The S&P 500 dropped over 1% after consumer inflation rose 0.4% in March and 3.5% from the previous year, indicating that high inflation could be here to stay. The report surprised forecasters and poses a challenge to President Joe Biden's reelection chances, as persistent inflation means higher gas prices and bigger grocery bills for voters.

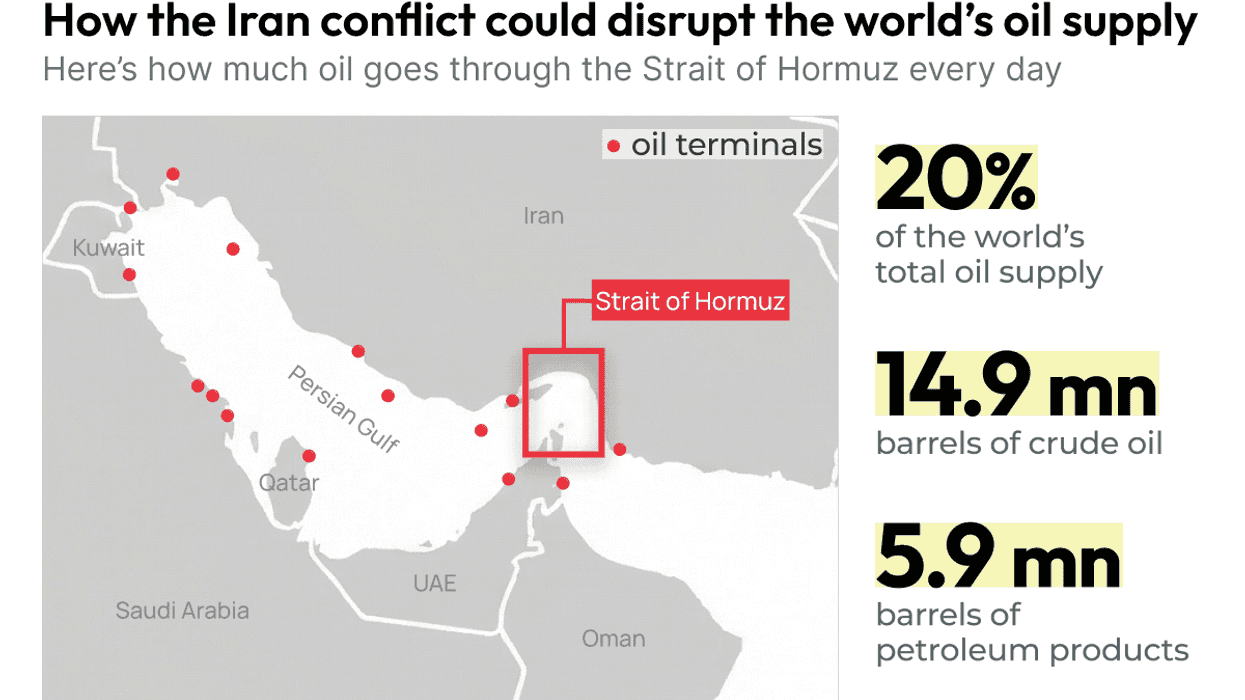

Energy prices continue to rise – 1.1% month over month and 2.1% year over year – thanks to wars in Ukraine and the Middle East driving up the price of oil and, as a result, inflation.

The latest figures have cast doubt on the Federal Reserve's progress toward its 2% inflation target, meaning it may reassess its interest rate plans. Investors now expect rate cuts to be pushed to later in the year, instead of earlier predictions of a March cut.

This is bad news for Biden, who has been anxious for inflation to fall even further to spur the Fed to cut interest rates — a move that would help drive down borrowing costs for mortgages, car loans, and other consumer credit.