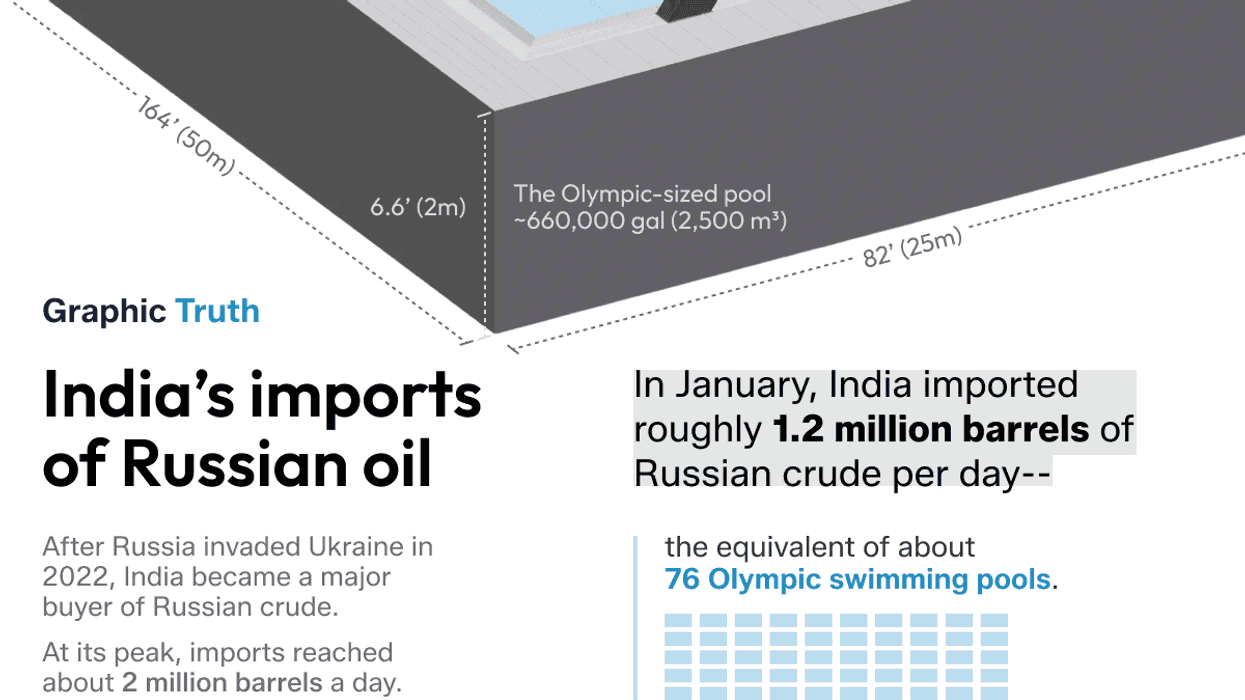

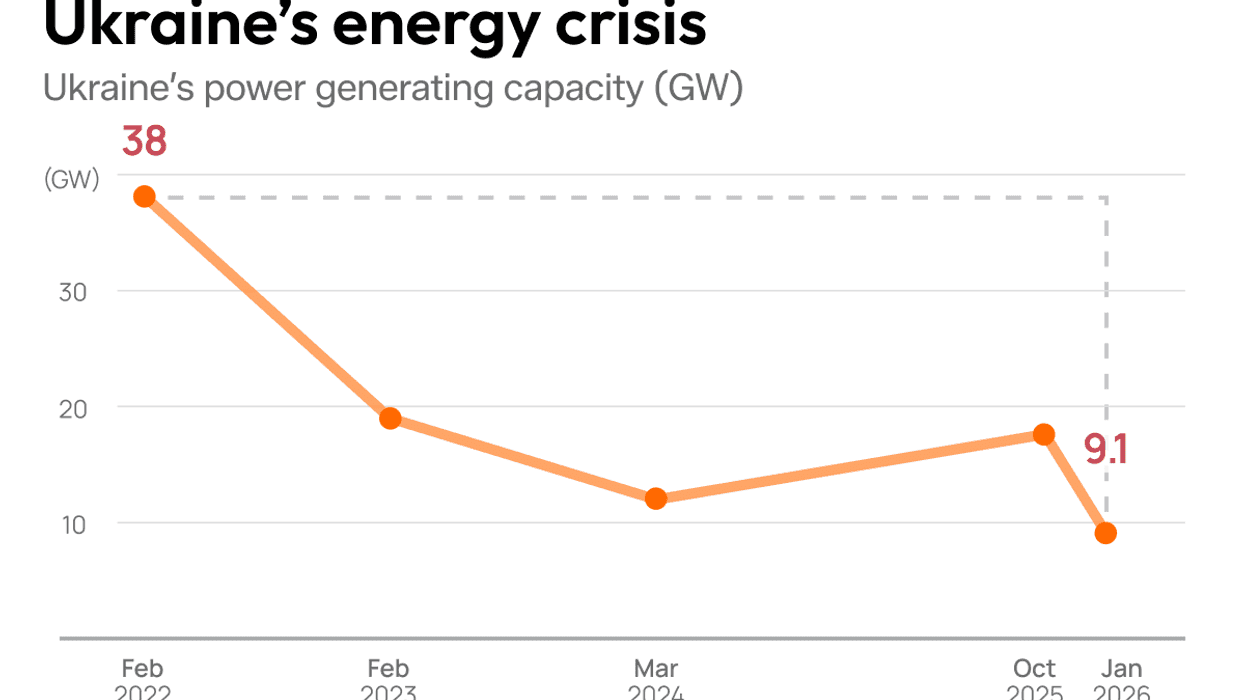

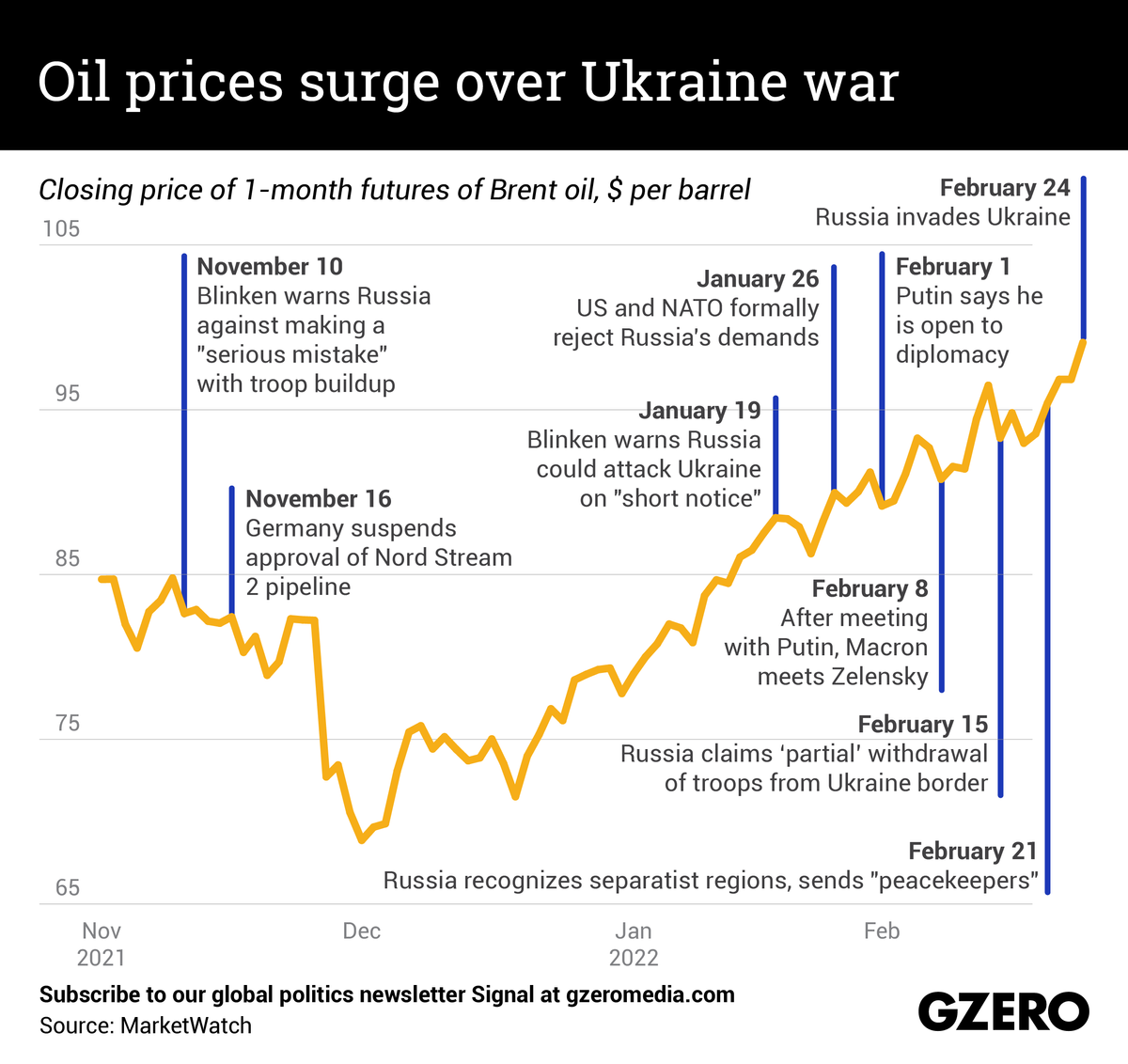

Russia’s invasion of Ukraine has sent energy prices soaring. One-month futures of Brent — the industry standard for the type of crude oil favored in international markets — topped $100 a barrel on Thursday for the first time since ... Russia annexed Crimea in 2014. That’s because traders are worried about possible supply disruptions or even sanctions that could interrupt flows from Russia, the world’s third-largest oil producer. Consumers, meanwhile, will feel that jump at the pump, because pricier crude drives up already high gasoline prices. But oil market jitters have been growing since Putin began massing troops around Ukraine last November. Here’s a look back at how prices have responded at key moments in the crisis.

Graphic Truth

The Graphic Truth: Oil prices surge over Ukraine war

Paige Fusco

Paige Fusco

Paige Fusco is a graphic designer creating visualizations - data-driven and otherwise - for Eurasia Group and GZERO Media.