As the anticipation builds in Hanoi, we go ringside for the walkouts of heavyweight contenders "KIM JONG-UNstoppable" and Donald "The Bitter Hitter of Twitter" Trump. Watch the showdown here.

News

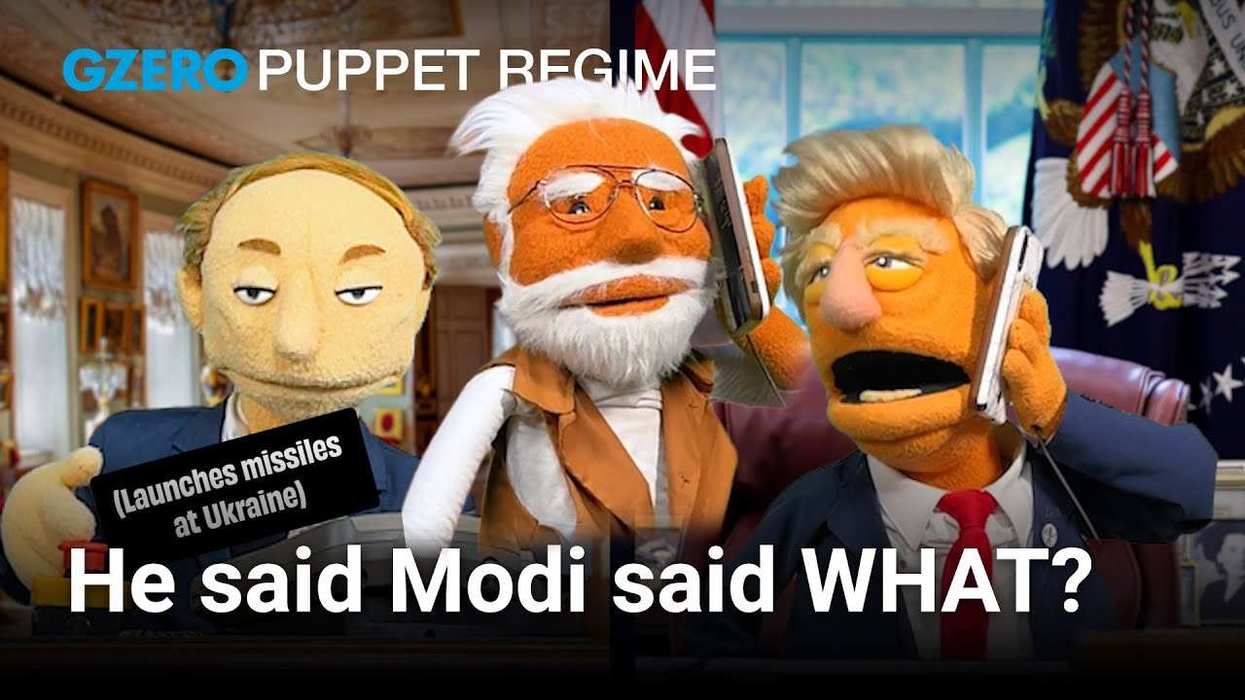

PUPPET REGIME: TRUMP AND KIM ENTER THE RING

PUPPET REGIME: Trump and Kim Enter the Ring

By Alex KlimentFebruary 25, 2019

Alex Kliment

Alex wears a few different caps and tips them all regularly. He writes for the GZERO Daily, works as a field correspondent for GZERO's nationally syndicated TV show GZERO WORLD WITH IAN BREMMER, and writes/directs/voices GZERO's award-winning puppet satire show PUPPET REGIME. Prior to joining GZERO, Alex worked as an analyst covering Russia and broader Emerging Markets for Eurasia Group. He has also written for the Financial Times from Washington, DC, and Sao Paulo Brazil. In his spare time, he makes short films and composes scores for long ones. He studied history and Slavic literature at Columbia and has a Master's from Johns Hopkins SAIS. He's a native New Yorker, a long-suffering Mets fan, and owns too many bicycles.