The United States observes National Savings Day every October 12 to remind folks of the importance of saving money for a rainy day (after the big blowout on Indigenous Peoples’ Day, natch). Now, I’m a geopolitical analyst, not a personal finance expert, so I won’t lecture you about your spending habits.

What I will do is talk to you about the US national debt. This is a subject much in the news these days, owing to the political showdown in Congress over raising the debt ceiling and funding the government. But surely this is not the first time you’ve heard of it. That’s because federal budget deficits and the national debt are recurring political footballs, used by one party or the other to score points and win elections. What this means is that the conversation around these issues is way too freighted with BS.

To help you cut through it, I spoke to my colleague Rob Kahn, director of global strategy and global macro at Eurasia Group. Rob is a brilliant macroeconomist who held senior positions in government, banking, and academia before joining us. And he’s not too boring. A transcript of our conversation follows.

Want to understand the world a little better? Subscribe to GZERO Daily by Ian Bremmer for free and get new posts delivered to your inbox every week.

Are Americans too profligate? Should we be saving more and consuming less?

Yes and no! (Or is it maybe?)

For many years, US national savings lagged behind the levels seen in other major industrial economies, and economists worried that this reflected disincentives in our laws (e.g., our tax code, fiscal deficits, demographics or other factors) that acted as a drag on growth.

That all changed with the pandemic. Substantial fiscal support fell unevenly across the economy, at a time when spending was limited by the pandemic and the uncertainty surrounding the future. With the start of the pandemic, the savings rate soared from12.7% to above 32% and has remained high since. A strong and durable recovery requires a resilient consumer, so some further decline in savings would actually be welcome.

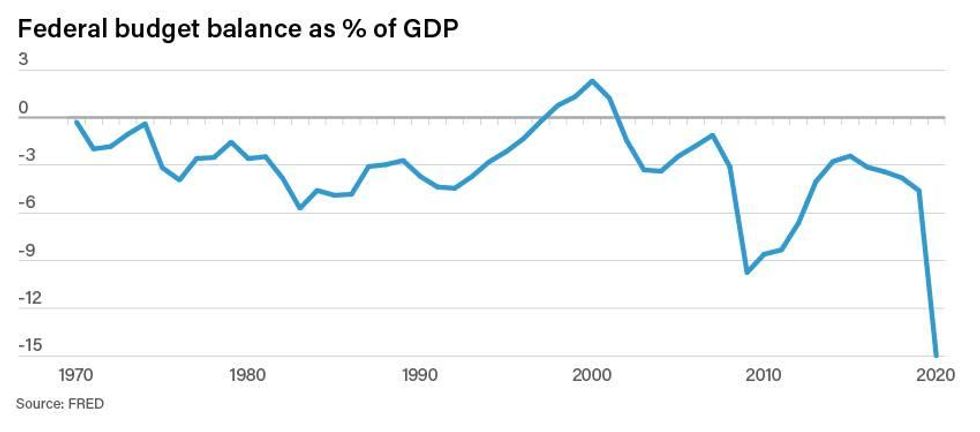

What about the government? The last time the US had a budget surplus was in 2001. Since 1970, the US federal government has spent more money than it collected every single year with the exception of 1998-2001. Are these deficits a problem?

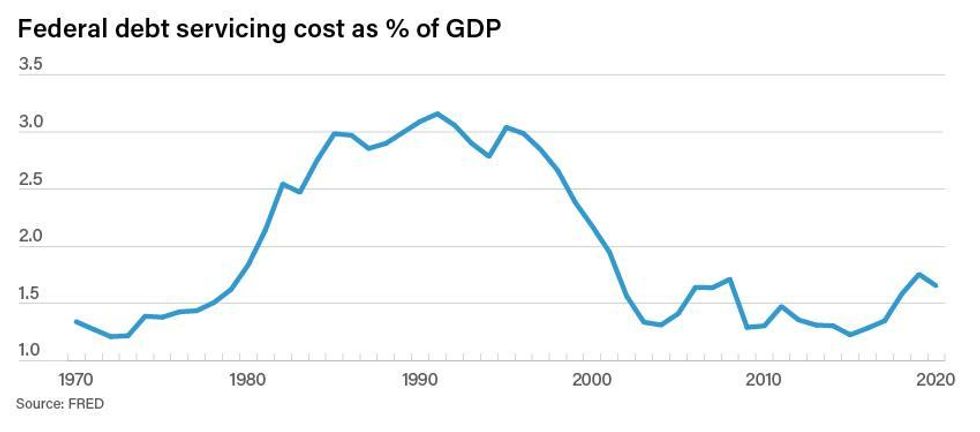

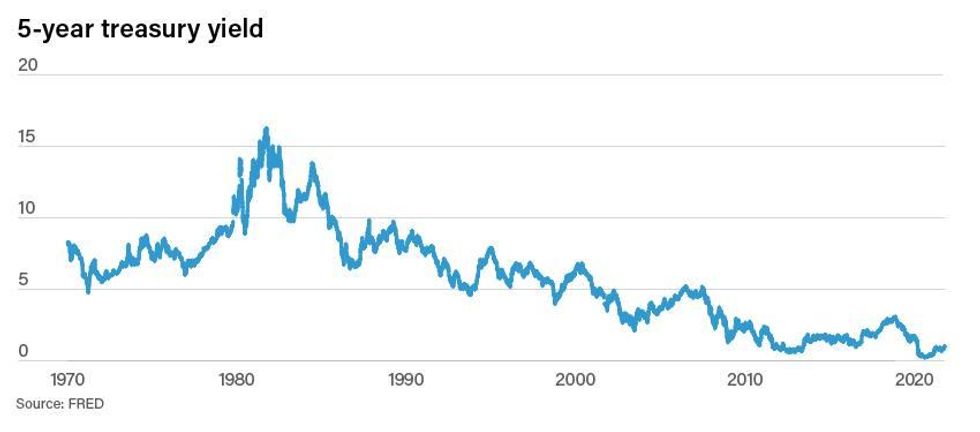

Large and continuing deficits can become a serious problem when borrowing costs rise or investors decide it is no longer prudent to lend to the government. Over the last few decades, borrowing costs have been low in both nominal and real (adjusted for inflation) terms, and this has led some economists to argue that we should not pay as much attention to deficits absent clear evidence of rising inflation and interest rates. That seems a dangerous invitation to our political leaders to not worry about deficits till it’s too late.

When financial analysts assess a company’s health, they look at both sides of the ledger: assets and liabilities. They understand that taking on more debt to make productive investments is good, not bad, for the bottom line. So why is it that when it comes to the government balance sheet, the political conversation focuses overwhelmingly on debt, as opposed to also looking at what the country is doing with the money it’s borrowing?

What the country does with the money it borrows is important, even critical for the decisions our politicians make. Much of what the government spends on are “public goods” such as national defense or protection against viruses, for which the benefits are broadly shared and the government may not collect revenue. In that sense, the calculation is different from that of a corporation worried about whether it will generate the revenue to repay its debt. Perhaps more importantly, some government spending (and ideally most of it) actually increases the country’s long-term debt servicing capacity, meaning that in effect it “pays for itself.” Such is the case of infrastructure investments, for example, which would boost the nation’s productivity and economic growth.

Households can’t live beyond their means forever. At some point, the bank stops lending and it’s time to pay up. Why is the government budget different from a household budget?

First, the US issues its own currency, so government spending is not operationally constrained by revenues. This means that unlike a household, the government can create money out of thin air and therefore can spend money it hasn’t yet earned. The ultimate budget constraint is the total amount of real resources, i.e., the country’s productive capacity. Insofar as creditors believe that the US is good for it, they will allow it to roll over its debt indefinitely.

Second, the government’s decision to run a deficit represents a contract of sorts with future generations and with our future selves. We borrow today, and the deficits become the responsibility of our children and older selves. That is the sense in which it is sometimes said that “we owe the debt to ourselves.” That may not always be great policy, but it’s sustainable as a strategy farlonger than an individual household can sustain it.

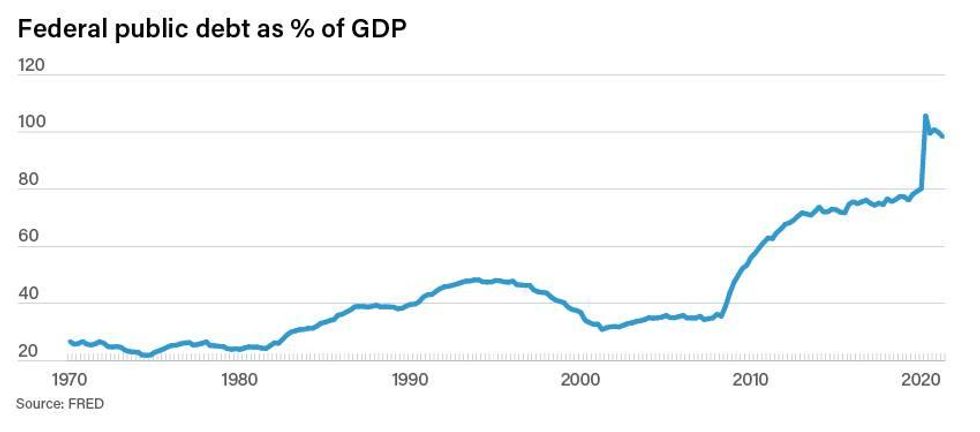

Is the national debt too high? What are the risks that the US defaults on its obligations, or that government borrowing debases the dollar and triggers hyperinflation?

A lower debt level would certainly create the “fiscal space” to expand deficits again in the case of a deep recession, a war, or some other disruption without destabilizing markets. But there is no single number for debt that is a red line, above which is “too much” on economic grounds. That depends on investors’ judgment about the country’s creditworthiness.

There is little economic risk that the US defaults any time in the future—there is ample demand for our securities around the world. The problem is more political, the extent to which high levels of debt become talking points for politicians and divisive in their own right. In recent years, those political risks have centered around Congress’s difficulty in extending the debt ceiling and represent a failure of our political process to make sound fiscal decisions. Still, the likelihood that such policies debase the dollar and trigger hyperinflation, as we have seen in other economies in the past, is remote given the Fed’s institutional independence and the strong public support for broad price stability.

Does all of this mean the US can keep running deficits and racking up debt forever?

No. Investors need to believe that the debt is sustainable and that their investments are safe, and that confidence can evaporate quickly.

Why is the US exceptional among countries in its ability to borrow safely?

The US benefits from an “exorbitant privilege” as the issuer of the world’s primary reserve currency, and Treasury securities are still seen as the world’s predominant safe haven investment. But such status should not be taken for granted and is not an indefinite right—it’s earned through strong economic and political decision making that provides confidence in people’s investment.

What is the debt ceiling? What does the deal reached by Democrats and Republicans mean for everyday Americans?

The US constitution gives Congress the sole power to decide what the government spends and how it taxes, and with that the authority to borrow to pay the bills. That meant for many years that Congress approved each and every bond that was issued by the Treasury, but by the early 20th century that became such a burden that Congress looked for a way to give Treasury more flexibility in managing the debt. In 1939, a general debt limit was established. But it's very existence makes no sense conceptually. The debt ceiling is breached when the US government spends money based on legislation that has already been approved by Congress, meaning that aside from instigating a global financial meltdown, by not raising it Congress stops the implementation of the laws it already passed. That’s what egg heads call an “inherent contradiction.”

The deal reach last week avoids the US government running out of the capacity to borrow, which would have led to a default by the government on its obligations. But the reprieve is temporary. The debt limit will become binding in December, meaning the risk will return.

Please explain the trillion-dollar coin idea that has been floated, both jokingly and seriously, as a solution to the debt ceiling crisis. US Treasury Secretary Janet Yellen has called the meme “just a gimmick”, but isn’t all money a gimmick at some level?

There’s an odd quirk in US law (don’t ask) that allows the US government to create a platinum coin and assign a value of its choosing. In theory, it could then deposit the coin with the Federal Reserve, creating a credit in their account there that would avoid the need for issuing new debt. Which means that technically, the administration could bypass the need to get Congress to raise the debt limit by itself.

But don’t hold your breath: no one currently in a position of power is actually going to “mint the coin” (even if it is legally possible).

🔔 And if you haven't already, don't forget to subscribe to my free newsletter, GZERO Daily by Ian Bremmer, to get new posts delivered to your inbox.