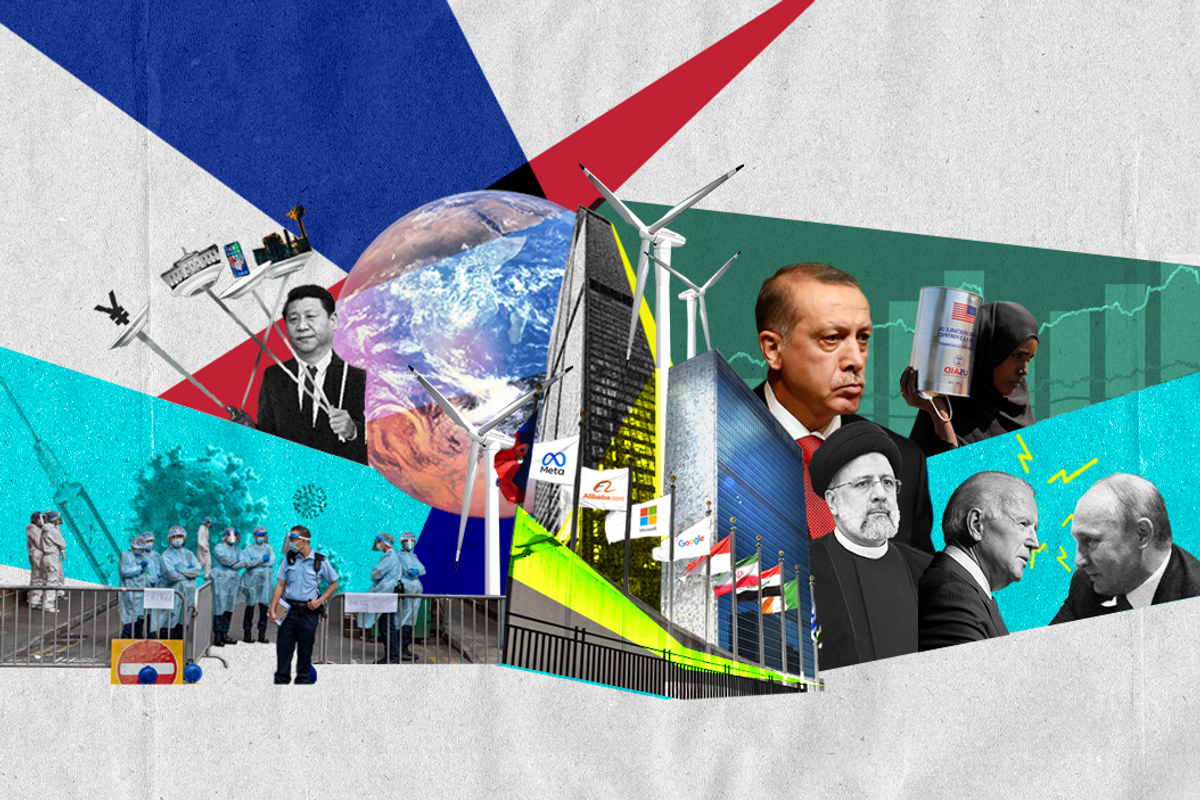

This week, our parent company Eurasia Group published its annual list of top geopolitical risks for 2022, which we hosted a livestream conversation about on Monday. During the program we received many great questions from our viewers, but couldn’t answer them all in the time allotted, so we thought we’d have some Eurasia Group experts tackle them here.

What are Jair Bolsonaro’s chances in Brazil’s upcoming presidential election?

He has a chance, but they aren’t good. Bolsonaro has the support of close to 30 percent of Brazil’s electorate, with his anti-establishment message still resonating amongst his core base of support. But he has paid a high price for mismanaging the pandemic, and with inflation squeezing the disposable income of poor families, economic discontent has also risen. With most economists forecasting close to zero growth in 2022, odds are he won’t recover. His best shot remains one of reaching a run-off against former president Lula da Silva, and exploring the latter’s vulnerabilities over the massive corruption scandal that rocked the Worker Party’s two previous administrations. Possible, but unlikely to succeed.

Chris Garman. Managing Director, Americas

In Turkey, what share of the country’s youth backs the leadership?

The ruling Justice and Development Party gets more votes from the older age groups. It’s the same for the AKP’s parliamentary ally, the Nationalist Movement Party. The AKP receives only 17 percent of its support from those aged 18 to 34, whereas its average support is close to 24 percent. Young Turks are also the most dissatisfied with the state of the economy, with around 85 percent of those aged between 18 and 34 evaluating the economy as very bad or bad.

What is the probability of war between the US and China in the next 15 years?

Very low, but likely to grow over time.

If there is a war anytime soon, it is more likely to be the result of an accidental conflict resulting from miscommunication than one resulting from miscalculation. The US and China have the most robust trading relationship in world history. Unless there is a fundamental rebalancing of that economic relationship over the next 15 years — which is possible given ongoing decoupling in the tech and capital flows — the two countries are unlikely to escalate any conflict to disrupt that. Furthermore, the cyber capabilities and economic are so interlinked that any actual conflict is more likely to be limited to economic disruption, and not turn into a hot war.

The top flashpoint remains Taiwan, and China is years away from having the military capability and economic dominance to invade without major risks for economic and political stability. Even if the Chinese were to act fast enough to surprise and overwhelm Taiwan’s defenses, the US is likely to respond with sanctions and trade embargoes that would severely impact the Chinese economy, and significantly raise the costs of invading.

Fifteen years is a long time, of course. The conditions for war would include one and probably more than one of the following: accelerated decoupling in trade of physical goods between the US and China, a significantly more advanced Chinese military, an internally weak US president unable to rally Americans to defend Taiwan, more dependence of regional Chinese trade partners (India, Japan, and Australia), and a rebalancing of economic power in those countries away from the US towards China.

Jon Lieber. US managing director

How big of an economic and security threat are high energy prices?

High energy prices have become a significant drag on global economic growth. In China, Japan, South Korea, and many European countries — all of which are highly dependent on fossil fuel imports of natural gas and thermal coal — prices have skyrocketed since late 2020. Europe has the additional complication of security of supply due to escalating tensions with its biggest gas supplier, Russia. Major emerging economies like India and Indonesia are also affected by surging import costs and supply disruptions due to COVID.

In the best case, rising industrial and household energy bills weigh on economic growth prospects. In the worst case, there are supply shortages that lead to industrial closures or even localized blackouts.

Government reactions show the severity of the problem. European governments have implemented measures to secure affordable household energy during this winter, including by windfall taxes on the energy industry. China has repeatedly interfered in energy markets by capping prices, and shut down some energy-intensive industries. Indonesia, the world’s biggest exporter of thermal coal, suspended exports amid tight domestic supply. Even in the US, which is rich in domestic oil and gas reserves, the Biden administration in late 2021 interfered in markets by releasing part of the Strategic Petroleum Reserve in order to cool retail gas prices.

The global energy crunch has led to emotional and polarized debates about its cause. This will hamper climate action efforts, as governments juggle the long-term need to reduce greenhouse gas emissions with the immediate priority of ensuring affordable and reliable energy for everyone.

Henning Gloystein. Director for Energy, Climate & Resources

Should we expect more government regulation of crypto this year?

Following the massive inflow of capital into the crypto sector and increased industry lobbying in 2021, friendly lawmakers in the US Congress plan to introduce soon a sweeping piece of legislation to fully integrate digital assets into the financial system. The growing pro-digital asset group of representatives and senators want to provide clearer guidance for digital assets and will seek to normalize their use with rules for stablecoins, consumer protection provisions, and updated taxation guidance. While likely to spur debate across industry and regulators, the bill’s passage will probably be delayed by more pressing administration priorities and a lack of policymaker understanding of crypto issues.

New action by the Securities and Exchange Commission is likely before any new legislation is enacted. SEC Chairman Gary Gensler gave a series of speeches in late 2021 on the need for more regulation of the crypto sector, and the SEC appears nearly ready to launch a major regulatory probe of global centralized cryptocurrency exchange leader Binance and its CEO, likely on charges including money laundering. Jurisdictions in Asia and Europe already moved last year to rein in Binance operations. Nevertheless, major digital asset players have deep pockets and will certainly launch legal challenges to any SEC moves. The outcome of the current SEC lawsuit against Ripple — for which expert witness testimony was largely completed in December — will be closely watched for indications about where US courts stand on issues related to the definition of cryptocurrencies as securities.

Paul Triolo. Practice head, Geotech

What major shifts should we watch for in (sub-Saharan) Africa this year?

Upcoming elections around the continent will be a major watchpoint. Kenya goes to the polls in August to select President Uhuru Kenyatta’s successor in a race that is poised to be close, while Joao Lourenço is likely to win a second term as Angolan president in the same month despite an anticipated stronger showing by the opposition. Meanwhile, Nigeria’s two main parties will hold primaries to select their presidential candidates ahead of pivotal elections in 2023, while South African President Cyril Ramaphosa is favored to win another term as head of the African National Congress despite growing factionalism within the party. Finally, the African Continental Free Trade Area is likely to launch this year once technical negotiations are completed, creating the world’s largest trade community by area. Yet the economic benefits of the agreement will take years to materialize given the persistence of non-tariff barriers to trade.

Tochi Eni-Kalu. Analyst and Practice Manager, Africa