VIDEOSGZERO World with Ian BremmerQuick TakePUPPET REGIMEIan ExplainsGZERO ReportsAsk IanGlobal Stage

Site Navigation

Search

Human content,

AI powered search.

Latest Stories

Sign up for GZERO Daily.

Get our latest updates and insights delivered to your inbox.

Global Stage: Live from Davos

WATCH

Closing the Gap

How can technology and digital tools help close the inequality gap globally?

Presented by

By the end of the decade, 70% of all new value in the global economy will come from digitally enabled businesses. The pandemic accelerated a push toward digitalization, especially in developing nations, yet nearly 4 billion people are still offline, and 1.4 billion don't have a bank account.

Expanding access to digital tools for individuals and small businesses is a no-brainer, but easier said than done. So, what can we do to expand digital trade further, come up with fairer and safer remittances and digital payments, and push to include everyone in tomorrow's digital-first economy?

To get some answers, GZERO hosted in partnership with Visa the livestream conversation "Closing the Gap: Digital Tools for Economic Empowerment," moderated by JJ Ramberg, co-founder of Goodpods and former host of MSNBC's Your Business.

Rubén Salazar, global head of Visa Direct, underscored how digital decency has become more acute in the post-pandemic world, yet many systems — for instance, payroll — remain analog. He also explained why unbanked people live in a vicious cycle of hardship because they can only operate in cash and lamented why cash-only networks make remittance fees so high — even as the UN goal wants to set a global 3% limit by 2030.

Ali Wyne, senior analyst for global macro-geopolitics at Eurasia Group, discussed how the discrepancy of having 1.7 billion people now cut off from the direction of travel of the global economy creates both an urgent imperative to go digital and an opportunity to narrow the gap. The likely geopolitical fallout from all of this happening after COVID and the food and energy crisis made worse by the war in Ukraine? Waves of political unrest that'll topple governments.

Dilip Ratha, head of KNOMAD and lead economist at the World Bank, shared his personal story of sending remittances to his family when he was still a student in the US. That's how he learned why it's so hard for migrants to send money back home — a lifeline for their families and remittance-dependent economies around the world.

Kati Suominen, founder and CEO of digital tech firm Nextrade Group, extolled the virtuous cycle of digital payments and access, which helps everyone the same way lack of it holds up all of us. She singled out paperless customs and logistics tech improvements as a major COVID silver lining for digital trade and offered her take on why — when they go digital — women-led small businesses often perform those led by men.

Usman Ahmed, head of global public affairs and strategic research at PayPal, offered some striking figures on what happens to small businesses when they embrace digital: sales triple by selling online, and quadruple by selling across borders. Does he see any downsides to a cashless economy? Nope, especially when it comes to the digital services created around it, but Ahmed recognized that unbanked people face tough challenges to ditch cash.

Keep reading...Show less

More from Closing the Gap

Divergent cyberattack responses: Estonia & India

October 01, 2023

The digitalization divide: opportunities and challenges in emerging markets

September 30, 2023

How digitization is accelerating international trade

November 16, 2022

The weaknesses of a digital economy

November 11, 2022

The debilitating cost of remittances

November 05, 2022

Political unrest when governments fail struggling citizens

November 02, 2022

Adapting to a digital economy around the world

October 28, 2022

The world economy’s digital destiny

October 28, 2022

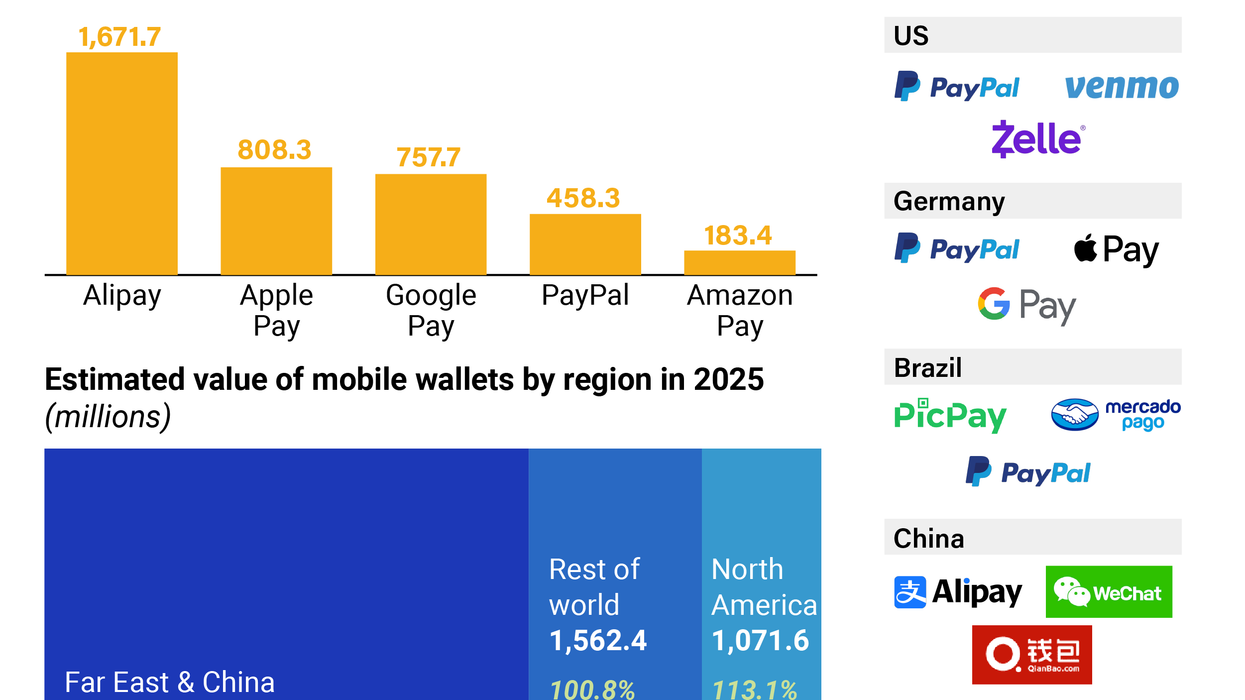

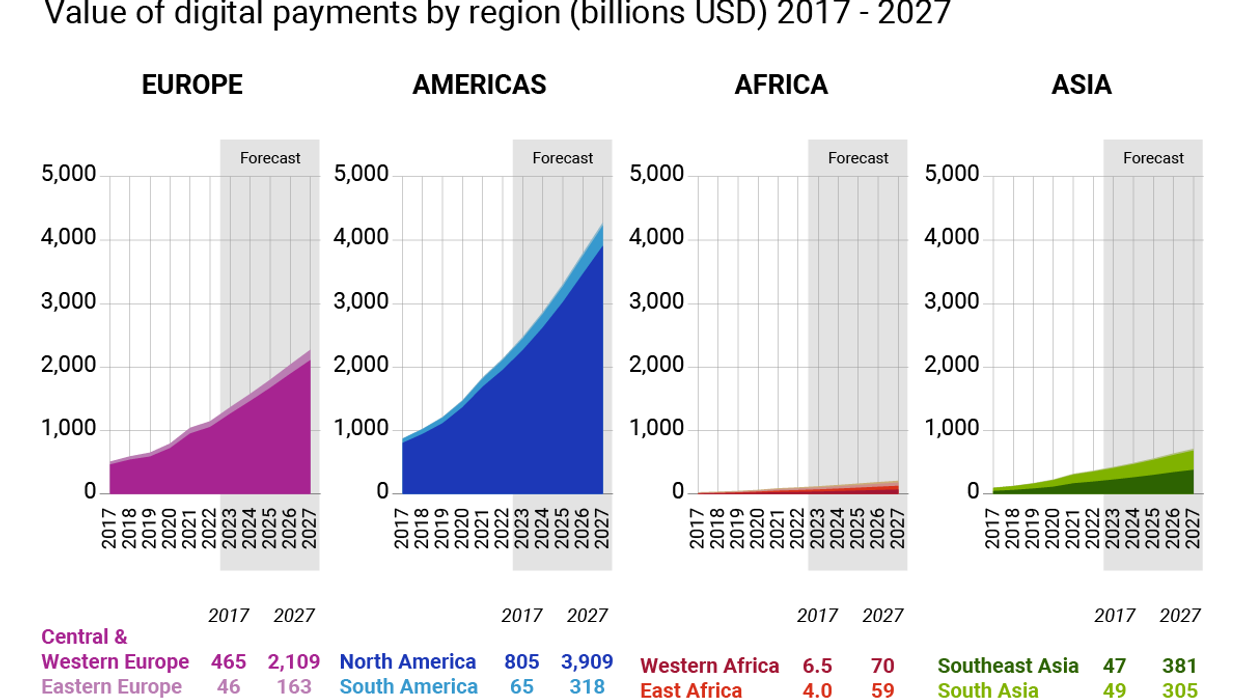

The Graphic Truth: Mobile payments around the world

October 28, 2022

How can we get unbanked people to go digital?

October 19, 2022

Will Nepal cash out?

October 14, 2022

How it pays to innovate

October 14, 2022

The Graphic Truth: The world needs less cash

October 14, 2022

Connecting the world: the power of digital trade

October 07, 2022

Why regulating cross-border digital trade is tricky

October 07, 2022

The Graphic Truth: The digital payment boom

October 07, 2022

Critical lifeline: remittances and the developing world

September 30, 2022

The Graphic Truth: Sending money home

September 30, 2022

Money on the move

September 30, 2022

GZERO Series

GZERO Daily: our free newsletter about global politics

Keep up with what’s going on around the world - and why it matters.