Hard Numbers

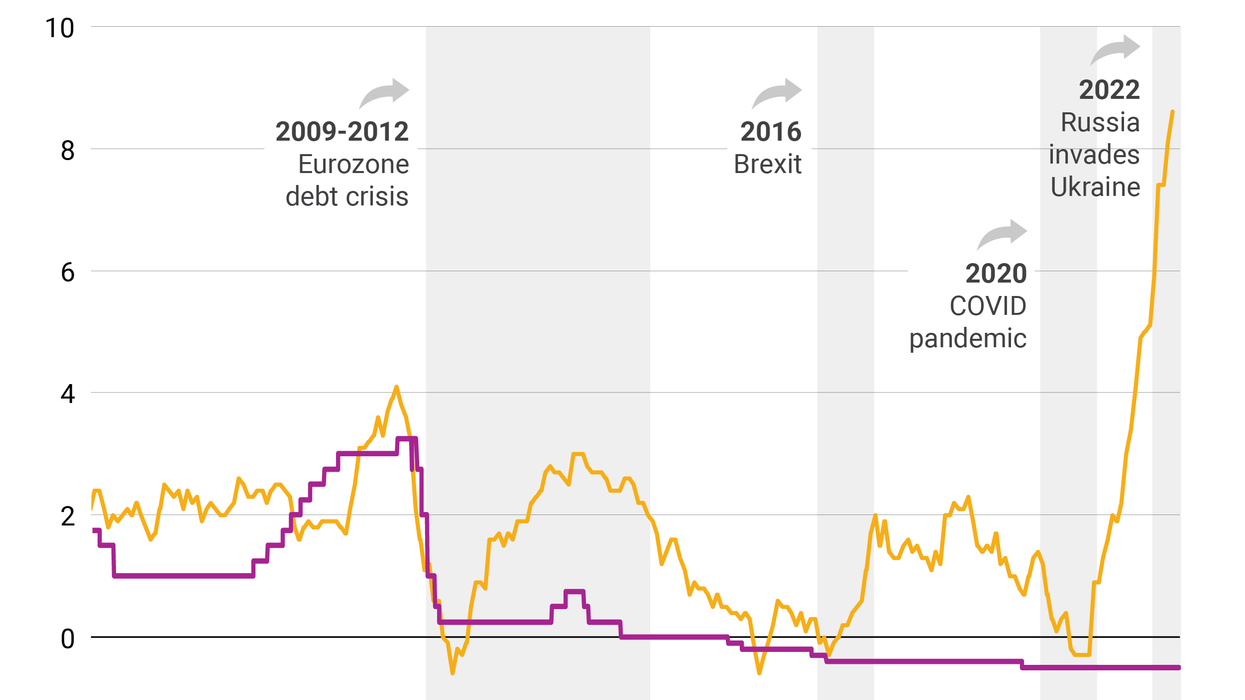

Hard Numbers: Venezuela readies “battlegrounds”, US inflation creeps up, art market continues to collapse, Mexico to boost China tariffs

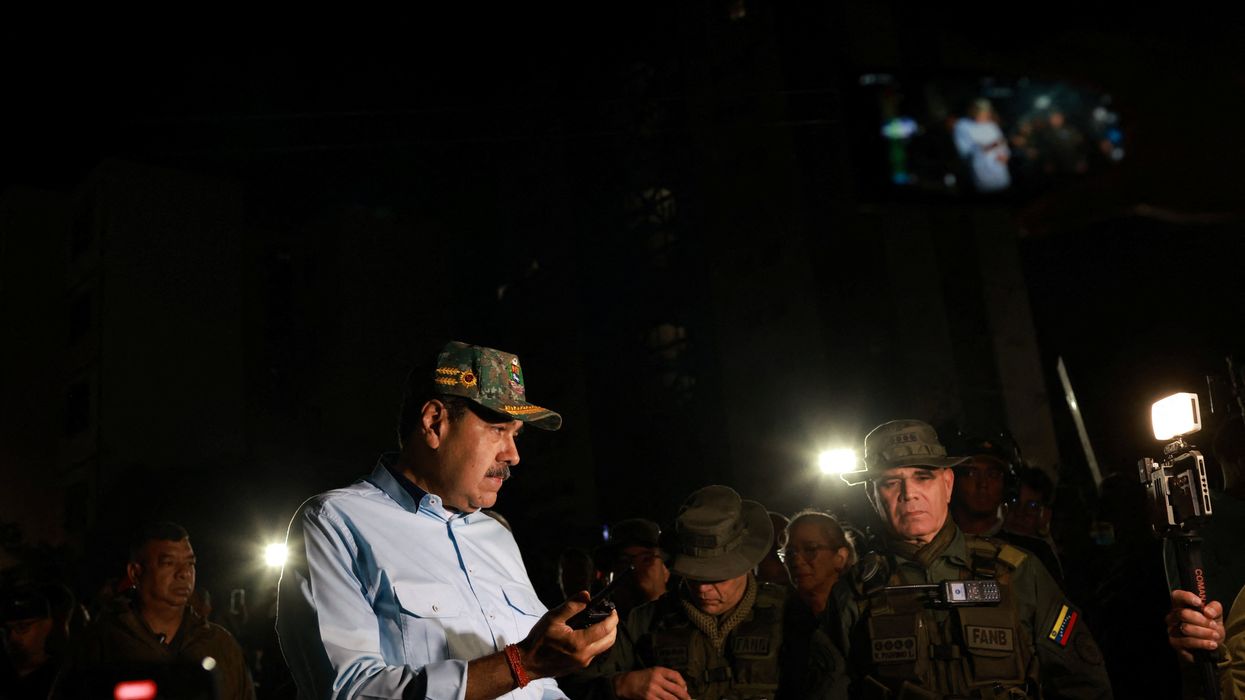

284: Venezuelan president Nicolás Maduro has deployed military assets to 284 “battlefront” locations across the country, amid rising tensions with the US.

Sep 11, 2025