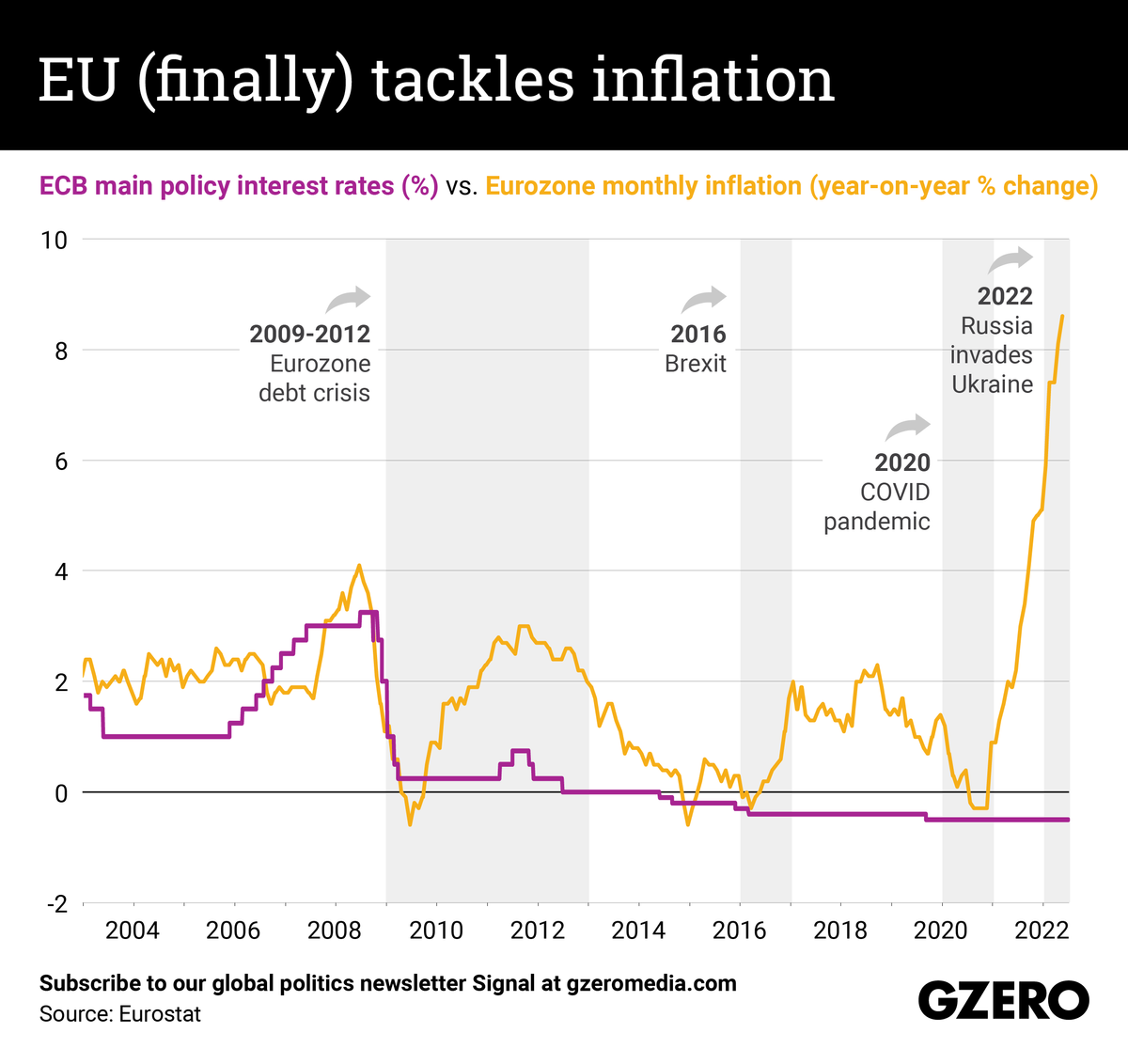

In its Thursday meeting, the European Central Bank is expected to raise interest rates by up to 50 basis points — its first hike in more than 11 years — in a bid to tame rising inflation. For months, the ECB has stubbornly resisted calls to boost rates as inflation soared to a record 8.6% in June amid fears of a looming EU-wide recession. The hike will end the ECB's eight-year experiment with negative interest rates, which make it less attractive to save money but help spur demand (and, in turn, inflation). We take a look at Eurozone interest rates compared to inflation over the past 20 years.

This article comes to you from the Signal newsletter team of GZERO Media, a subsidiary of Eurasia Group that offers balanced, nonpartisan reporting, and analysis of foreign affairs. Subscribe to Signal today.