Viewpoint

Viewpoint: How would Trump’s crypto reserve work?

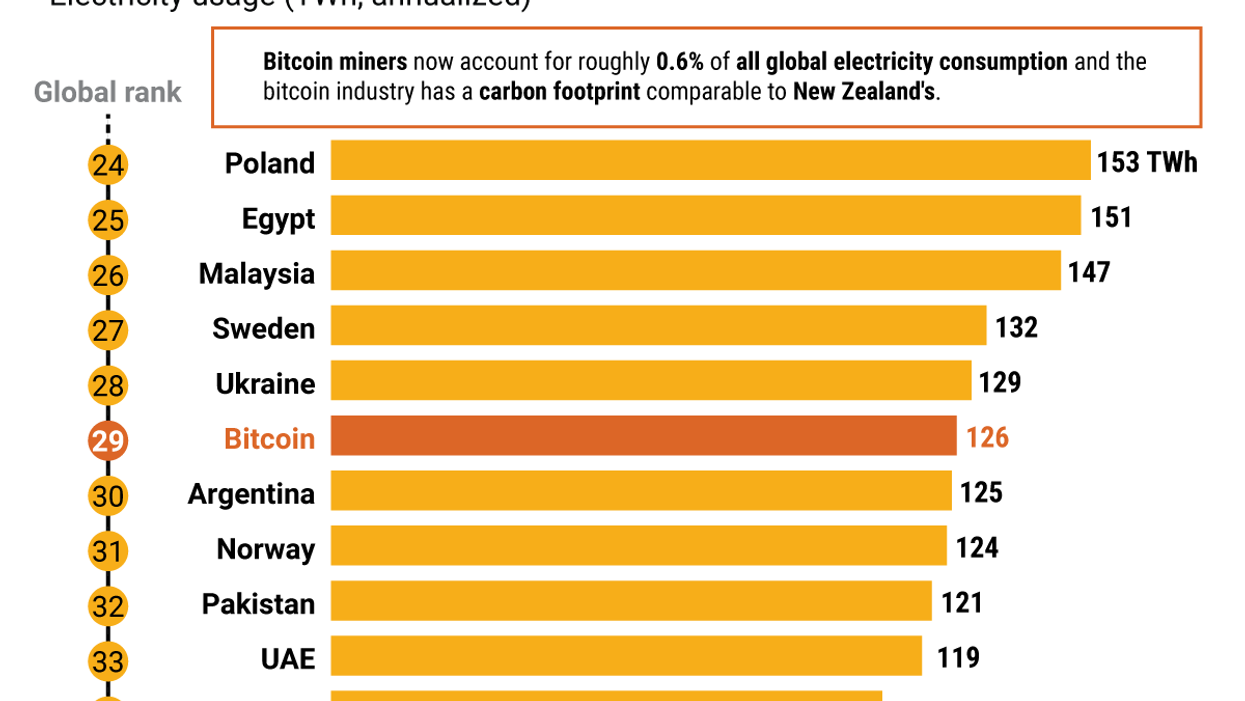

Once a crypto skeptic, President Donald Trump has become an enthusiastic supporter of the industry. His media company began investing in crypto years ago, and on the campaign trail, he pledged to reverse the Biden administration's tough regulatory approach. Trump also proposed creating a national Bitcoin stockpile, and his recent announcement of a “strategic crypto reserve” showed his continued commitment to this idea, as well as his indifference to perceptions of conflicts of interest. We asked Eurasia Group expert Babak Minovi how a “strategic crypto reserve” would work.

Mar 05, 2025