I posted something on Twitter last Sunday that I didn’t think particularly novel or controversial but that has since gotten a lot of play:

Now, many folks missed the point of the tweet and instead took issue with me calling the U.S. government “left,” which I agree it isn’t really when you consider the policies and worldview President Biden espouses. Looked from, say, Europe, Biden is a centrist or even center-right. In fact, from a global perspective, the entire U.S. political spectrum—including most Democrats—sits on the right.

But of course, that’s not how most Americans see it. If instead I had called the U.S. government a right-wing one, my post would no doubt have been met with more derision. Fox News and elected Republicans say Biden and the Democrats are a bunch of socialists, and even if they wouldn’t go that far, the majority of Americans broadly think of the Democratic Party as being on the left. As far as my argument is concerned, that’s the only thing that matters.

Want to understand the world a little better? Subscribe to GZERO Daily by Ian Bremmer for free and get new posts delivered to your inbox every week.

So what is my argument?

That the multidecade-high inflation that we’re currently experiencing in the United States—and in the United Kingdom, Germany, Canada, Italy, Brazil, and so many others—is a global phenomenon with global, not domestic, origins. It has nothing to do with the specific political parties or leaders in government. It doesn’t matter whether it was Trump or Biden, Johnson or Starmer, Scholz or Laschet, or Bolsonaro or Haddad that got elected—we still would have gotten high inflation globally.

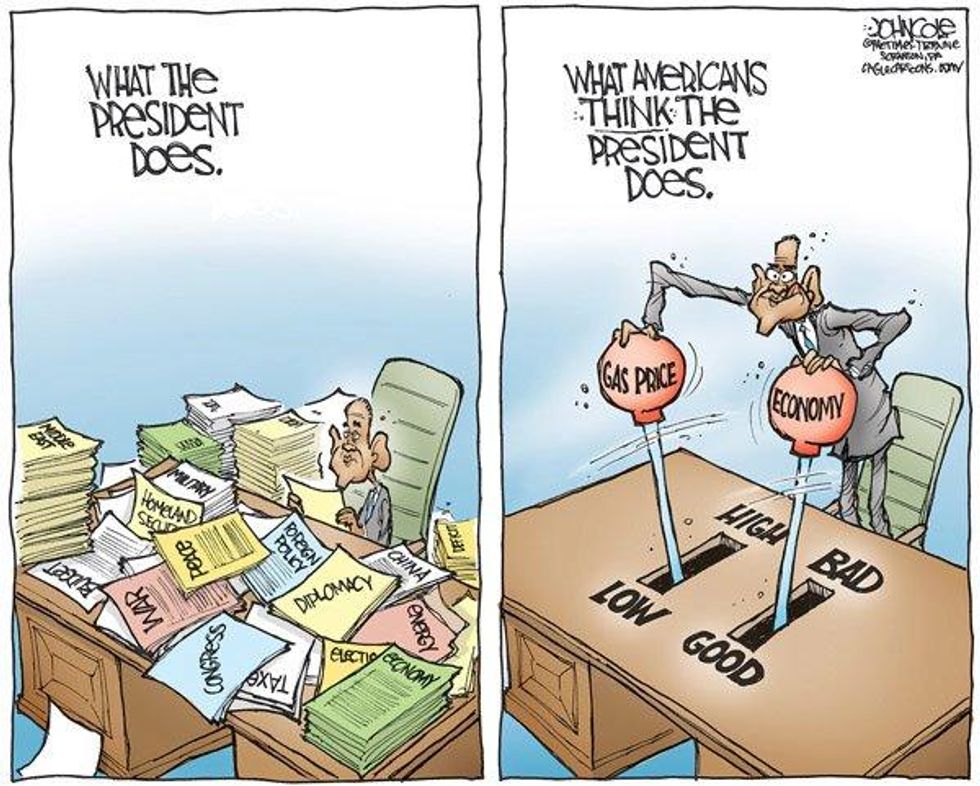

Don’t get me wrong: it's understandable that when something upsetting like high and persistent inflation happens in a country that’s so divided like the U.S., people are going to blame the government in charge. The buck, as they say, stops with the president. But just because the political reaction is understandable, it doesn’t mean that the government is actually to blame. And that’s a difference I want my readers to understand.

What did cause the global inflation shock?

First was the Covid-19 pandemic, which disrupted labor markets and global supply chains and prompted governments everywhere to try to cushion the fall in incomes by putting cash into people’s wallets. The policy response worked wonders, preventing millions from falling into unemployment, bankruptcy, and poverty. At a time when supply was constrained, though, the flipside of people having enough money to spend was a rise in goods inflation.

Then, just as the United States and Europe were coming out of the pandemic and supply and demand were starting to normalize, China doubled down on its zero-Covid policy in the face of the highly contagious Omicron variant, locking down some of the global economy’s most important manufacturing and shipping hubs and boosting goods inflation further.And then on February 24 Russian President Vladimir Putin decided to launch a war of aggression against Ukraine, triggering Western sanctions and leading to massive dislocations in the global supply of energy, food, and fertilizer. As a consequence, the prices of these critical commodities shot through the roof.

This unprecedented confluence of overlapping shocks naturally led to inflation almost everywhere (China and Japan being the notable exceptions). Frankly, you’d be surprised if it hadn’t.

In hindsight, it’s easy to criticize the U.S. government for doing too much fiscal stimulus—especially in 2020—and the Federal Reserve for failing to tighten monetary policy sooner. Heck, some commentators are making a living out of it.

But hindsight is 20/20 and policymaking is hard. Let’s not forget how much uncertainty and fear we all were shrouded in when the pandemic hit. There was no playbook for how to protect people and businesses from a once-in-a-century pandemic with the potential to cause mass unemployment and poverty (in addition to death).

Policymakers were never going to get it exactly right: really, they were just trying to feel their way in a dark room without breaking too much furniture. Scarred by the timidity of the response to the 2008 financial crisis, which the U.S. took nearly a decade to fully recover from, they erred on the side of too much rather than too little stimulus. Arguably, that was the right call to prevent the most suffering with the limited information they had at the time, leading to the strongest labor market in half a century.

We should also remember that fiscal and monetary relief was one of the very few things that both Democrats and Republicans over the last two administrations agreed on. By the time Biden signed the $1.9 trillion American Rescue Plan into law in March 2021, former President Trump had already approved a total of $3.1 trillion in pandemic-related economic stimulus. And Fed chair Jay Powell was originally nominated to his position by Donald Trump before he was re-appointed by Joe Biden, both times being confirmed in the Senate by a bipartisan vote. So if anything, the fault for overdoing it lies with both parties.

The good news is that inflation will come down, because none of these shocks are permanent in nature. Demand is stabilizing because households have already worked through most of their pandemic savings. Supply chains will become normalized, especially as more Chinese get vaccinated and China’s zero-Covid policy ebbs away over the coming year. Sanctions on Russia will remain for the foreseeable future, but the Europeans will diversify their energy supply sources and lessen their dependence on fossil fuels altogether. All of this means that inflation will prove temporary, even if not short-lived (no, they are not the same thing).

In the meantime, though, inflation poses at least as much of a political problem as it does an economic one. Just ask Jimmy Carter. Voters positively hate inflation and blame the president for it—regardless of what caused it, how long it lasts, or whether there’s anything he can do about it in the near term. They don’t care that there’s little the Fed can do to lower inflation without choking off the labor market (i.e., throwing people out of work), or that presidents have no control over gas and food prices.

source:j John Cole / The Scranton Times Tribune

source:j John Cole / The Scranton Times Tribune

President Biden can announce a gas tax holiday, lift tariffs on China, or enact new green energy subsidies to make life a little cheaper for the average American, but none of these measures are going to save him and Democrats from a sure defeat in November’s midterm elections.

The biggest danger is that this strong public aversion to inflation will pressure the Fed to induce a recession in order to tamp down inflationary expectations—as economists are now expecting—and leave the U.S. government with little fiscal firepower left to offset it. Given the widespread belief that the current inflation was fueled by excess spending, it’s unlikely that Congress would be able to find a politically palatable consensus on any significant relief policies, putting the U.S. economy at risk of a prolonged stagflation.

🔔 And if you haven't already, don't forget to subscribe to my free newsletter, GZERO Daily by Ian Bremmer, to get new posts delivered to your inbox.