Load More

VIDEOSGZERO World with Ian BremmerQuick TakePUPPET REGIMEIan ExplainsGZERO ReportsAsk IanGlobal Stage

Site Navigation

Search

Human content,

AI powered search.

Latest Stories

Sign up for GZERO Daily.

Get our latest updates and insights delivered to your inbox.

Global Stage: Live from Munich

WATCH RECORDING

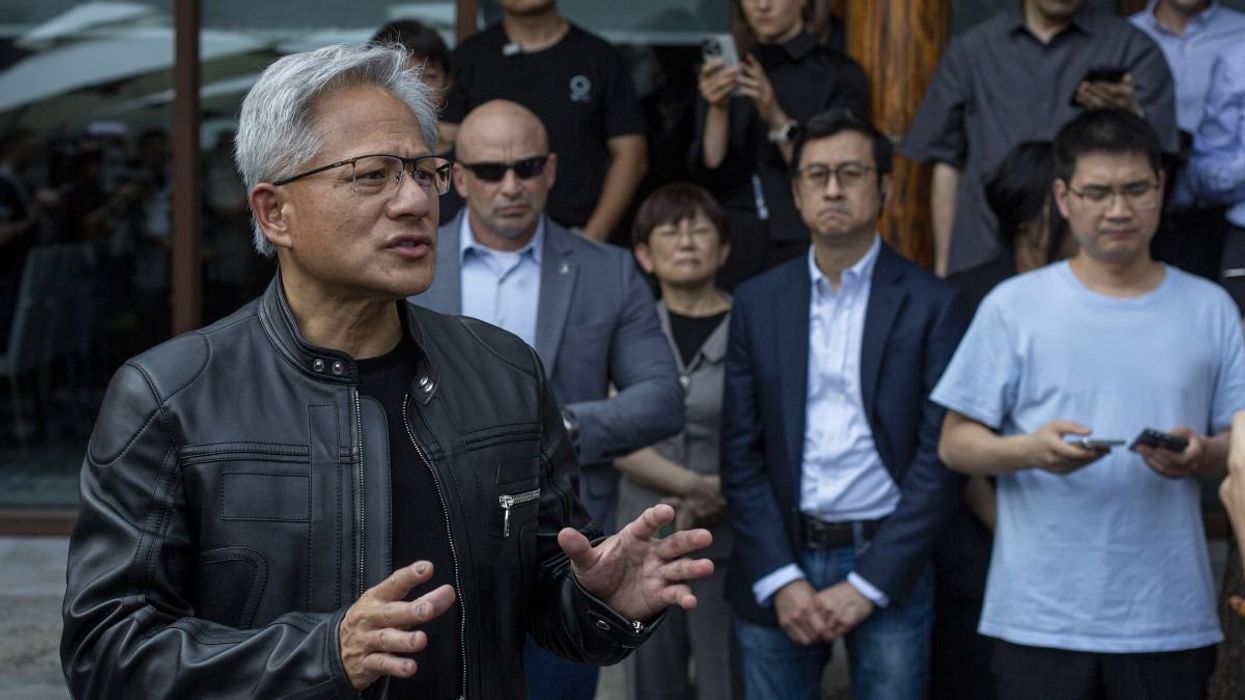

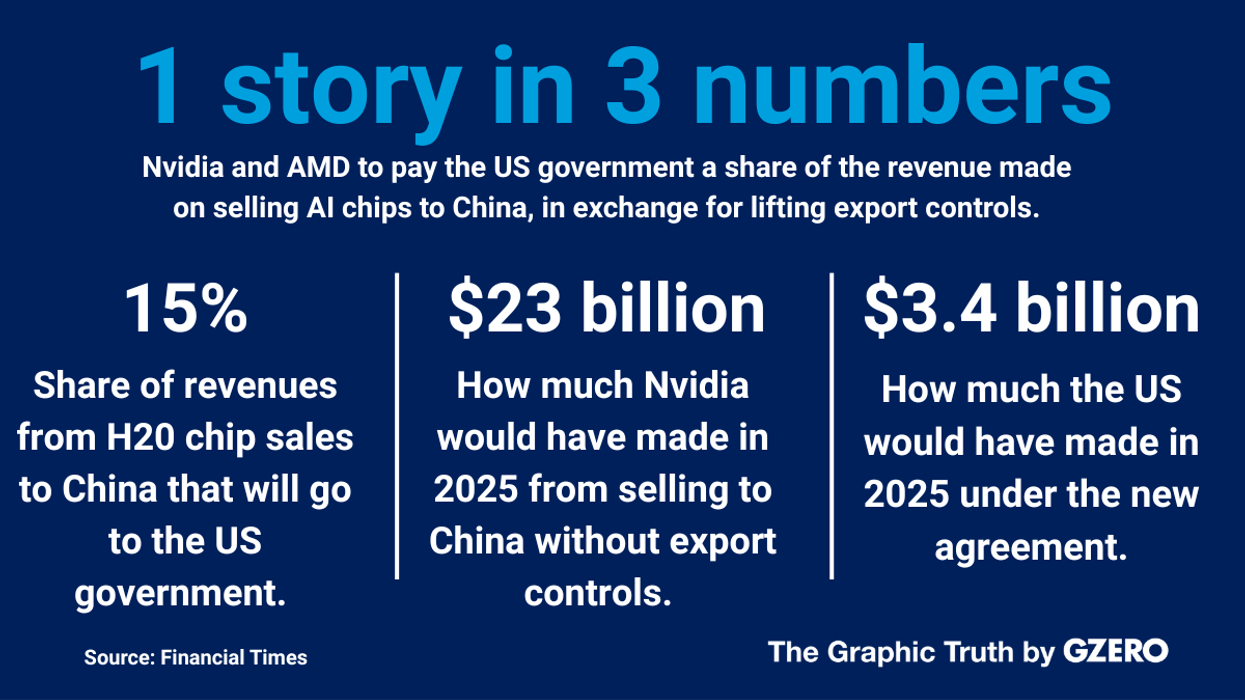

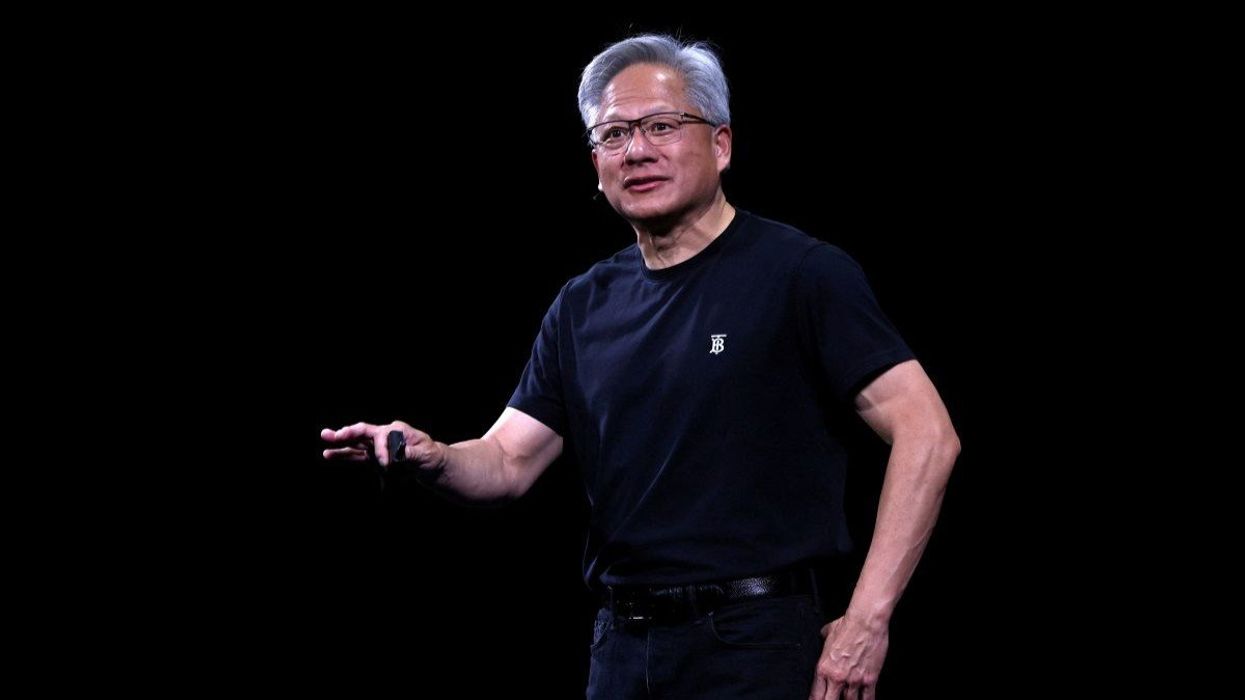

nvidia

GZERO Daily: our free newsletter about global politics

Keep up with what’s going on around the world - and why it matters.