Two years ago, life as we knew it came to a halt. COVID-induced lockdowns and quarantines hit businesses hard, shuttering stores and restaurants on main streets around the globe.

Now, COVID restrictions have been lifted throughout much of the West. While many businesses that survived (or launched amid) the pandemic are equipped with the creative, innovative spirit that helped them weather 2020-2021, challenges remain.

GZERO Media, in partnership with Visa, hosted a livestream discussion with business experts to examine the consequences and possibilities emerging from COVID, and how micro, small, and medium-sized businesses can thrive. Participants included GZERO President Ian Bremmer, Visa’s Global SVP Merchant Sales & Acquiring Jeni Mundy, US Chamber of Commerce’s Tom Sullivan, Kiva CEO Chris Tsakalakis, and SMEunited’s Veronique Willems. JJ Ramberg, the co-founder of Goodpods and former host of MSNBC’s Your Business, moderated.

So, where do things really stand with the global economy? Moderator JJ Ramberg asked GZERO Media President Ian Bremmer to share his thoughts.

“The biggest change we’ve seen from the pandemic has been a growth of inequality,” Bremmer said, referring to massive debt among poor countries and their subsequent debt burden. “As interest rates get higher, it’s going to be harder for them.” And while the big economic story of the last 50 years has been about the rising middle class globally, that’s being slowed now thanks to COVID. Increasing poverty and hunger — both exacerbated by rising prices and supply chain shortages — are to blame.

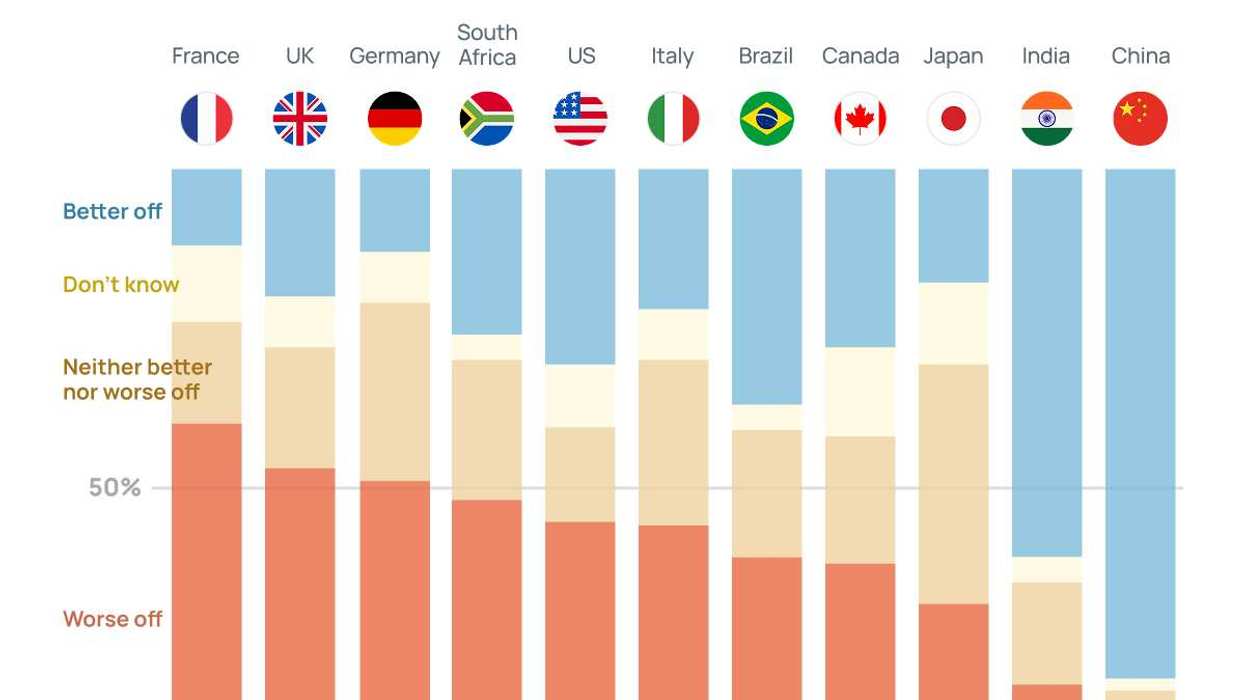

Turning to consumer confidence in the West, Ramberg referred to an online poll by GZERO Media in which 44% said they believed their economy was worse now than before the pandemic. Such skepticism, Bremmer said, likely stems from the fact that wage hikes have not matched price hikes. “We haven’t this level of inflation in 40 years in the United States,” he said. Business owners, however, have a reason for hope, owing to the changes in flexible working arrangements and small business support available today.

Indeed, small business owners in much of the West are optimistic, said Visa’s Jeni Mundy. Having changed their business models during COVID to survive, she says, they’re now able to use their new e-commerce solutions to get ahead.

Visa surveys show that 90% of small businesses in nine different markets are optimistic about the future, which is an “incredibly high number,” Mundi said. That’s up from 75% at the beginning of the pandemic. In Visa’s economic empowerment study, businesses reflected a desire for tools to help them operate in the digital age, and even in developing markets, entrepreneurs are asking less for government support and more for better connectivity and digital solutions.

Tom Sullivan, VP of Small Business Policy at the US Chamber of Commerce, agreed that there’s a “tremendous amount of optimism” in the US, thanks to massive stimulus programs and the lifting of restrictions. But that optimism, he warns, “is under a very heavy wet blanket of inflation.”

Still, the bipartisan US legislation dedicated to small businesses in recent years has been impressive, Sullivan added, referring to PPP and SBA Economic Injury Disaster Loans. “I’ve heard reference from small businesses all across the country using words like ‘lifesaver,’” he said, referring to the relief packages.

But entrepreneurial optimism isn’t universal. In fact, in Europe, many small business owners are very concerned about their prospects, especially as they look east to Ukraine and the impacts of Russia’s aggression on the global economy.

SMEunited’s Veronique Willems is worried about the European business outlook. She said a recent SMEunited survey showed that while business confidence was up last spring, new COVID variants and increased protocols in the autumn had caused renewed concern. On top of that is inflation and the knock-on effects of war in Ukraine, all of which are making entrepreneurs nervous.

“The sentiment, let’s say, is big uncertainty at the moment,” she said.

Meanwhile, labor shortages are front of mind for business owners the world over.

Finding skilled staff was an issue before COVID, Willems said, and it’s even worse today, especially in sectors that have been shut down throughout the pandemic.

Supply chain issues are another global problem. Small business owners are loathed to raise prices (fearing a loss of customers), according to Sullivan, which is why 61% of them in the US have been working to “rejigger their supply chain.”

Yet, despite all these seemingly daunting obstacles to succeeding in business, there’s been a higher launch rate for startups throughout the pandemic. Some 58% of new business owners Visa surveyed in the US said they created their businesses during COVID because they lacked other options, and 42% did so because they saw a business opportunity.

“COVID has almost ushered in a new business boom,” Mundy said, referring to this high launch rate, which was as much as 40% higher than in 2019 in the US. The two main drivers? One, the need for flexibility amid COVID and, two, the desire to fill a gap or niche. These new startups also notably showed higher numbers of female leadership. “It’s great to see so many female CEOs now emerging,” Mundy said.

So what will these small businesses need moving forward to survive in a post-pandemic world?

Sullivan isn’t too worried because “small businesses are problem-solvers.” Just as they swooped in amid the pandemic with unique solutions and services, they will continue to adjust to meet the challenges of the future. But to keep startups on an upward trajectory, governments need to be enablers, not inhibitors, and private industries need to help.

Chris Tsakalakis, CEO of Kiva, is one of those enablers. Kiva is a crowdfunding-based lender to entrepreneurs worldwide. Tsakalakis said he saw growth in both borrowers and lenders over the past year following a drop the year before.

Most of the small companies Kiva works with are small, often solo entrepreneurs, in need of basic business training. They need to understand pricing, business planning, marketing – the fundamentals, he said. Kiva works with partners to get this know-how to these customers, and partners like Visa help pay for that training. Digital and technology training, he said, is the next level.

Small business owners are passionate about their product and business, but not necessarily technology. Yet technology is key to success — covering everything from inventory to accounts receivable and payable — as is cyber security. All of these matters are front of mind for many entrepreneurs, said Mundy.

Luckily, “technology is increasingly coming to the fore to be able to solve all these problems,” she said, noting that some services and aggregators solve for several of them at once. So small businesses, she advised, should look around for these helpful players and partners.

Digital connectivity and know-how is, of course, uneven worldwide, but that’s an area where the pandemic has helped. “One of the major silver linings of the pandemic,” said Bremmer, “is the fact that tech companies and investment in infrastructure did move basically 10 years over the course of just 18 months.” This also meant that places that weren’t as digitized, such as sub-Saharan Africa and parts of Asia, got people connected much more quickly.

Greater digital inclusivity will continue helping small businesses around the world thrive.