeguard the value of their assets and honor their rights over them, making the dollar the ultimate safe-haven currency and U.S. government bonds the world’s most valued safe assets.

None of this means that the dollar’s advantage can’t slip. After all, the pound sterling and all the reserve currencies that came before it were dominant until the moment they ceased to be. Yet in all those cases, there was another currency on the sidelines ready to take their place. Today there’s no such challenger.

Of the serious candidates to dethrone “king dollar,” the euro is not a viable alternative because of Europe’s persistent fragmentation. Despite having a sizeable economy, well-developed and deep financial markets, decently free trade and capital openness, and generally robust institutions, Europe lacks a true capital markets, banking, fiscal, and political union.

Ever since the eurozone debt crisis in 2009, European bond markets have been much more fragmented and illiquid than America’s, leaving investors with a dearth of high-quality euro-denominated assets. While the pandemic did push the EU to finally issue common debt to fund recovery efforts, that move alone is not sufficient to boost the euro’s international role, as markets know that even if full fiscal and financial integration was on the horizon—a big if—political integration isn’t.

The Chinese yuan is not a viable alternative because of China’s autocratic and state capitalist proclivities. Xi Jinping’s and the Chinese Communist Party’s domestic policy priorities—economic self-reliance, financial stability, common prosperity, social harmony, and political control of the economy—run directly counter to their global-currency ambitions.

Despite its growing role in the global economy and its long-standing desire to unseat the dollar, China lacks the investor protections, institutional quality, and capital market openness required to internationalize a yuan that is still not even fully convertible overseas. Persistent currency and capital controls, an opaque banking system with too many non-performing loans, spotty contract enforcement, and often arbitrary and draconian regulations will all continue to undermine Beijing’s efforts to elevate the yuan.

Last and most definitely least, so-called cryptocurrencies like Bitcoin are not a viable alternative because they are speculative assets with no intrinsic or legislated value. By contrast, as legal tender, the U.S. dollar is backed by America’s current and future wealth and by the U.S. government’s ability to tax it.

I say “so-called cryptocurrencies” because these digital tulips are not really currencies or money: they are expensive and slow to transact in, they can rarely be used to pay taxes or buy groceries, and they are far too volatile to be useful as means of payment, stores of value, or units of account. Just since the beginning of the year, the price of Bitcoin has fallen by 60% and the market value of all cryptocurrencies has shrunk from over $2 trillion to well under $1 trillion.

The main threat to dollar dominance might actually come not from abroad (Europe, China) or from beyond (the digital space) but from within. The United States is still the world’s superpower, and it will arguably emerge stronger from the pandemic than any other nation on earth. It’s also the most politically divided and dysfunctional of all the major industrial democracies. The single biggest risk to the dollar’s global status is that growing inequality, tribalism, polarization, and gridlock undermine trust in America’s stability and credibility.

But no matter how much the dollar seems to lose its shine, global currency status is about relative—not absolute—advantages. Without a viable challenger, it’s very unlikely that the dollar will lose its special role. You can’t replace something with nothing.

As Margaret Thatcher might have said, there is no alternative.

🔔 And if you haven't already, don't forget to subscribe to my free newsletter, GZERO Daily by Ian Bremmer, to get new posts delivered to your inbox.