Graphic Truth

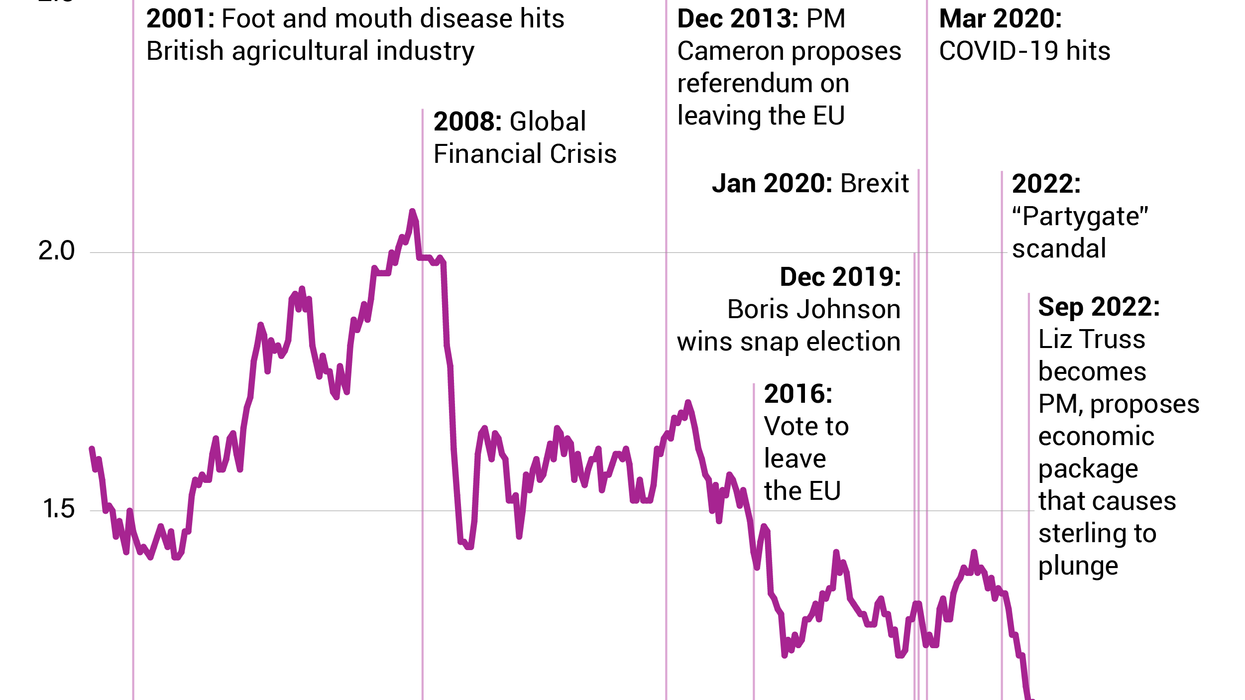

The Graphic Truth: The tumbling British pound

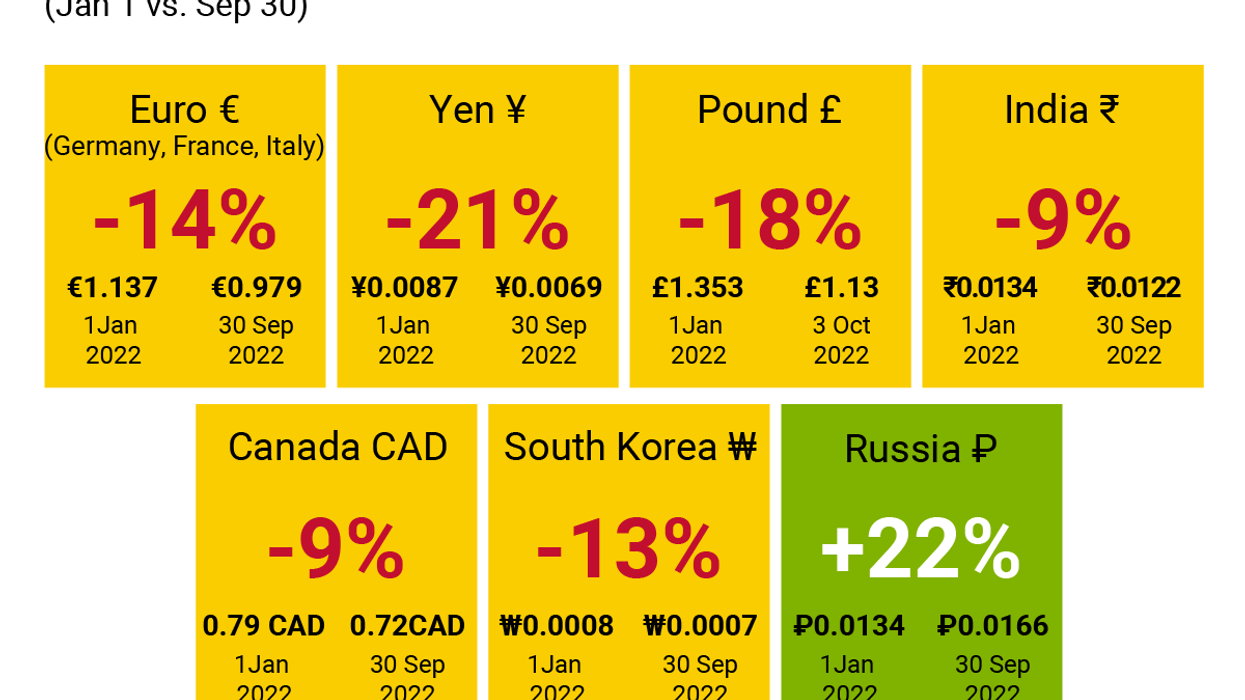

UK Prime Minister Liz Truss’s recent attempt to stimulate the country’s inflation-ridden economy by pushing for massive tax cuts has sent the markets into a tailspin and caused the British pound to plummet in value against the US dollar. But even before this episode – and the government’s subsequent policy U-turn – sterling had been steadily declining amid the Brexit fallout. It also doesn’t help that the US dollar is at its strongest level in years. We take a look at the value of the British pound against the greenback since 2000.

Oct 17, 2022