The European Union just pulled off something that, a year ago, seemed politically impossible: it froze $247 billion in Russian central bank assets indefinitely, stripping the Kremlin of one of its most reliable pressure points. No more six-month renewal cycles. No more Hungarian vetoes. The money stays locked up, full stop.

Turns out that was the easy part.

This week, EU leaders gather in Brussels for a summit that will determine whether Europe can convert that frozen leverage into something that actually matters: a $246 loan backed by these assets to keep Ukraine solvent and fighting through 2026 and beyond. The mechanics are simple: Ukraine gets the cash, the frozen reserves serve as collateral, and Kyiv only has to repay the loan if Russia pays war reparations. Since Moscow will never do that, the money is effectively a transfer from Russia's coffers to Ukraine's war effort – but without ever technically "seizing" the assets.

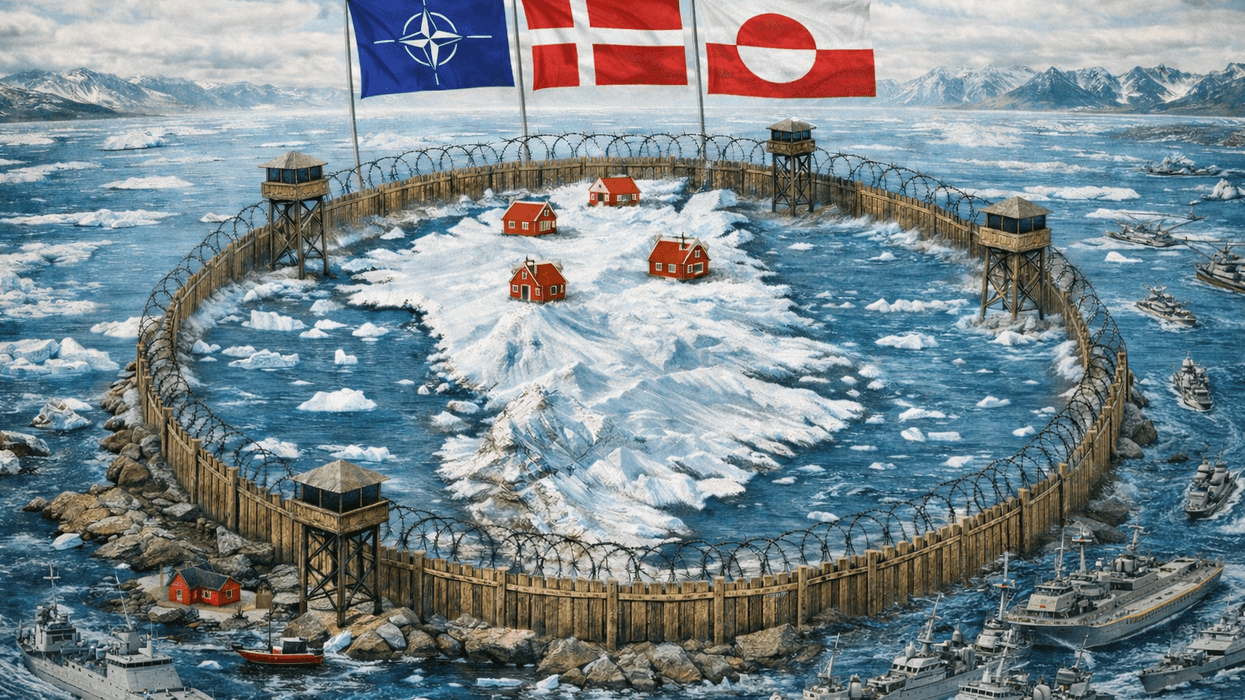

It's a perfect plan. But right now, it’s in serious trouble. Approval of the loan doesn't technically require unanimity – a qualified majority could push it through – but since the bulk of the frozen funds ($217 billion) sit in Belgium-based Euroclear accounts, Brussels has effective veto power. And Brussels is saying no.

Prime Minister Bart De Wever's government is spooked by legal risk: Russia’s central bank has already filed suit against Euroclear in a Moscow court, and Brussels fears it could be left holding the bag if Russia wins the war and finds a way to claw back the money. Russian operatives have also made physical threats against Euroclear staff. The European Commission has offered Belgium access to the full $246 billion as a backstop, instructed all EU countries to terminate their bilateral investment treaties with Russia so Belgium wouldn't face retaliation alone, and required that no funds flow to Ukraine until at least 50 percent is covered by member-state guarantees. But Brussels still refuses to budge.

Belgium isn’t the only one opposing the deal. Italy, Malta, Bulgaria, and the newly installed Czech government of Andrej Babiš have joined in demanding the Commission explore alternative financing mechanisms – namely, Eurobonds or other forms of joint debt. Germany's Friedrich Merz, leading the charge for the asset-backed loan, warned Monday that failure would leave the EU "severely damaged for years, if not for a longer period." He’s right (even if Berlin's insistence on using Russian assets conveniently aligns with its blanket opposition to EU common borrowing).

That internal opposition might be easier to overcome if Brussels weren't also facing pressure from both Russia and the United States. European officials fear Moscow's lawsuit against Euroclear is the opening salvo in what could be a sustained legal campaign against the bloc. And Washington has been actively pushing EU states to reject the scheme. Sure, President Trump is happy that American taxpayers no longer fund Ukraine and Europeans are now footing the bill, but he’s had a very different vision for Russia’s frozen assets. The original 28-point peace plan would have $100 billion of those funds redirected toward American-led reconstruction efforts in Ukraine, with Washington taking half the profits; the remainder of the Russian assets would fund a separate U.S.-Russia joint investment vehicle aimed at "strengthening relations" between the two countries. The last thing Trump wants is for Europe to spend Russia's money before he can cut a deal to do it himself.

There's also a more immediate irritant: the proposed loan would require Ukraine to purchase weapons first from its own industry, then from European countries, and only then from the United States. American defense contractors would be last in line, which helps explain why Trump administration officials have been working to kill the deal. Trump wants a piece of the action, but he doesn't want to own the outcome.

The US president says he wants peace in Ukraine (and the Nobel that would come with it). But more than peace, he wants to avoid responsibility for whatever happens next. If what you really care about is avoiding responsibility, then you don't need leverage – you just step back and let others sort it out. That's exactly what's happening. The Europeans and Ukrainians are the ones who will shape whatever comes next because they're the ones who care enough to stay in the fight.

Which brings us back to Thursday's summit. Europe has the tools to own this: the frozen assets, the legal workarounds, a collective GDP to rival America's (and far surpass Russia’s). What’s missing is leadership and unity.

When Beijing pushed back against Trump's tariffs, it had the economic heft to inflict real pain on the United States. The two sides have something approaching mutually assured economic destruction, which is why they ended up de-escalating and negotiating. Europe doesn't have that kind of leverage on security – not yet. The EU has been ramping up defense spending, talking about competitiveness and growth, trying to get serious about border security – all things it should have done a decade or two ago. The question is whether it can catch up fast enough.

Especially with an American administration that is actively hostile to European integration. Trump isn't only pushing for a quick peace deal in Ukraine – he's putting his thumb on the scale for Europe's most Euroskeptic movements: Marine Le Pen in France, the AfD in Germany, Nigel Farage in the UK. If those forces gain ground, the EU's ability to act collectively on defense, trade, or migration crumbles. Individual countries might muddle through, but Europe as a unified actor – capable of standing up to Russia, China, or the United States – ceases to exist.

Those are the real stakes of this week's summit. It's not just about whether Ukraine gets the money it needs to keep fighting, but whether Europe can prove it has the political will to match its economic weight. If 27 EU leaders can't agree on using Russia's own money to defend a European neighbor against Russian aggression, it validates every critique Trump has lobbed at the bloc. It tells the world that Europe can't act decisively even when its own security is on the line. And it hands Putin a strategic win without him having to fire another shot.

Maybe Belgium will get enough reassurances to climb down. Maybe the holdouts will accept that Eurobonds aren't viable because Hungary would veto them anyway. Maybe the looming threat of American abandonment will focus minds in a way that years of polite prodding never did. European leaders insist no one wants to let Ukraine fail for lack of funding. That’s probably true. But wanting something and delivering it are different things.

The bigger question is what kind of world emerges from all this. For years, I've talked about the G-Zero – a world without global leadership, where no single power or alliance is willing or able to set the rules. What comes after the G-Zero is still up for grabs. A genuinely multipolar system, with a stronger Europe as one of the poles – more unified, more capable, more strategically coherent, able to hold its own alongside the United States and China? Or more fragmentation – a Europe divided against itself, weaker than the sum of its parts, unable to defend its interests or its values?

This week's summit won't settle that. But it's a test. Europe has the leverage to shape Ukraine's future – and its own. Whether it has the political will to use it … that's what we're about to find out.