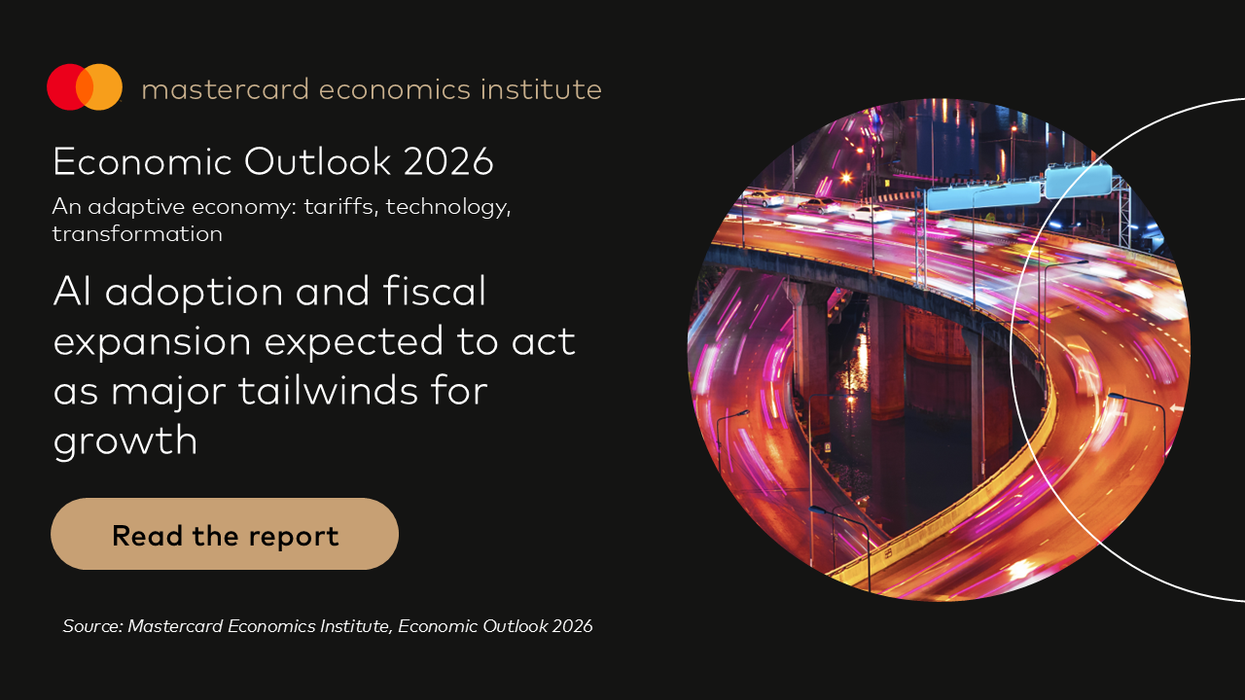

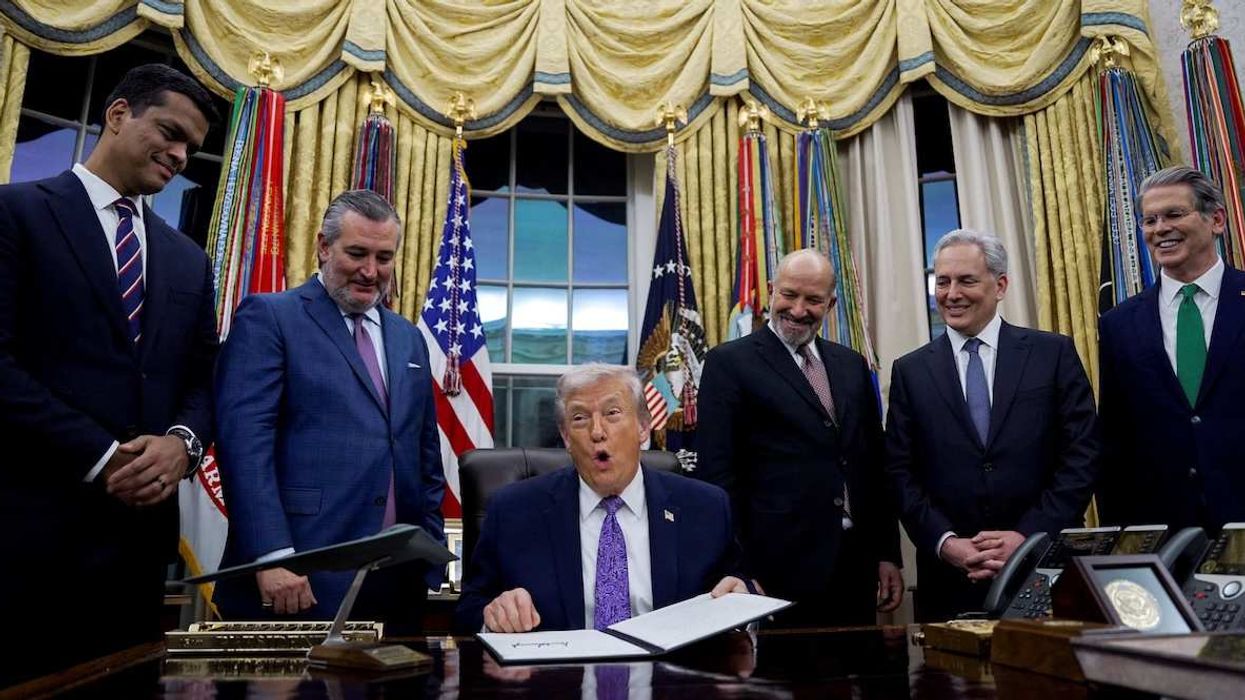

The US-China trade confrontation will soon enter a new phase, as Washington looks set to unveil new investment restrictions designed to stop strategic technologies from falling into Chinese hands. Last week, we asked whether the Trump administration was prepared to fire its big guns in the trade spat — $200 billion worth of tariffs. But the more consequential fight, for both countries, isn’t about trade, it’s about ownership–specifically, who controls artificial intelligence, advanced robotics, and other the technologies of the future.

While the Treasury Department had been widely expected to announce new investment restrictions this week, it now looks like Congress might take the lead, with less certainty around timing. Either way, the result will be a new form of pressure on China.

Here’s what makes this next phase of the US-China spat different:

The future matters more than the past. The Trump administration’s technology tariffs (see graphic below) are meant to compensate for what the US considers to be China’s long history of technology theft and unfair trade practices. By nature, they’re backward-looking. The new investment regime, in contrast — which encompasses both new limits on Chinese investment in the US and potentially heightened government scrutiny of US high-tech exports — is aimed at stopping future transfers of “industrially significant technology” from the US to China. Even if the Washington and Beijing can reach a truce on tariffs, the investment restrictions are likely to linger. They may even become permanent.

Concentrated pain. The new investment regime will target high-tech industries that Chinese President Xi Jinping considers vital to cementing his country’s power and prestige in the 21st century. Beijing will look to retaliate by making life harder for US companies in China, but China’s dependence on the US for key components like cutting-edge semiconductors mean it will feel real, unavoidable pain.

The big picture: This is an irresistible-force-meets-immovable-object situation, where both sides will be reluctant to cave, and the global tech sector risks getting caught in the middle.